Question: I need help understanding this material so PLEASE truthfully answer, DO NOT USE AI or I will thumbs down. 1. Today is the expiration day

I need help understanding this material so PLEASE truthfully answer, DO NOT USE AI or I will thumbs down.

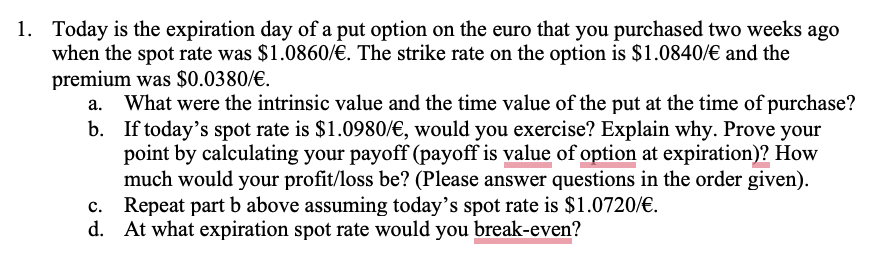

1. Today is the expiration day of a put option on the euro that you purchased two weeks ago when the spot rate was $1.0860/. The strike rate on the option is $1.0840/ and the premium was $0.0380/. a. What were the intrinsic value and the time value of the put at the time of purchase? b. If today's spot rate is $1.0980/, would you exercise? Explain why. Prove your point by calculating your payoff (payoff is value of option at expiration)? How much would your profit/loss be? (Please answer questions in the order given). c. Repeat part b above assuming today's spot rate is $1.0720/. d. At what expiration spot rate would you break-even

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts