Question: I need help will a - f l Verizon 5:39 PM 47% . Chapter 3.docx 10 Recall the Innis Investments peoblem (Chapter 2, Problem 39).

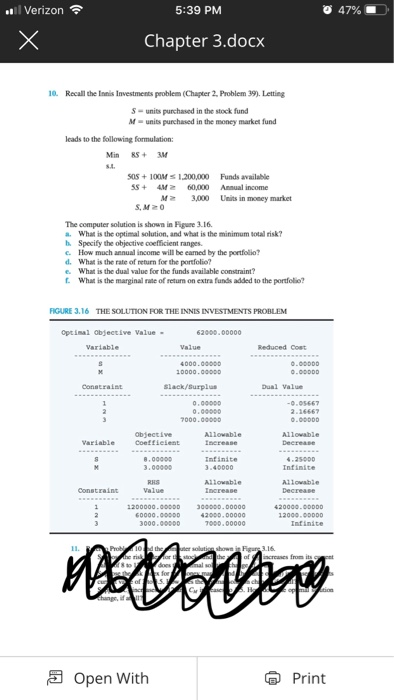

l Verizon 5:39 PM 47% . Chapter 3.docx 10 Recall the Innis Investments peoblem (Chapter 2, Problem 39). Letting S- units purchased in the stock fund M- units purchased in the money market fund leads to the following formulation: Min RSM s0s +10OM 1.200,000 Funds available 5S 4M 60,000 Anual income M3,000 Units in money market S,M20 The computer solution is shown in Figure 3.16 . What is the optimal solution, and what is the minimum total risk? h. Specify the objective coefficient ranges. c. How much annual income will be eamed by the portfolio? d. What is the rate of return for the portfolio? e. What is the dual value for the funds available constraint? What is the marginal rate of return on extra funds added to the porfolio? FIGURE 3.16 THE SOLUTION FOR THE INNIS INVESTMENTS PROBLEM ptinal objective Value- o.000D0 0000.00000 0.00000 000.00obd 2-16667 0.00000 objective Variable Coefielent Infinite 3.40000 4.2s000 Infinite 3.00000 Value 20000.0oooD Infinite creases from its Open With Print

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts