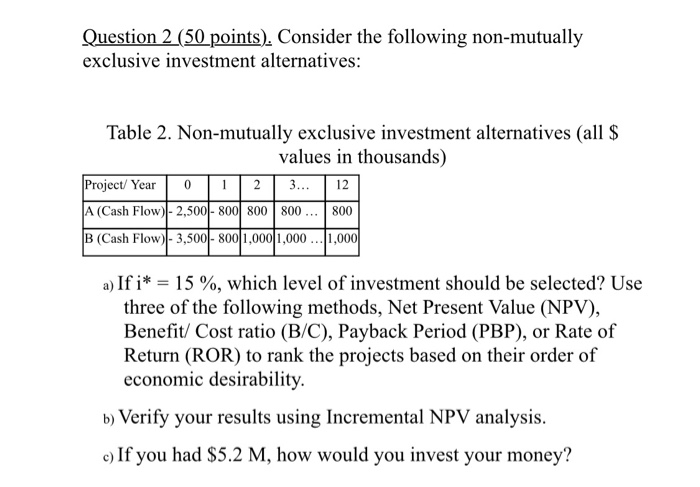

Question: I need help with #2 please Question 2 (50 points). Consider the following non-mutually exclusive investment alternatives: Table 2. Non-mutually exclusive investment alternatives (all $

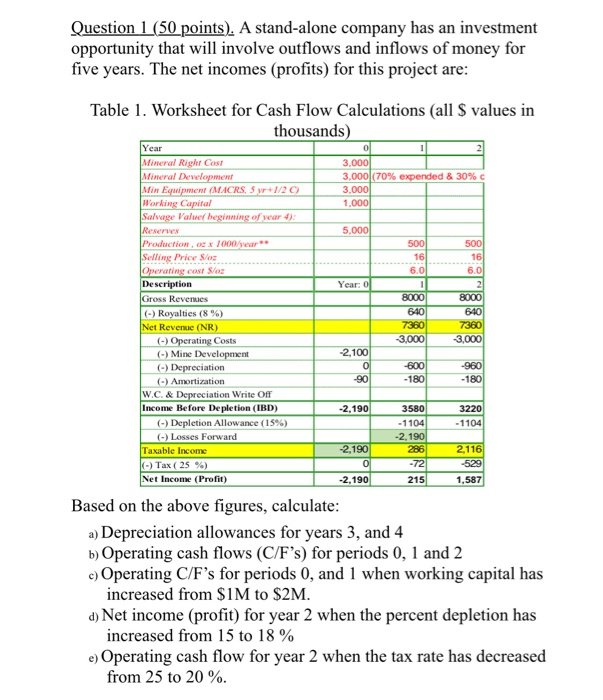

Question 2 (50 points). Consider the following non-mutually exclusive investment alternatives: Table 2. Non-mutually exclusive investment alternatives (all $ values in thousands) Project/ Year 0 1 2 3... 12 A (Cash Flow)- 2,500 - 800 800 800 ... 800 B (Cash Flow) - 3,500 - 8001,000 1,000... 1,000 a) If i* = 15%, which level of investment should be selected? Use three of the following methods, Net Present Value (NPV), Benefit/ Cost ratio (B/C), Payback Period (PBP), or Rate of Return (ROR) to rank the projects based on their order of economic desirability. b) Verify your results using Incremental NPV analysis. c) If you had $5.2 M, how would you invest your money? Question 1 (50 points). A stand-alone company has an investment opportunity that will involve outflows and inflows of money for five years. The net incomes (profits) for this project are: Table 1. Worksheet for Cash Flow Calculations (all $ values in thousands) Year 012 Mineral Righ Cost 3.000 Mineral Development 3.000|(70% expended & 30% C Min Equipment (MACRS, Syr+1/20) 3.000 Working Capital 1.000 Salvage Value beginning of year 4): Reserve 5.000 Production, oz x 1000/year ** 500 Selling Price S/os Operating cart S/ Description Year: 0 Gross Reventies 8000 8000 - Royalties (8 %) 640 640 Net Revenue (NR) 72260 7360 (-) Operating Costs 3,000 3,000 (-) Mine Development (-) Depreciation 600 -960 (-) Amortization 90 -180 -180 W.C. & Depreciation Write Of Income Before Depletion (IBD) -2,190 3580 3220 (-) Depletion Allowance (15%) -1104 -1104 (-) Losses Forward -2.190 Taxable income -2,190 286 2,116 (-) Tax (25 %) Net Income (Profit) -2,190 2151,587 Based on the above figures, calculate: a) Depreciation allowances for years 3, and 4 b) Operating cash flows (C/F's) for periods 0, 1 and 2 c) Operating C/F's for periods 0, and 1 when working capital has increased from $1M to $2M. d) Net income (profit) for year 2 when the percent depletion has increased from 15 to 18 % e) Operating cash flow for year 2 when the tax rate has decreased from 25 to 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts