Question: I need help with 5-10 positionty the ending spot rate is $0.091/Ps? 3-4 Peleh, a Japan based investor, WRITES a put option on dollar with

I need help with 5-10

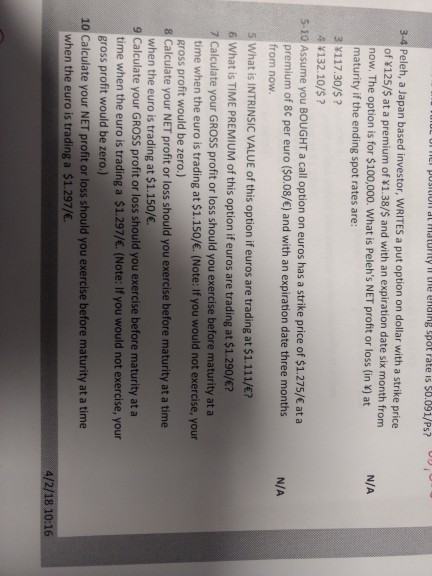

positionty the ending spot rate is $0.091/Ps? 3-4 Peleh, a Japan based investor, WRITES a put option on dollar with a strike price of Y125/S at a premium of 1.38/S and with an expiration date six month from now. The option is for $100,000. What is Peleh's NET profit or loss (in V) at maturity if the ending spot rates are: X117.30/$? N/A 132.10/$? 5-10 Assume you BOUGHT a call option on euros has a strike price of $1.275/ at a premium of 8c per euro ($0.08/) and with an expiration date three months from now. N/A What is INTRINSIC VALUE of this option if euros are trading at $1.111/? What is TIME PREMIUM of this option if euros are trading at $1.290/E? Calculate your GROSS profit or loss should you exercise before maturity at a time when the euro is trading at $1.150/. (Note: If you would not exercise, your gross profit would be zero.) 8 Calculate your NET profit or loss should you exercise before maturity at a time when the euro is trading at $1.150/. Calculate your GROSS profit or loss should you exercise before maturity at a time when the euro is trading a $1.297/. (Note: If you would not exercise, your gross profit would be zero.) 10 Calculate your NET profit or loss should you exercise before maturity at a time when the euro is trading a $1.297/. 4/2/18 10:16

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts