Question: I need help with 9-12 please How much is Krystal's NET receipt in dollar with an option hedge, assuming the spot rate at maturity is

I need help with 9-12 please

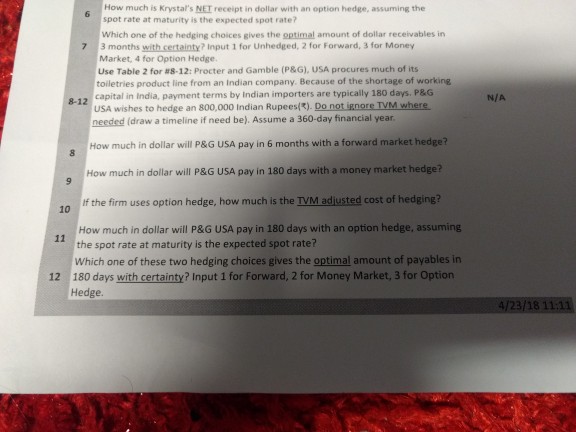

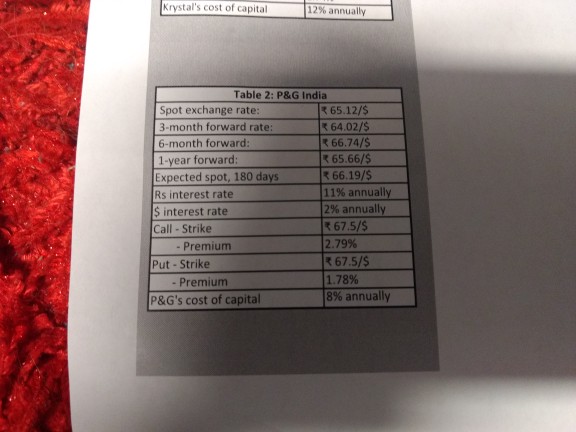

How much is Krystal's NET receipt in dollar with an option hedge, assuming the spot rate at maturity is the expected spot rate? Which one of the hedging choices gives the optimal amount of dollar receivables in Market, 4 for Option Hedge 7 3 months with certainty? Input 1 for Unhedged, 2 for Forward, 3 for Money Use Table 2 for #8-12: Procter and Gamble (P&G), USA procures much of its toiletries product line from an Indian company. Because of the shortage of working capital in India, payment terms by Indian importers are typically 180 days. P&G USA wishes to hedge an 800,000 Indian Rupees ). Do notwnoreTVMwhere 8-12 N/A needed (draw a timeline if need be). Assume a 360-day financial year How much in dollar will P&G USA pay in 6 months with a forward market hedge? How much in dollar will P&G USA pay in 180 days with a money market hedge? 10 If the firm uses option hedge, how much is the TVM adusted cost of hedging? How much in dollar will P&G USA pay in 180 days with an option hedge, assuming Which one of these two hedging choices gives the optimal amount of payables in Hedge. the spot rate at maturity is the expected spot rate? 12 180 days with certainty? Input 1 for Forward, 2 for Money Market, 3 for Option 4/23/18 11:11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts