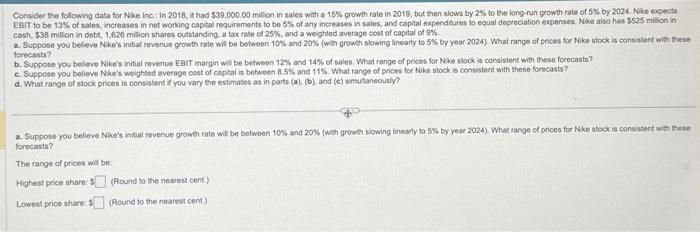

Question: i need help with a, b, c , and d please Consider the folowing data for Nike inc- in 2018 , it had 539,000.00 millon

Consider the folowing data for Nike inc- in 2018 , it had 539,000.00 millon in salos with a 15% growth rate in 2019, but then siows by 2% to the iong-run growth rale of 5 th by 2024 . Nike expects EBIT to be 13% of sales, increases in net working copital requirements to be 5% of any increases in sales, and capital expendeurtes to equal depreciation oxpensos. Nave also has $525 milion in cash, 538 millon in debe, 1,626 milion shares outstanding, a tax role of 25%, and a weighted average cost of captal of 9%. a. Suppose you beleve Nike's initial tevenue growth rate wit be between 10% and 20% (with growch slowing linearly to 5% by year 2024 ) What range of prices for Nike stock is consistent with these forecasts? b. Suppose you beleve Nike's initial revenue EBrT margin will be between 12% and 14% of sales. What range of prices for Nke stock is conalslent with these forecasts? c. Suppose you believe Niwe's weighted average cost of copital is between 8.5% and 11%. What range of prices for Nile stock is consistent with these forecasts? d. What range of stock prices is consissent if you vary the estimatos as in parts (a), (b), and (c) simulaneously? a. Suppose you believe Nive's infial fevenue growth rate will be between 10% and 20% (wht groweh slowing lineady to 5% by yeer 2024 ). What range of prices for Nkke stock is consistent wath these forecasts? The range of prices wit be: Highast price share: $ (Round to the nearest cent) Lowest price share: 4 (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts