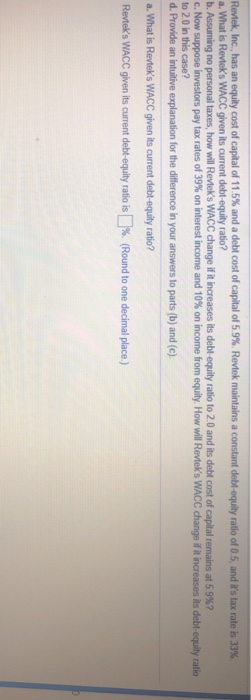

Question: i need help with A B C D please asap Retek, Inc.,has an equity cost of capital of 115% and a debt cost of capital

Retek, Inc.,has an equity cost of capital of 115% and a debt cost of capital of 5 9% Revtek maintains a a. What is aconstant debt-o nity ratio of 0 5, and rs tax rate is 33% s WACC given its current debt-equity ratio? no personal taxes, how will Reviek's WACC change if it increases its debt equity ratio to 2.0 and its debt cost of capital remains at 5 9%? c. Now suppose investors pay tax rates of 39% on interest i come and 10% on income rom equity How will Rev ek's WACC change to 2.0 in this case? increases its debt equity ratio d. Provide an intuitive explanation for the difference in your answers to parts (b) and (c) Re teks WACC given its current debt-equity ratio is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts