Question: i need help with A B C D please asap Re tek, Inc has an equity cost of capital of 12 4% and a debt

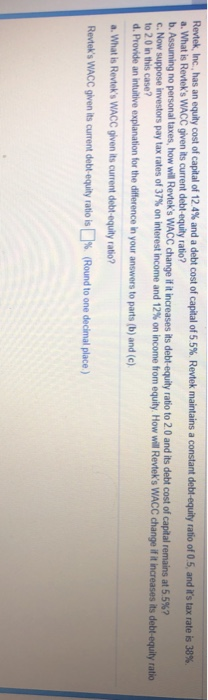

Re tek, Inc has an equity cost of capital of 12 4% and a debt cost of capital of 5 5% Re tek maintains a constant debt equity ratio of 0 5 and rs tax rate is 38% a. What is Revtek's WACC given its current debl-equity ratio? b. As ing no personal taxes, how wil Revtek's WACC change if it increases its debt-equity ratio to 2.0 and its debt cost of capital remains at 55%? c. Now suppose investors pay tax rates of 37% on interest income and 12% on income from equity How wil Revtek's WACC change if it increases its to 2.0 in this case? d. Provide an intuitive explanation for the difference in your answers to debt-equity ratio parts (b) and (c) . What is Revtek's WACC given its current debt-equity ratio? Revtek's WACC given its current debl-equity ratio is% (Round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts