Question: i need help with all please 14) The Standard & Poor's 500 Index includes 14)_ A) 30 of the largest (market capitalization) and most active

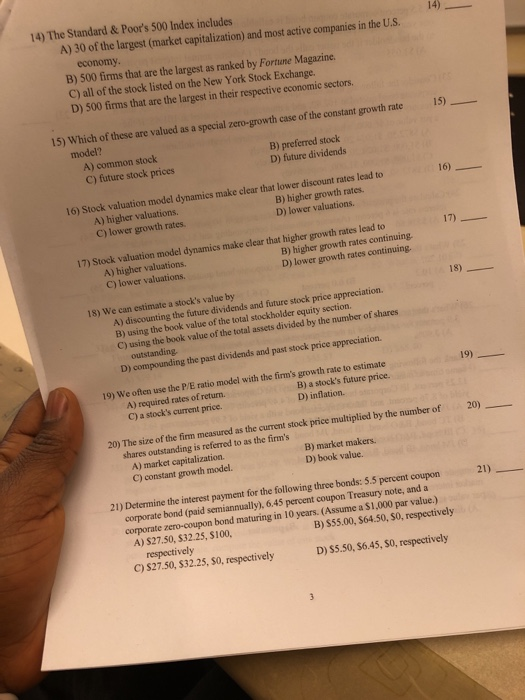

14) The Standard & Poor's 500 Index includes 14)_ A) 30 of the largest (market capitalization) and most active companies in the U.S. economy B) 500 firms that are the largest as ranked by Fortune Magazine C) all of the stock listed on the New York Stock Exchange. D) 500 firms that are the largest in their respective economic sectors 15) 15) Which of these are valued as a special zero-growth case of the constant growth rate model? A) common stock C) future stock prices B) preferred stock D) future dividends 16) make clear that lower discount rates lead to 16) Stock valuation model dynamics B) higher growth rates. D) lower valuations. A) higher valuations. C) lower growth rates 17) Stock valuation model dynamics make clear that higher growth rates lead to B) higher growth rates continuing D) lower growth rates continuing. A) higher valuations. C) lower valuations. 18) 18) We can estimate a stock's value by the future dividends and future stock price appreciation. A) discounting B) using the book value of the total stockholder equity section. C) using the book value of the total assets divided by the number of shares outstanding. D) compounding the past dividends and past stock price appreciation. 9) We often use the P/E ratio model with the firm's growth rate to estimate B) a stock's future price. A) required rates of return. C) a stock's current price. D) inflation. 20) of the firm measured as the current stock price multiplied by the number of shares outstanding is referred to as the firm's B) market makers. D) book value. A) market capitalization. C) constant growth model. 21) Determine the interest payment for the following three bonds: 5.5 percent couporn corporate bond (paid semiannually). 6.45 percent coupon Treasury note, and a corporate zero-coupon bond maturing in 10 years. (Assume a $1,000 par value.) 21) A) $27.50, $32.25, S100 B) S55.00, S64.50, S0, respectively respectively C)S27.50, $32.25, S0, respectively D) S5.50, $6.45, S0, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts