Question: I need help with answer the question to 6. Could you show your work The table below provides information relating to important characteristics of the

I need help with answer the question to 6. Could you show your work

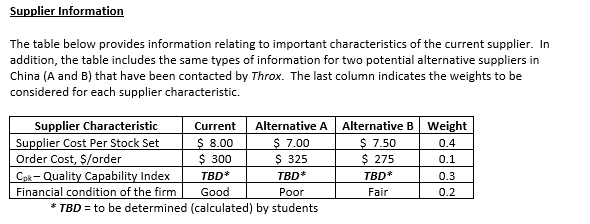

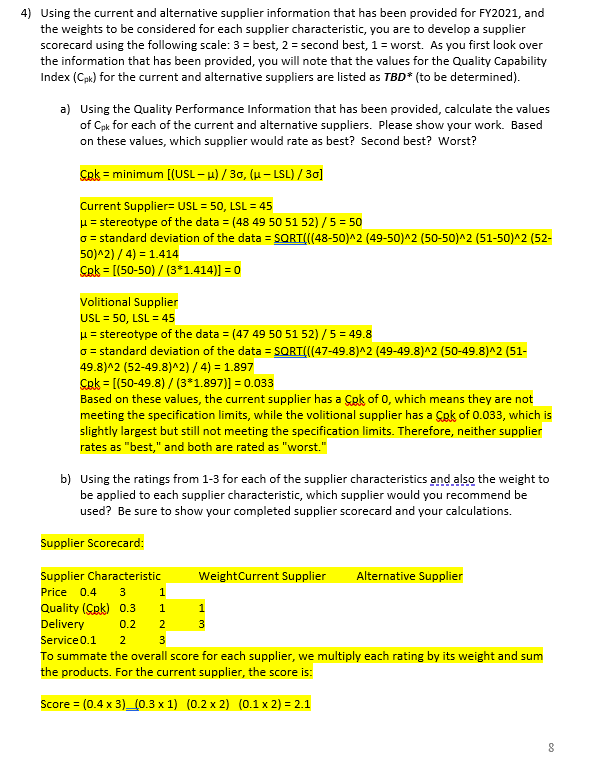

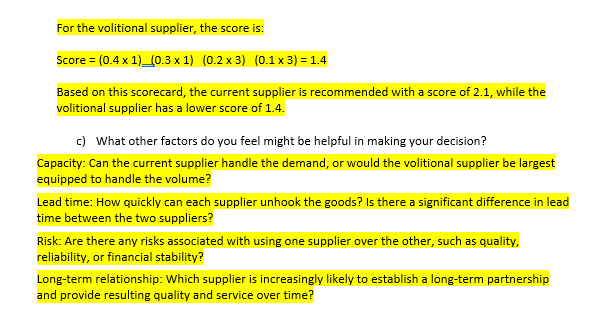

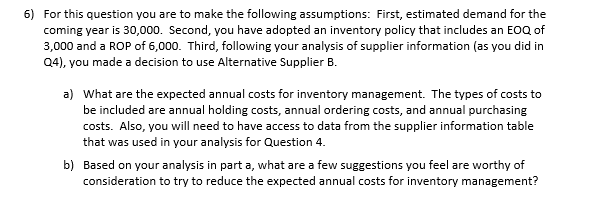

The table below provides information relating to important characteristics of the current supplier. In addition, the table includes the same types of information for two potential alternative suppliers in China ( A and B ) that have been contacted by Throx. The last column indicates the weights to be considered for each supplier characteristic. TBD= to be determined (calculated) by students 4) Using the current and alternative supplier information that has been provided for FY2021, and the weights to be considered for each supplier characteristic, you are to develop a supplier scorecard using the following scale: 3 = best, 2 = second best, 1 = worst. As you first look over the information that has been provided, you will note that the values for the Quality Capability Index (Cpk) for the current and alternative suppliers are listed as TBD (to be determined). a) Using the Quality Performance Information that has been provided, calculate the values of Cpk for each of the current and alternative suppliers. Please show your work. Based on these values, which supplier would rate as best? Second best? Worst? Cgk = minimum [(USL)/3,(LSL)/3] Current Supplier= USL =50,LSL=45 = stereotype of the data =(4849505152)/5=50 = standard deviation of the data =SQRT(((4850)2(4950)2(5050)2(5150)2(52 50)2)/4)=1.414 Cpk=[(5050)/(31.414)]=0 Volitional Supplier USL=50,LSL=45 = stereotype of the data =(4749505152)/5=49.8 = standard deviation of the data =SORT(((4749.8)2(4949.8)2(5049.8)2(51 49.8)2(5249.8)2)/4)=1.897 C.Ck =[(5049.8)/(31.897)]=0.033 Based on these values, the current supplier has a Cok of 0 , which means they are not meeting the specification limits, while the volitional supplier has a Cok of 0.033 , which is slightly largest but still not meeting the specification limits. Therefore, neither supplier rates as "best," and both are rated as "worst." b) Using the ratings from 1-3 for each of the supplier characteristics and also the weight to be applied to each supplier characteristic, which supplier would you recommend be used? Be sure to show your completed supplier scorecard and your calculations. To summate the overall score for each supplier, we multiply each rating by its weight and sum the products. For the current supplier, the score is: Score =(0.43)(0.31)(0.22)(0.12)=2.1 For the volitional supplier, the score is: Score =(0.41)(0.31)(0.23)(0.13)=1.4 Based on this scorecard, the current supplier is recommended with a score of 2.1 , while the volitional supplier has a lower score of 1.4. c) What other factors do you feel might be helpful in making your decision? Capacity: Can the current supplier handle the demand, or would the volitional supplier be largest quipped to handle the volume? ead time: How quickly can each supplier unhook the goods? Is there a significant difference in lead ime between the two suppliers? Risk: Are there any risks associated with using one supplier over the other, such as quality, eliability, or financial stability? ong-term relationship: Which supplier is increasingly likely to establish a long-term partnership ind provide resulting quality and service over time? 6) For this question you are to make the following assumptions: First, estimated demand for the coming year is 30,000 . Second, you have adopted an inventory policy that includes an EOQ of 3,000 and a ROP of 6,000 . Third, following your analysis of supplier information (as you did in Q4), you made a decision to use Alternative Supplier B. a) What are the expected annual costs for inventory management. The types of costs to be included are annual holding costs, annual ordering costs, and annual purchasing costs. Also, you will need to have access to data from the supplier information table that was used in your analysis for Question 4. b) Based on your analysis in part a, what are a few suggestions you feel are worthy of consideration to try to reduce the expected annual costs for inventory management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts