Question: I need help with answering questions e though I please. Step by step. in each case in the preceding quesHoh? f. Suppose that the bond

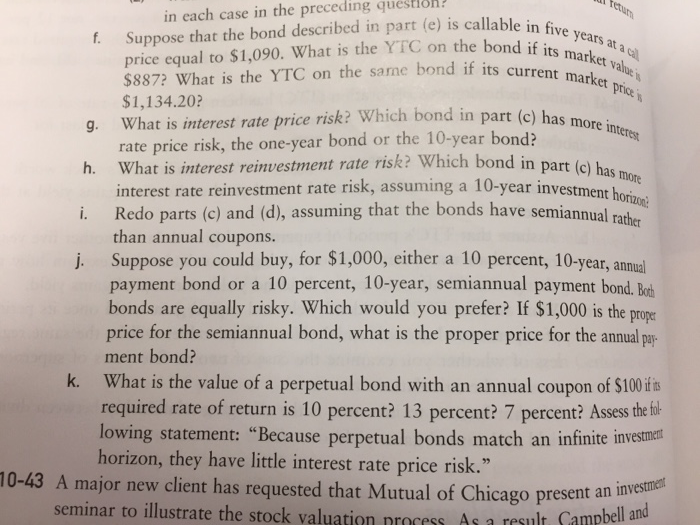

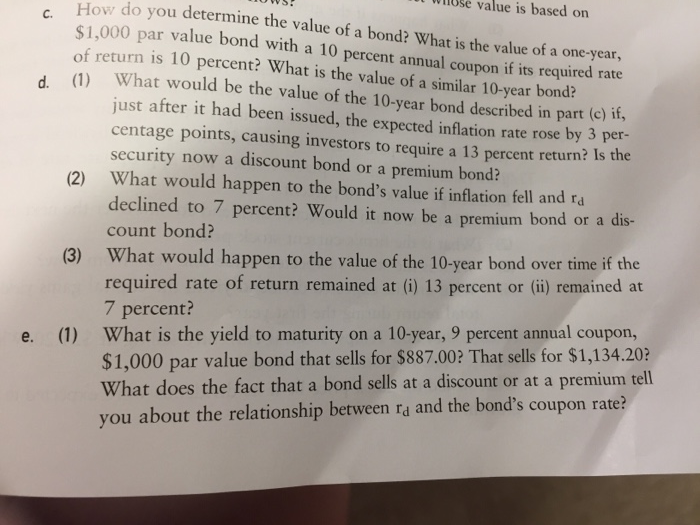

in each case in the preceding quesHoh? f. Suppose that the bond described in part (e) is callable i five years at a cal price equal to $1,090. What is the YTC on the bond if its n $8872 What is the YTC on the same bond if its current mark $1,134.20? e bond if its current market D g. What is interest rate price risk? Which bond in part h. What is interest reinvestment rate risk? Which bond in part (c) has more interes rate price risk, the one-year bond or the 10-year bond? c) has mate interest rate reinvestment rate risk, assuming a 10-year investment hotie Redo parts (c) and (d), assuming that the bonds have semiannual rathcr than annual coupons. Suppose you could buy, for $1,000, either a 10 percent, 10-year, annual payment bond or a 10 percent, 10-year, semiannual payment bond. Bot j. bonds are equally risky. Which would you prefer? If $1,000 is the prope price for the semiannual bond, what is the proper price for the annual pp ment bond? k. What is the value of a perpetual bond with an annual coupon of $100 ifs required rate of return is 10 percent? 13 percent? 7 percent? Assess th f lowing statement: "Because perpetual bonds match an infinite investmeti horizon, they have little interest rate price risk." 10-43 A major new client has requested that Mutual of Chicago present an invesu seminar to illustrate the stock valuation nrocess As a rrs t. Campbella WlOSe value is based on How do you determine the value of a bond? What is the value of a one-year, $1,000 par value bond with a 10 percent annual coupon if its required rate of return is 10 percent? What is the value of a similar 10-year bond? 1) What would be the value of the 10-year bond described in part (c) 11, . C. d. just after it had been issued, the expected inflation rate rose by 3 per- centage points, causing investors to require a 13 percent retu security now a discount bond or a premium bond? What would happen to the bond's value if inflation fell and ra declined to 7 percent? Would it now be a premium bond or a dis- count bond? What would happen to the value of the 10-year bond over time if the required rate of return remained at (i) 13 percent or (ii) remained at 7 percent? rn is the (2) (3) $1,000 par value bond that sells for $887.00? That sells for $1,134.20? What does the fact that a bond sells at a discount or at a premium tell you about the relationship between rd and the bond's coupon rate? e. (1) What is the yield to maturity on a 10-year, 9 percent annual coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts