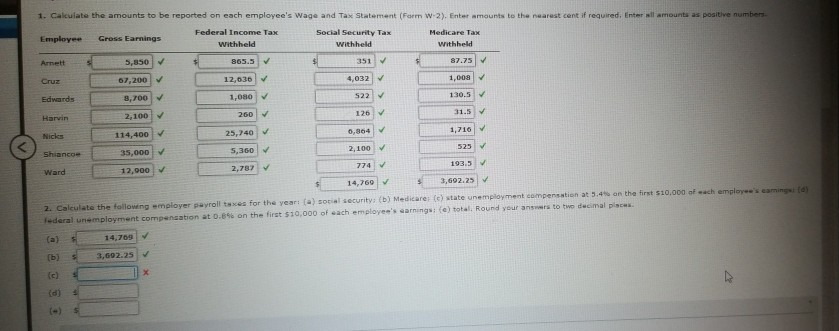

Question: I need help with C, D and E. thank you 1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form

I need help with C, D and E. thank you

1. Calculate the amounts to be reported on each employee's Wage and Tax Statement (Form W 2). Enter amounts to the nearest cent if required. Enter all amounts as positive numbers Federal Income Tax Social Security Tax Medicare Tax Gross Earnings Employee Withheld Withheld Withheld 87.75 865.5 351 Arnett 5,850 1,008 4.032 12,036 Cruz 67,200 130.5 522 1,080 8,700 Edwards 31.5 126 260 2,100 Harvin 1,716 0.864 25,740 114,400 Nicks 52 2,100 S,360 35,000 Shiancoe 193.5 774 2,787 12,000 Ward 3,692.25 14,769 2. Caleulate the followng empioyer payroll texes for the yeari (a) sorial security: (b) Medicare: (c) state unemployment compensation at 5.4% on the first $10.000 of each employee's eamings (d) federal unemplovment compengation at 0.6% on the first $10,000 of each employee's earnings: (e) total. Round your answers to two decimal places. 14,709 (a) 3,002.25 (b). (c) (d) () s

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts