Question: I need help with d and the last row for e. I'm doing something wrong with the after tax income. Problem 14-10 Assume you have

I need help with d and the last row for e. I'm doing something wrong with the after tax income.

I need help with d and the last row for e. I'm doing something wrong with the after tax income.

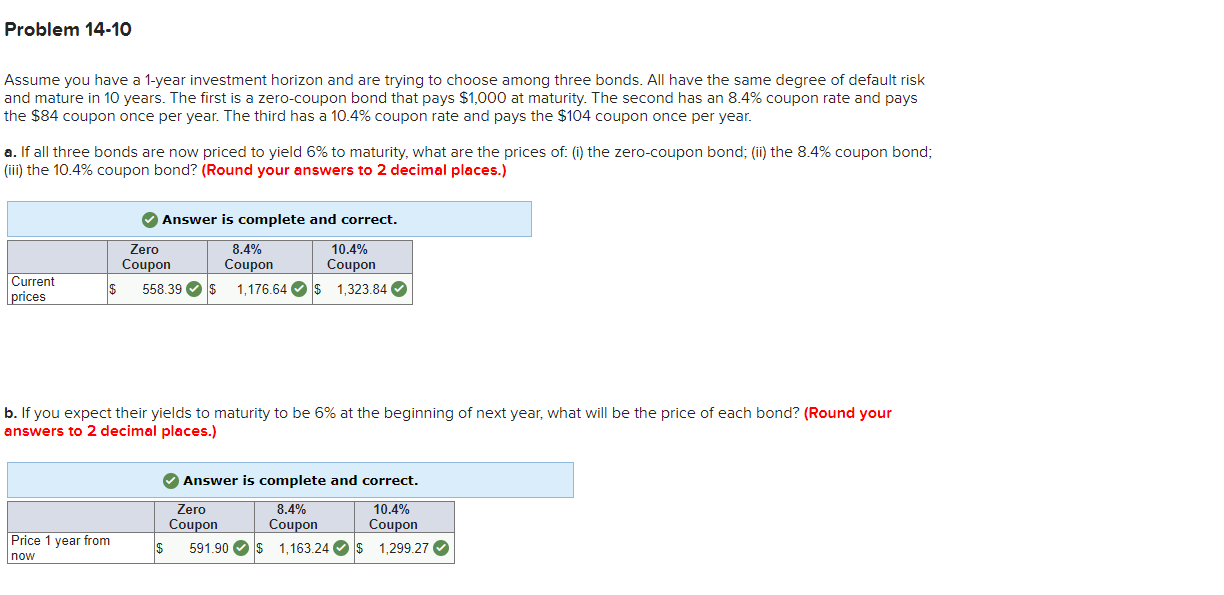

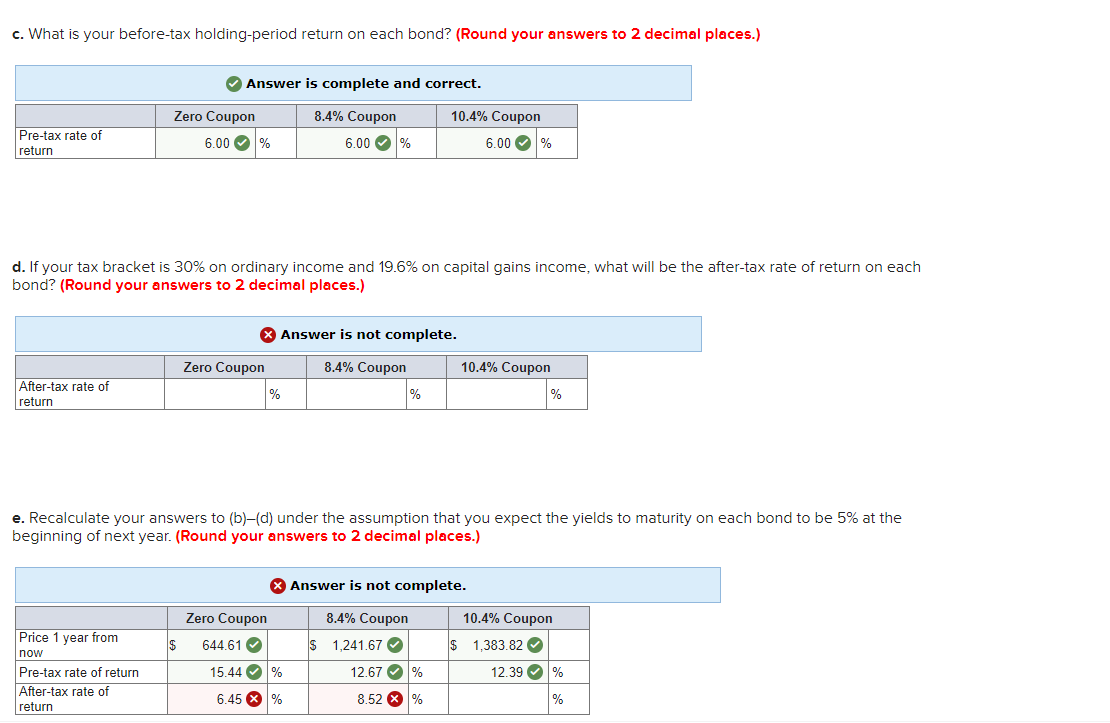

Problem 14-10 Assume you have a 1-year investment horizon and are trying to choose among three bonds. All have the same degree of default risk and mature in 10 years. The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 8.4% coupon rate and pays the $84 coupon once per year. The third has a 10.4% coupon rate and pays the $104 coupon once per year. a. If all three bonds are now priced to yield 6% to maturity, what are the prices of: (i) the zero-coupon bond; (ii) the 8.4% coupon bond; (iii) the 10.4% coupon bond? (Round your answers to 2 decimal places.) Answer is complete and correct. Zero Coupon 558.39 8.4% 10.4% Coupon Coupon 1,176.64 $ 1,323.84 Current prices $ b. If you expect their yields to maturity to be 6% at the beginning of next year, what will be the price of each bond? (Round your answers to 2 decimal places.) Answer is complete and correct. Zero 8.4% 10.4% Coupon Coupon Coupon 591.90$ 1,163.24 $ 1,299.27 Price 1 year from now c. What is your before-tax holding-period return on each bond? (Round your answers to 2 decimal places.) Answer is complete and correct. 8.4% Coupon Zero Coupon 6.00 % Pre-tax rate of return 10.4% Coupon 6.00% 6.00 % d. If your tax bracket is 30% on ordinary income and 19.6% on capital gains income, what will be the after-tax rate of return on each bond? (Round your answers to 2 decimal places.) Answer is not complete. Zero Coupon After-tax rate of return 8.4% Coupon % 10.4% Coupon % % e. Recalculate your answers to (b)(d) under the assumption that you expect the yields to maturity on each bond to be 5% at the beginning of next year. (Round your answers to 2 decimal places.) X Answer is not complete. Zero Coupon 8.4% Coupon 10.4% Coupon $ 1,383.82 $ 644.61 1,241.67 Price 1 year from now Pre-tax rate of return After-tax rate of return 15.44 % 12.67% 12.39% 6.45 X % 8.52 X % %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts