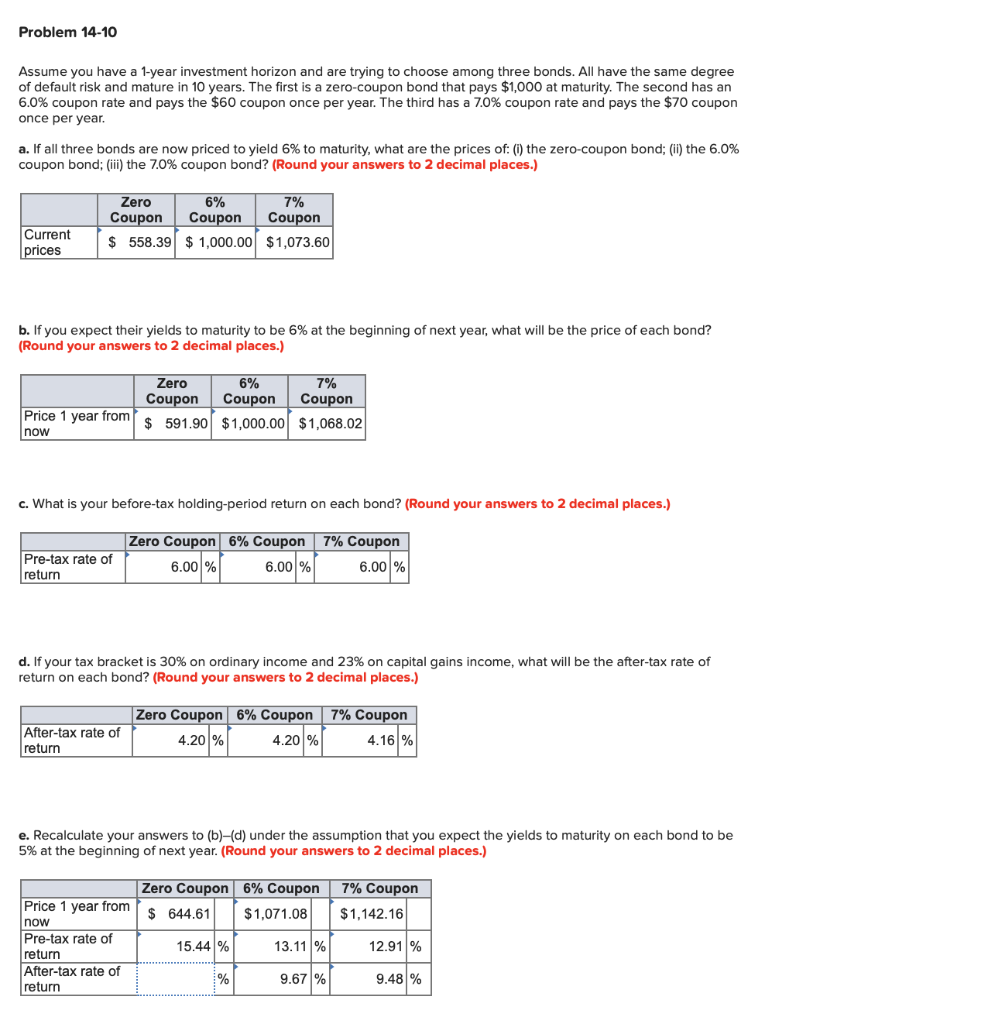

Question: Plz answer e. After-tax rate of return (Zero Coupon). Problem 14-10 Assume you have a 1-year investment horizon and are trying to choose among three

Plz answer e. After-tax rate of return (Zero Coupon).

Problem 14-10 Assume you have a 1-year investment horizon and are trying to choose among three bonds. All have the same degree of default risk and mature in 10 years. The first is a zero-coupon bond that pays $1,000 at maturity. The second has an 6.0% coupon rate and pays the $60 coupon once per year. The third has a 7.0% coupon rate and pays the $70 coupon once per year. a. If all three bonds are now priced to yield 6% to maturity, what are the prices of: (1) the zero-coupon bond; (ii) the 6.0% coupon bond; (iii) the 7.0% coupon bond? (Round your answers to 2 decimal places.) Zero 6% 7% Coupon Coupon Coupon $ 558.39 $ 1,000.00 $1,073.60 Current prices b. If you expect their yields to maturity to be 6% at the beginning of next year, what will be the price of each bond? (Round your answers to 2 decimal places.) Zero 6% 7% Coupon Coupon Coupon $ 591.90 $1,000.00 $1,068.02 Price 1 year from now c. What is your before-tax holding-period return on each bond? (Round your answers to 2 decimal places.) Pre-tax rate of return Zero Coupon 6% Coupon 7% Coupon 6.00 % 6.00% 6.00% d. If your tax bracket is 30% on ordinary income and 23% on capital gains income, what will be the after-tax rate of return on each bond? (Round your answers to 2 decimal places.) After-tax rate of return Zero Coupon 6% Coupon 7% Coupon 4.201% 4.20 % 4.16% e. Recalculate your answers to (b)-(d) under the assumption that you expect the yields to maturity on each bond to be 5% at the beginning of next year. (Round your answers to 2 decimal places.) Zero Coupon 6% Coupon $ 644.61 $1,071.08 7% Coupon $1,142.16 Price 1 year from now Pre-tax rate of return After-tax rate of return 15.44 % 13.11% 12.91% % 9.67% 9.48 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts