Question: I need help with Exercise #5 XTimes New Roman Paste Paragraph Styles Editing Font Exercise #3 How much would you pay for a perpetuity which

I need help with Exercise #5

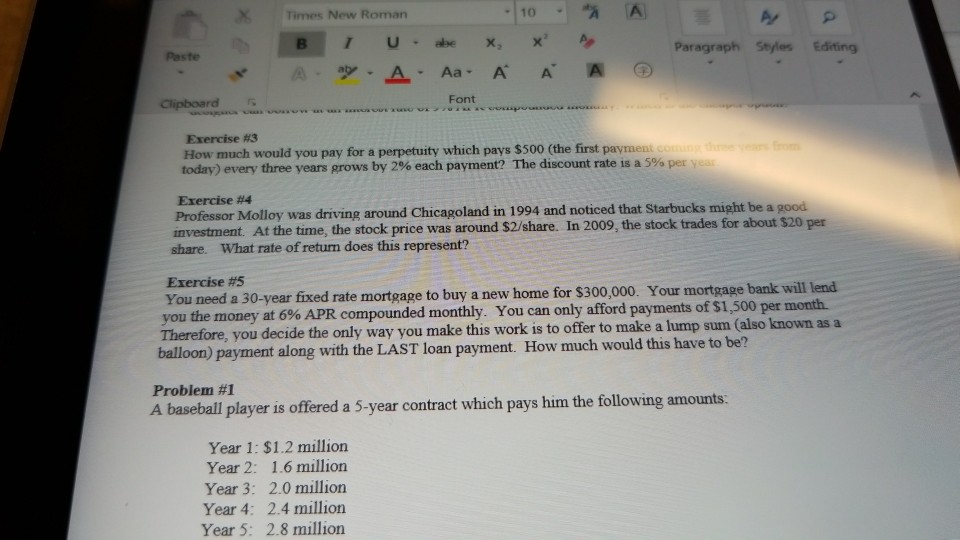

XTimes New Roman Paste Paragraph Styles Editing Font Exercise #3 How much would you pay for a perpetuity which pays $500 (the first payment today) every three years grows by 2% each payment? The discount rate is a 5% per y Professor Molloy was driving around Chicagoland in 1994 and noticed that Starbucks might be a good share. What rate of return does this represent? Exercise #5 price was around $2/share. In 2009, the stock trades for about $20 per You need a 30-year fixed rate mortgage to buy a new home for $300,000. Your mortgage bank will lend you the money at 6% APR compounded monthly. You can only afford payments of $1,500 per month. Therefore, you decide the only way you make this work is to offer to make a lump sum (also known as a balloon) payment along with the LAST loan payment. How much would this have to be? Problem #1 A baseball player is offered a 5-year contract which pays him the following amounts: Year 1: $1.2 million Year 2: 1.6 million Year 3: 2.0 million Year 4: 2.4 million Year 5: 2.8 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts