Question: I need help with figuring out this question, as I am really not sure how to do it. The reference for this question, comes from

I need help with figuring out this question, as I am really not sure how to do it.

The reference for this question, comes from here

However, the focus and the main problem come from (4a).

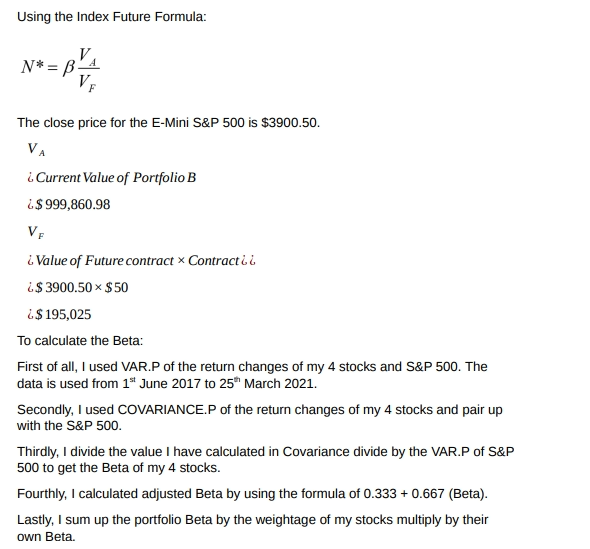

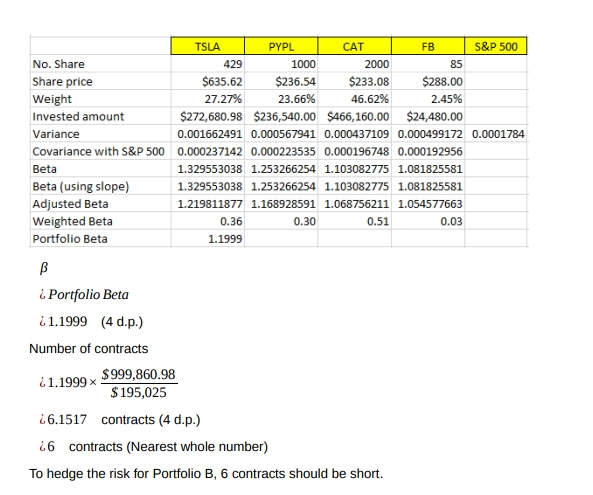

Using the Index Future Formula: N* =/ The close price for the E-Mini S&P 500 is $3900.50. VA L Current Value of Portfolio B & $ 999,860.98 VE L Value of Future contract x Contract & & 4 $ 3900.50 * $50 4 $ 195,025 To calculate the Beta: First of all, I used VAR.P of the return changes of my 4 stocks and S&P 500. The data is used from 1" June 2017 to 25" March 2021. Secondly, I used COVARIANCE.P of the return changes of my 4 stocks and pair up with the S&P 500. Thirdly, I divide the value I have calculated in Covariance divide by the VAR.P of S&P 500 to get the Beta of my 4 stocks. Fourthly, I calculated adjusted Beta by using the formula of 0.333 + 0.667 (Beta). Lastly, I sum up the portfolio Beta by the weightage of my stocks multiply by their own Beta.TSLA PYPL CAT FB S&P 500 No. Share 429 1000 2000 85 Share price $635.62 $236.54 $233.08 $288.00 Weight 27.27% 23.66% 46.62% 2.45% Invested amount $272,680.98 $236,540.00 $466,160.00 $24,480.00 Variance 0.001662491 0.000567941 0.000437109 0.000499172 0.0001784 Covariance with S&P 500 0.000237142 0.000223535 0.000196748 0.000192956 Beta 1.329553038 1.253266254 1.103082775 1.081825581 Beta (using slope) 1.329553038 1.253266254 1.103082775 1.081825581 Adjusted Beta 1.219811877 1.168928591 1.068756211 1.054577663 Weighted Beta 0.36 0.30 0.51 0.03 Portfolio Beta 1.1999 B L Portfolio Beta 4 1.1999 (4 d.p.) Number of contracts 41.1999 x $999,860.98 $ 195,025 46.1517 contracts (4 d.p.) 46 contracts (Nearest whole number) To hedge the risk for Portfolio B, 6 contracts should be short

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts