Question: Thinking and Inquiry /15 1) A, B, and C formed a partnership. When applicable, the partnership agreement states that salaries are to be paid first,

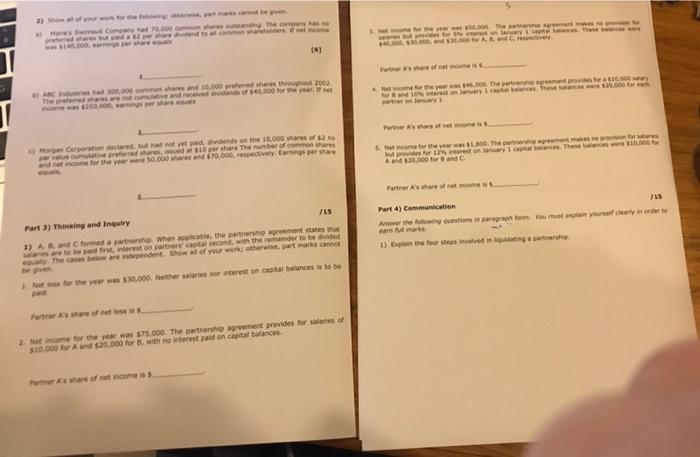

Thinking and Inquiry /15 1) A, B, and C formed a partnership. When applicable, the partnership agreement states that salaries are to be paid first, interest on partners' capital second, with the remainder to be divided equally. The cases below are independent. Show all of your work; otherwise, part marks cannot be given.

1. Net loss for the year was $30,000. Neither salaries nor interest on capital balances is to be paid. Partner A's share of net loss is $____________.

2. Net income for the year was $75,000. The partnership agreement provides for salaries of $10,000 for A and $20,000 for B, with no interest paid on capital balances. Partner A's share of net income is $____________.

3. Net income for the year was $50,000. The partnership agreement makes no provision for salaries but provides for 5% interest on January 1 capital balances. These balances were $40,000, $30,000, and $30,000 for A, B, and C, respectively. Partner A's share of net income is $____________.

4. Net income for the year was $46,000. The partnership agreement provides for a $10,000 salary for B and 10% interest on January 1 capital balances. These balances were $20,000 for each partner on January 1. Partner A's share of net income is $____________.

5. Net income for the year was $1,800. The partnership agreement makes no provision for salaries but provides for 12% interest on January 1 capital balances. These balances were $10,000 for A and $20,000 for B and C. Partner A's share of net income is $____________.

2) h of your work for the foowngherw, ert marks can be en Has Swt Company hed 70,000 mon hares otanding The ompeny hes: emed hares buk pd per share dend tis coemen sharhoders S.0. agser share (incame 1 Net inn fr the yeer .000The partnert sgrement msprvn te saes nides tor itrt en lenuaryi ap la These es $40,000, .000, nd 000 ARandC tivt Partner Aharef net ome s AC re had 00,000 conen shar and 10,000 preferret are thot 200a. The preteed shares are net utive ndreceved dends of 0.000 for the year. e .000, aing per Mare e 4Netme or the year w .000. The partentp ageme provdes tr 0.00 stry trnd 10 arst on Jaury 1 a belences hese alances were sa.0o for h ertner en eary Parer Ashare of et e is Morgan Corporation dectaret but had not yet pad, avidends on the 10.000 shares of s2 na par value cumutative preferred shares, ed at 10 per share The number of common share and net ome for the vear were S0.000 shares and 70,000, respectively. Earnings per share S at income fer the vear was L800. The pannertg agreme mae no provon for salares ut prevides for 12 erest on aary 1 capital beancs These belances were 10.000 for Aand s20.000 forand C. ual Partner As share of net incomeins. Part 3) Thinking and Inquiry Part 4) Communication and C formed a partnershp. When applicatie, the partnenship agreement states that Answer the folowing ouestions n paragran form Tu must explain yurself cearly in order t eare ut marks 1) salares are to be paid firut, interest on partners capital second, with the remainder to be divided al e gven The cases beow are independent. Show al of your work otherwise, part marks cannot 4) Esplain the four steps invalved in uidating s partnershi 1. Net oes for the year was 30,000. Nether selaries nor interest on capital balances is to be paid Fartner As share of net los s 2 Nat income for the year was S75,000. The partnership agreement provides for salaries of $10.000 for A and s20,000 for B, with no interest paid on capital balances Partner A's share of net income is

Step by Step Solution

3.59 Rating (153 Votes )

There are 3 Steps involved in it

Answer 1 Partner As share of net loss 30000 13 10000 Answer 2 Calculation of remainder income which ... View full answer

Get step-by-step solutions from verified subject matter experts