Question: I need help with form 1040 TIL LIBRARY MOODLE HELP COURSE EVAL ENGLISH - UNITED STATES (EN_US) - 20SP Financial Business Practices (BUS-208-NA) Dashboard /

I need help with form 1040

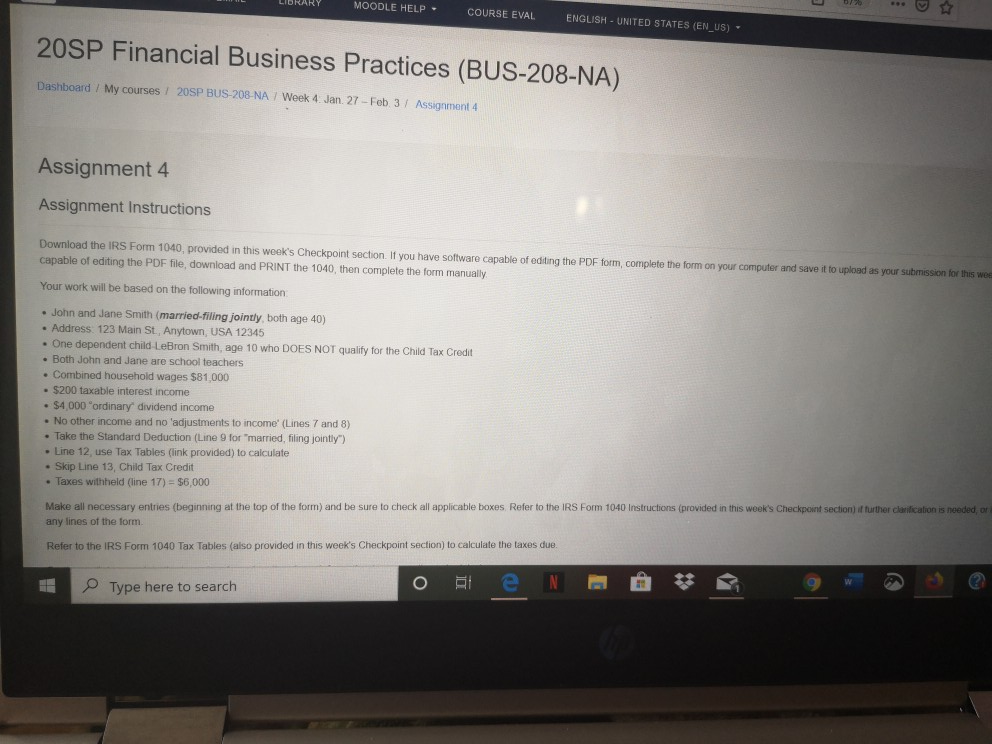

TIL LIBRARY MOODLE HELP COURSE EVAL ENGLISH - UNITED STATES (EN_US) - 20SP Financial Business Practices (BUS-208-NA) Dashboard / My courses / 20SP BUS-208-NA / Week 4 Jan 27 - Feb 3 / Assignment 4 Assignment 4 Assignment Instructions Download the IRS Form 1040. provided in this week's Checkpoint section. If you have software capable of editing the PDF form, complete the form on your computer and save it to upload as your submission for this we capable of editing the PDF file, download and PRINT the 1040, then complete the form manually Your work will be based on the following information John and Jane Smith (married-filing jointly both age 40) Address: 123 Main St, Anytown, USA 12345 . One dependent child LeBron Smith, age 10 who DOES NOT qualify for the Child Tax Credit . Both John and Jane are school teachers Combined household wages $81.000 $200 taxable interest income $4000 "ordinary dividend income . No other income and no 'adjustments to income' (Lines 7 and 8) Take the Standard Deduction (Line 9 for "married, filing jointly) Line 12, use Tax Tables (link provided) to calculate Skip Line 13, Child Tax Credit Taxes withheld (line 17) = $6,000 Make all necessary entries (beginning at the top of the form) and be sure to check all applicable boxes Refer to the IRS Form 1040 Instructions (provided in this week's Checkpoint section of further clarification is needed, or any lines of the form Refer to the IRS Form 1040 Tax Tables (also provided in this week's Checkpoint section) to calculate the taxes due Type here to search TIL LIBRARY MOODLE HELP COURSE EVAL ENGLISH - UNITED STATES (EN_US) - 20SP Financial Business Practices (BUS-208-NA) Dashboard / My courses / 20SP BUS-208-NA / Week 4 Jan 27 - Feb 3 / Assignment 4 Assignment 4 Assignment Instructions Download the IRS Form 1040. provided in this week's Checkpoint section. If you have software capable of editing the PDF form, complete the form on your computer and save it to upload as your submission for this we capable of editing the PDF file, download and PRINT the 1040, then complete the form manually Your work will be based on the following information John and Jane Smith (married-filing jointly both age 40) Address: 123 Main St, Anytown, USA 12345 . One dependent child LeBron Smith, age 10 who DOES NOT qualify for the Child Tax Credit . Both John and Jane are school teachers Combined household wages $81.000 $200 taxable interest income $4000 "ordinary dividend income . No other income and no 'adjustments to income' (Lines 7 and 8) Take the Standard Deduction (Line 9 for "married, filing jointly) Line 12, use Tax Tables (link provided) to calculate Skip Line 13, Child Tax Credit Taxes withheld (line 17) = $6,000 Make all necessary entries (beginning at the top of the form) and be sure to check all applicable boxes Refer to the IRS Form 1040 Instructions (provided in this week's Checkpoint section of further clarification is needed, or any lines of the form Refer to the IRS Form 1040 Tax Tables (also provided in this week's Checkpoint section) to calculate the taxes due Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts