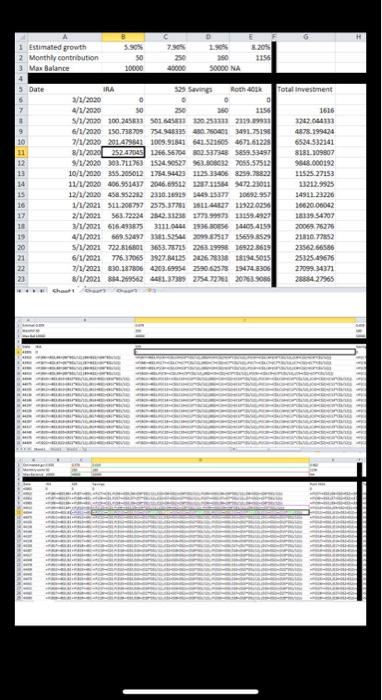

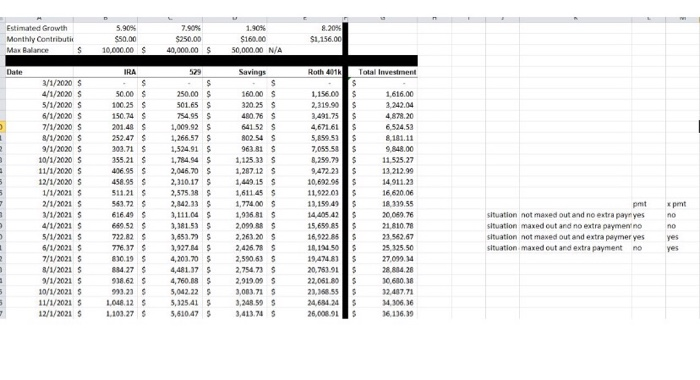

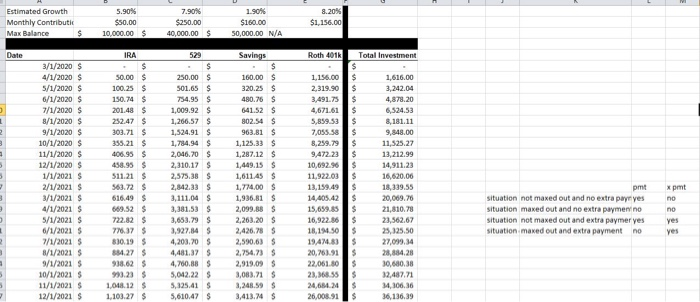

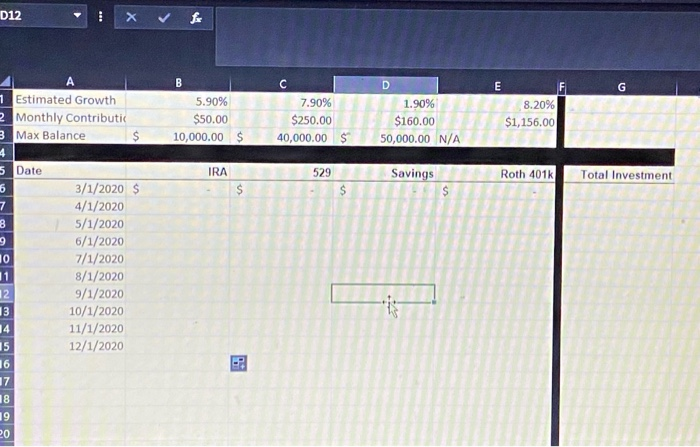

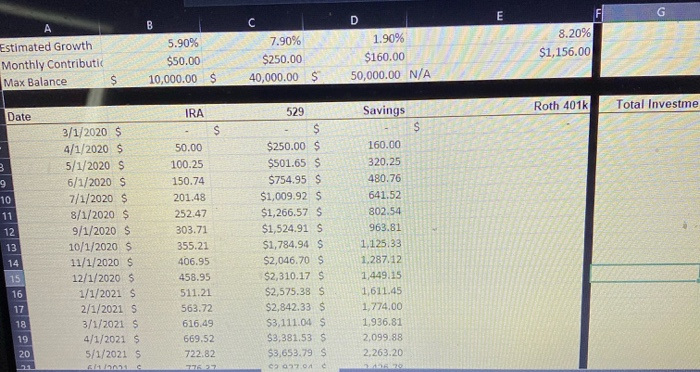

Question: i need help with formula for E 3. In the Investment worksheet, you will be calculating the monthly balance of a persons investments over a

1 Estimated growth 2 Monthly contribution 3 Max Balance 1156 350 SODO NA 5 Date Total investment 132 529 San Roth OER 3/1/2020 4/1/2020 W1/2020 100 3 501 102 6/1/2020 150.738709 753 750391.75198 2/12920201491009 50505 0671 61223 //2020 252.47045 1256 56704 302 53734 S85953497 9/1/2020 3211534627 2 0555512 30/1/2020 355. 2021754 1235 33406 3959.322 11/1/202006951437 205.2 011 2011 65351261 1/1/2021 S120 2573 372 1 27 1122 2/1/201563.72234 250 235177395731359.4323 1/2021636.493675 311 1936 BORSE AS.419 4/1/2016657155291517 1565529 5/1/2021 722 616013653.7875 226319998 16922 8529 6/1/2021726370651927.4106 1 115015 2/1/2021 830.107306 4203.094 209578 194748306 8/1/2021 2095213739 275472751 207538 1155275 13212935 1412220 165200002 16339.54707 2006 2010 77852 2626586 25125.49676 2709 288427965 Fuled Growth Monthly Contributi Max Race 7.90 $50.00 40.000. 00 $50.00 1000000 1.90% $16000 .000 0 $1.156.00 S $ 0 N/A Date Savings Roth 401 Total Investment 1/1/2020 S 4/1/2020 $ 5/1/2020 S 6/1/2020 S 2/1/2020 S 1/1/2020 $ 9/1/2020 S 10/1/2020 S 11/1/2020 S 12/1/2020 $ 1/1/2021 S 2/1/20215 1/1/2021 S 4/1/2021 5/1/2021 S 6/1/20215 7/1/20215 1/1/2021 9/1/2021 S 10/1/2021 S 11/1/2021 12/1/20215 50.00 $ 100.25 $ 150.74 $ 2014 252.47 $ 301.71 $ 255.21 406.95 $ 458.95 $ $11.21 567.72 $ 616.49 $ 2 $ 722.82 $ 7737 810 19 $ 634.27 $ 938.625 93.215 1 012 250.00 $ 501.65 $ 754.95 $ 1,009.) 1,266.57 $ 1.524.91 $ 1,714.94 $ 2,046.20 2,310.175 2.595.385 2,1423) 1,111.04 $ 1,181.535 1.651.70 S 1,027.345 4,201.05 4,481.375 4,780.8 042225 5,125.41 5,610.47 % 16000$ 32055 480.76 S 64155 309 545 96381 S 1,1251) S 1,267.12 S 1.440.15 S 1,611 455 1,77400S 1,9181 2,099 S 2.263.205 2,436.78 2.590.6) 2.754.7) 2010. 05 3,083715 3.240 995 3.41 $ 1196.00 2.31999 2.401.75 4.671.61 5.559 53 7.055 50 259.79 9472 23 10.699.95 11,92203 11.199 49 14 405 42 15.65985 16.922 85 11 19.474.81 20,75191 22.0519 21.168.55 24.63 26.000 1 616.00 2.242.04 4878,20 6.524 52 101.11 9648,00 11.525, 27 12.212.99 14 911.23 16 620.06 16.339.55 20069,76 21 810.78 23562.67 25.325.50 27.1.4 28 04.28 1000 32.487.71 ML106.36 16 116.39 spent situation not maxed out and no extra panyes situation maxed out and no extra paymenino situation not maxed out and extra paymer yes situation maxed out and extra payment no yes Estimated Growth Monthly Contributi Max Balance 5.90% $50.00 10,000.00 7.90% $250.00 40,000.00 1.906 $160.00 50.000,00 N/A 8.20% $1.156.00 $ $ $ Date IRA 529 Savings Roth 401k Total Investment $ 1.616.00 3,242.04 4,878.20 652053 3/1/2020 $ 4/1/2020 $ 5/1/2020 $ 6/1/2020 $ 7/1/2020 $ 8/1/2020 $ 9/1/2020 $ 10/1/2020 s 11/1/2020 S 12/1/2020 S 1/1/2021 S 2/1/2021 $ 3/1/2021 $ 4/1/2021 $ 5/1/2021 $ 6/1/2021 $ 7/1/2021 S 8/1/2021 9/1/2021 S 10/1/2021 $ 11/1/2021 $ 12/1/2021 $ 50.00 $ 100.25 $ 150.74 $ 201.48 $ 252.47 $ 303.71 $ 355.21 $ 406.95 $ 45.95 $ $11.21 $ 563.72 $ 616.49 $ 6 .52 $ 722.82 770.375 810.19 $ 84.27 $ 938.62 $ 993.23 $ 1,048.12 $ 1.103.27 $ 250.00 $ 501.65 $ 754.95 S 1,009.92 $ 1,266.57 $ 1,524.91 $ 1,784.94 $ 2.046,20 S 2.310.17 S 2,575.38 2,842,33 $ 111.04 $ 3.181.53 $ 3,653.79 $ 3,927.84 S 4,203.20 $ 4,481.32 $ 4,700.88 $ 5,042.22 $ 5,325.41 S 5,610.47 $ 160.00 $ 320.25 $ 490.76 $ 641.52 S 802.54 $ 963.81 $ 1,125.33 S 1.287.12 S 1.449.15S 1,611.45 $ 1,774.00 $ 1.936.81 S 2,099.88 $ 2.263.20 $ 2,426.78 2.590.63 $ 2,754,73 $ 2,919.09 3,083.715 3,248.59 $ 3,413.74 S 1.156,00 2,319.90 3.4917 4,671.61 5,859.53 7,055.58 8,259.79 9472 23 10.092.96 11.922.03 13.159.49 14.405.42 15,659.85 16.922.86 18.11.50 194.83 20,263.91 22,061.80 23.368.55 24,61 26,008 913 8,181.11 9,848.00 11.525.27 13,212.99 14.911.23 16.620.00 10.339.55 20.069,76 21,810,78 23.562.67 25, 125.50 27,099.34 28.84.28 30.680.38 32,487,71 34,300.36 36, 136.39 pmtxpmt situation not maxed out and no extra payr yes no situation maxed out and no extra paymenino no situation not maxed out and extra paymer yes yes situation maxed out and extra payment no yes 012 X 8.20% 1 Estimated Growth 2 Monthly Contributi 3 Max Balance 5.90% $50.00 10,000.00 7.90% $250.00 40,000.00 1.90% $160.00 50,000.00 N/A $1,156,00 St $ $ $ 5 Date Savings Roth 401k Total Investment 3/1/2020 $ 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 11/1/2020 12/1/2020 Estimated Growth Monthly Contributi Max Balance 5.90% $50.00 7.90% $250.00 40,000.00 0. 1.90% $160.00 50,000.00 N/A 8.20% $1,156.00 $ 10,000.00 $ $ Date IRA 529 Savings Roth 401k Total Investme 3/1/2020 $ 4/1/2020 $ 5/1/2020 $ 6/1/2020 $ 7/1/2020 $ 8/1/2020 $ 9/1/2020 $ 10/1/2020 $ 11/1/2020 $ 12/1/2020 $ 1/1/2021 S 2/1/2021 S 3/1/2021 $ 4/1/2021 5/1/2021 $ uc 50.00 100.25 150.74 201.48 252.47 303.71 355.21 406.95 458.95 511.21 563.72 616.49 669.52 722.82 $250.00 $ $501.65 $ $754.95 $ $1,009.92 $ $1,266.57 $ $1,524.91 S $1,784.94 $ $2,046.70 S $2,310.17 $ $2,575.38 S $2,842.33 $ $3,111.04 $ $3,381.53 S $3,653.79 $ 42027.04 160.00 320.25 480.76 641.52 802.54 963.81 1,125.33 1.287.12 1,449.15 1,611.45 1.774.00 1,936.81 2,099.88 2.263.20 Garano 1 Estimated growth 2 Monthly contribution 3 Max Balance 1156 350 SODO NA 5 Date Total investment 132 529 San Roth OER 3/1/2020 4/1/2020 W1/2020 100 3 501 102 6/1/2020 150.738709 753 750391.75198 2/12920201491009 50505 0671 61223 //2020 252.47045 1256 56704 302 53734 S85953497 9/1/2020 3211534627 2 0555512 30/1/2020 355. 2021754 1235 33406 3959.322 11/1/202006951437 205.2 011 2011 65351261 1/1/2021 S120 2573 372 1 27 1122 2/1/201563.72234 250 235177395731359.4323 1/2021636.493675 311 1936 BORSE AS.419 4/1/2016657155291517 1565529 5/1/2021 722 616013653.7875 226319998 16922 8529 6/1/2021726370651927.4106 1 115015 2/1/2021 830.107306 4203.094 209578 194748306 8/1/2021 2095213739 275472751 207538 1155275 13212935 1412220 165200002 16339.54707 2006 2010 77852 2626586 25125.49676 2709 288427965 Fuled Growth Monthly Contributi Max Race 7.90 $50.00 40.000. 00 $50.00 1000000 1.90% $16000 .000 0 $1.156.00 S $ 0 N/A Date Savings Roth 401 Total Investment 1/1/2020 S 4/1/2020 $ 5/1/2020 S 6/1/2020 S 2/1/2020 S 1/1/2020 $ 9/1/2020 S 10/1/2020 S 11/1/2020 S 12/1/2020 $ 1/1/2021 S 2/1/20215 1/1/2021 S 4/1/2021 5/1/2021 S 6/1/20215 7/1/20215 1/1/2021 9/1/2021 S 10/1/2021 S 11/1/2021 12/1/20215 50.00 $ 100.25 $ 150.74 $ 2014 252.47 $ 301.71 $ 255.21 406.95 $ 458.95 $ $11.21 567.72 $ 616.49 $ 2 $ 722.82 $ 7737 810 19 $ 634.27 $ 938.625 93.215 1 012 250.00 $ 501.65 $ 754.95 $ 1,009.) 1,266.57 $ 1.524.91 $ 1,714.94 $ 2,046.20 2,310.175 2.595.385 2,1423) 1,111.04 $ 1,181.535 1.651.70 S 1,027.345 4,201.05 4,481.375 4,780.8 042225 5,125.41 5,610.47 % 16000$ 32055 480.76 S 64155 309 545 96381 S 1,1251) S 1,267.12 S 1.440.15 S 1,611 455 1,77400S 1,9181 2,099 S 2.263.205 2,436.78 2.590.6) 2.754.7) 2010. 05 3,083715 3.240 995 3.41 $ 1196.00 2.31999 2.401.75 4.671.61 5.559 53 7.055 50 259.79 9472 23 10.699.95 11,92203 11.199 49 14 405 42 15.65985 16.922 85 11 19.474.81 20,75191 22.0519 21.168.55 24.63 26.000 1 616.00 2.242.04 4878,20 6.524 52 101.11 9648,00 11.525, 27 12.212.99 14 911.23 16 620.06 16.339.55 20069,76 21 810.78 23562.67 25.325.50 27.1.4 28 04.28 1000 32.487.71 ML106.36 16 116.39 spent situation not maxed out and no extra panyes situation maxed out and no extra paymenino situation not maxed out and extra paymer yes situation maxed out and extra payment no yes Estimated Growth Monthly Contributi Max Balance 5.90% $50.00 10,000.00 7.90% $250.00 40,000.00 1.906 $160.00 50.000,00 N/A 8.20% $1.156.00 $ $ $ Date IRA 529 Savings Roth 401k Total Investment $ 1.616.00 3,242.04 4,878.20 652053 3/1/2020 $ 4/1/2020 $ 5/1/2020 $ 6/1/2020 $ 7/1/2020 $ 8/1/2020 $ 9/1/2020 $ 10/1/2020 s 11/1/2020 S 12/1/2020 S 1/1/2021 S 2/1/2021 $ 3/1/2021 $ 4/1/2021 $ 5/1/2021 $ 6/1/2021 $ 7/1/2021 S 8/1/2021 9/1/2021 S 10/1/2021 $ 11/1/2021 $ 12/1/2021 $ 50.00 $ 100.25 $ 150.74 $ 201.48 $ 252.47 $ 303.71 $ 355.21 $ 406.95 $ 45.95 $ $11.21 $ 563.72 $ 616.49 $ 6 .52 $ 722.82 770.375 810.19 $ 84.27 $ 938.62 $ 993.23 $ 1,048.12 $ 1.103.27 $ 250.00 $ 501.65 $ 754.95 S 1,009.92 $ 1,266.57 $ 1,524.91 $ 1,784.94 $ 2.046,20 S 2.310.17 S 2,575.38 2,842,33 $ 111.04 $ 3.181.53 $ 3,653.79 $ 3,927.84 S 4,203.20 $ 4,481.32 $ 4,700.88 $ 5,042.22 $ 5,325.41 S 5,610.47 $ 160.00 $ 320.25 $ 490.76 $ 641.52 S 802.54 $ 963.81 $ 1,125.33 S 1.287.12 S 1.449.15S 1,611.45 $ 1,774.00 $ 1.936.81 S 2,099.88 $ 2.263.20 $ 2,426.78 2.590.63 $ 2,754,73 $ 2,919.09 3,083.715 3,248.59 $ 3,413.74 S 1.156,00 2,319.90 3.4917 4,671.61 5,859.53 7,055.58 8,259.79 9472 23 10.092.96 11.922.03 13.159.49 14.405.42 15,659.85 16.922.86 18.11.50 194.83 20,263.91 22,061.80 23.368.55 24,61 26,008 913 8,181.11 9,848.00 11.525.27 13,212.99 14.911.23 16.620.00 10.339.55 20.069,76 21,810,78 23.562.67 25, 125.50 27,099.34 28.84.28 30.680.38 32,487,71 34,300.36 36, 136.39 pmtxpmt situation not maxed out and no extra payr yes no situation maxed out and no extra paymenino no situation not maxed out and extra paymer yes yes situation maxed out and extra payment no yes 012 X 8.20% 1 Estimated Growth 2 Monthly Contributi 3 Max Balance 5.90% $50.00 10,000.00 7.90% $250.00 40,000.00 1.90% $160.00 50,000.00 N/A $1,156,00 St $ $ $ 5 Date Savings Roth 401k Total Investment 3/1/2020 $ 4/1/2020 5/1/2020 6/1/2020 7/1/2020 8/1/2020 9/1/2020 10/1/2020 11/1/2020 12/1/2020 Estimated Growth Monthly Contributi Max Balance 5.90% $50.00 7.90% $250.00 40,000.00 0. 1.90% $160.00 50,000.00 N/A 8.20% $1,156.00 $ 10,000.00 $ $ Date IRA 529 Savings Roth 401k Total Investme 3/1/2020 $ 4/1/2020 $ 5/1/2020 $ 6/1/2020 $ 7/1/2020 $ 8/1/2020 $ 9/1/2020 $ 10/1/2020 $ 11/1/2020 $ 12/1/2020 $ 1/1/2021 S 2/1/2021 S 3/1/2021 $ 4/1/2021 5/1/2021 $ uc 50.00 100.25 150.74 201.48 252.47 303.71 355.21 406.95 458.95 511.21 563.72 616.49 669.52 722.82 $250.00 $ $501.65 $ $754.95 $ $1,009.92 $ $1,266.57 $ $1,524.91 S $1,784.94 $ $2,046.70 S $2,310.17 $ $2,575.38 S $2,842.33 $ $3,111.04 $ $3,381.53 S $3,653.79 $ 42027.04 160.00 320.25 480.76 641.52 802.54 963.81 1,125.33 1.287.12 1,449.15 1,611.45 1.774.00 1,936.81 2,099.88 2.263.20 Garano

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts