Question: I need help with question 3 Comm/ Terms Bid Ask Mid AUD/USD 0.6135 0.614 0.6138 AUD EUR 0.554877372 0.554477405 0.554677389 EUR AUD 1.8022 1.8035 1.8029

I need help with question 3

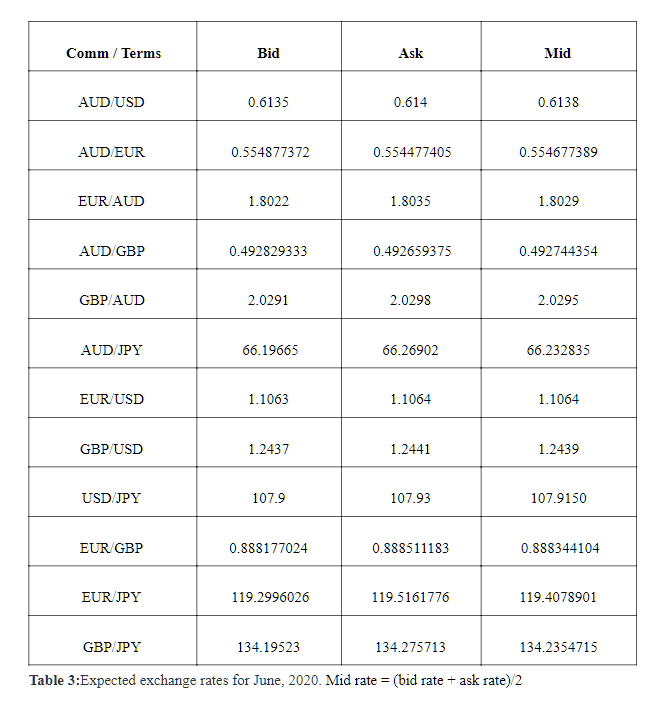

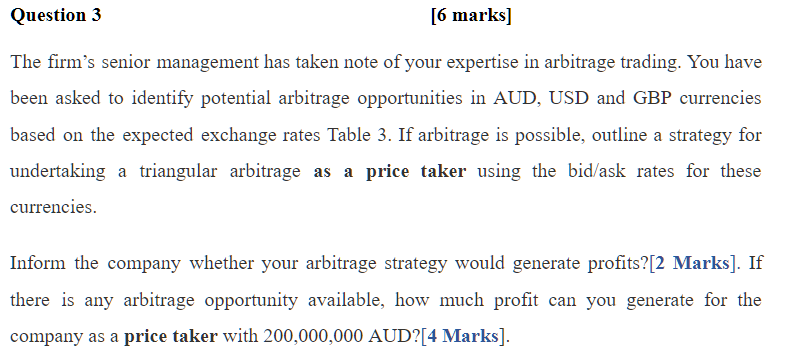

Comm/ Terms Bid Ask Mid AUD/USD 0.6135 0.614 0.6138 AUD EUR 0.554877372 0.554477405 0.554677389 EUR AUD 1.8022 1.8035 1.8029 AUD GBP 0.492829333 0.492659375 0.492744354 GBP AUD 2.0291 2.0298 2.0295 AUD JPY 66.19665 66.26902 66.232835 EUR USD 1.1063 1.1064 1.1064 GBP/USD 1.2437 1.2441 1.2439 USD/JPY 107.9 107.93 107.9150 EUR GBP 0.888177024 0.888511183 0.888344104 EUR JPY 119.2996026 119.5161776 119.4078901 GBP/JPY 134.19523 134.275713 134.2354715 Table 3:Expected exchange rates for June, 2020. Mid rate = (bid rate + ask rate) 2 Question 3 [6 marks] The firm's senior management has taken note of your expertise in arbitrage trading. You have been asked to identify potential arbitrage opportunities in AUD, USD and GBP currencies based on the expected exchange rates Table 3. If arbitrage is possible, outline a strategy for undertaking a triangular arbitrage as a price taker using the bid/ask rates for these currencies. Inform the company whether your arbitrage strategy would generate profits?[2 Marks]. If there is any arbitrage opportunity available, how much profit can you generate for the company as a price taker with 200,000,000 AUD?[4 Marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts