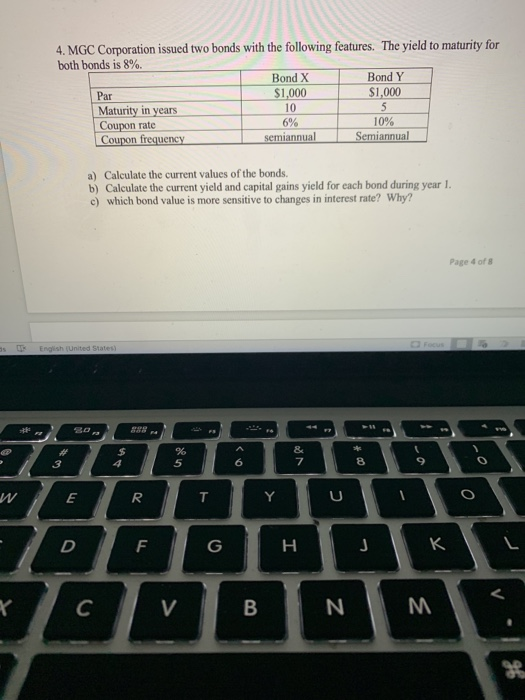

Question: i need help with question 4 with explanation on how you got the answer, thank you 4. MGC Corporation issued two bonds with the following

4. MGC Corporation issued two bonds with the following features. The yield to maturity for both bonds is 8%. Bond X Bond Y Par $1,000 $1,000 Maturity in years 10 5 Coupon rate 6% 10% Coupon frequency semiannual Semiannual a) Calculate the current values of the bonds. b) Calculate the current yield and capital gains yield for each bond during year I. c) which bond value is more sensitive to changes in interest rate? Why? Page 6 of 8 English (United States) EN ERTYUIO DFGHJK

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts