Question: i need help with question 5, need to have the explanation on how the answer was found, thank you 20 5. FMC has just paid

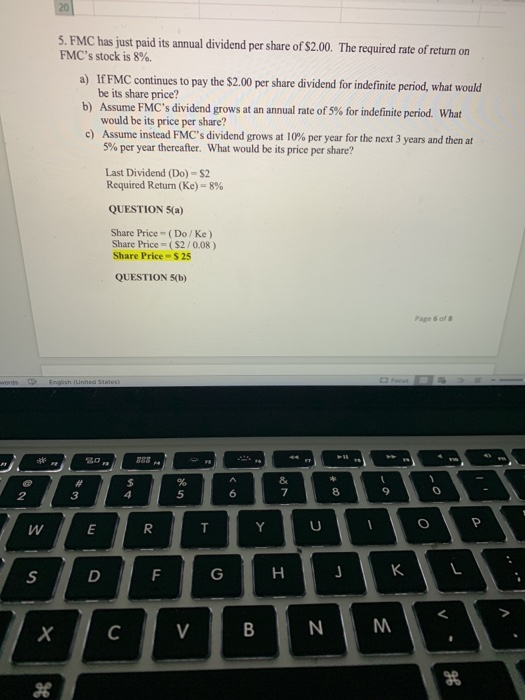

20 5. FMC has just paid its annual dividend per share of $2.00. The required rate of return on FMC's stock is 8%. a) If FMC continues to pay the $2.00 per share dividend for indefinite period, what would be its share price? b) Assume FMC's dividend grows at an annual rate of 5% for indefinite period. What would be its price per share? c) Assume instead FMC's dividend grows at 10% per year for the next 3 years and then at 5% per year thereafter. What would be its price per share? Last Dividend (Do) - $2 Required Return (Ke) = 8% QUESTION 5(a) Share Price -(Do / Ke) Share Price = ($2/0.08 ) Share Price $ 25 QUESTION 5(b) Page of words cp English (Unnes sinen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts