Question: I need help with question D. Please show all the work. If you do question D in Excel please show the formula (NOT THE FUNCTION!!!).

I need help with question D. Please show all the work. If you do question D in Excel please show the formula (NOT THE FUNCTION!!!). I need to see the formula for each answer (i.e. 4 total answers)

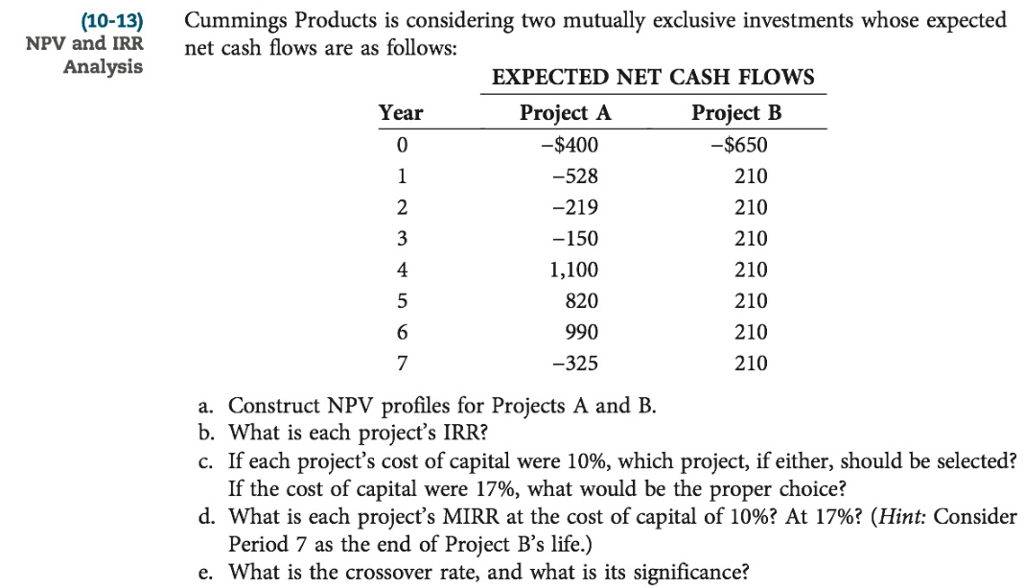

(10-13) NPV and IRR Analysis Cummings Products is considering two mutually exclusive investments whose expected net cash flows are as follows: EXPECTED NET CASH FLOWS Year Project A Project B $400 -528 219 -150 1,100 820 990 325 $650 210 210 210 210 210 210 210 4 7 a. Construct NPV profiles for Projects A and B. b. What is each project's IRR? C. If each project's cost of capital were 10%, which project, if either, should be selected? If the cost of capital were 17%, what would be the proper choice? d. What is each project's MIRR at the cost of capital of 10%? At 17%? (Hint: Consider Period 7 as the end of Project B's life.) e. What is the crossover rate, and what is its significance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts