Question: i need help with question number 2 Straight Bond Value 14-1. Sean Thornton has invested in a convertible bond issued by Cohan Enterprises. The conversion

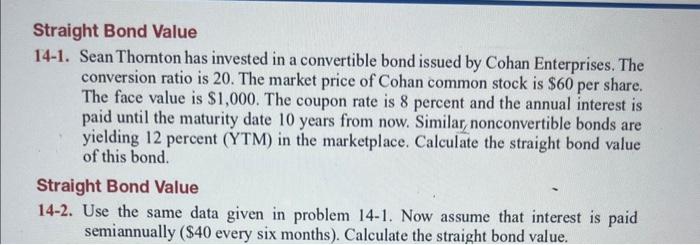

Straight Bond Value 14-1. Sean Thornton has invested in a convertible bond issued by Cohan Enterprises. The conversion ratio is 20 . The market price of Cohan common stock is $60 per share. The face value is $1,000. The coupon rate is 8 percent and the annual interest is paid until the maturity date 10 years from now. Similar, nonconvertible bonds are yielding 12 percent (YTM) in the marketplace. Calculate the straight bond value of this bond. Straight Bond Value 14-2. Use the same data given in problem 14-1. Now assume that interest is paid semiannually ( $40 every six months). Calculate the straight bond value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts