Question: I need help with Required 3 and 4 please Legacy issues $750,000 of 8.0%, four-year bonds dated January 1, 2017, that pay interest semiannually on

I need help with Required 3 and 4 please

I need help with Required 3 and 4 please

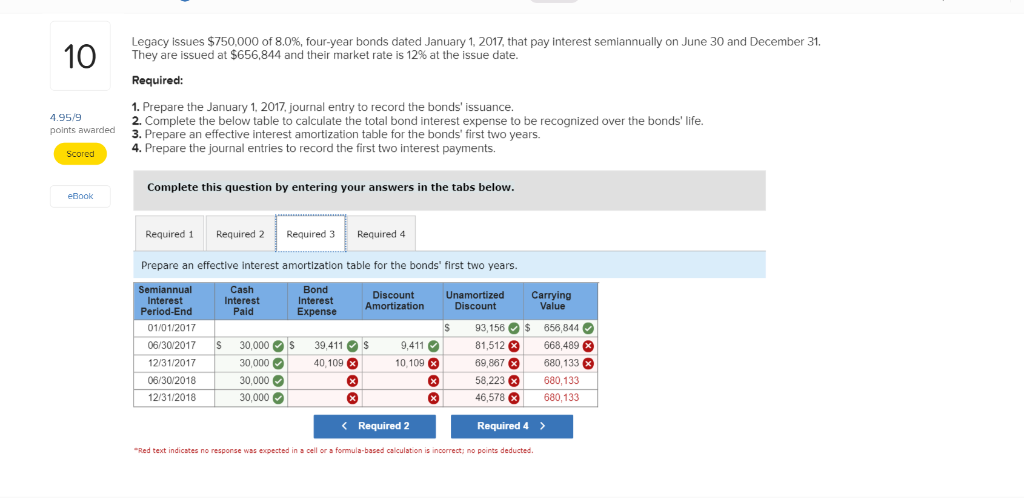

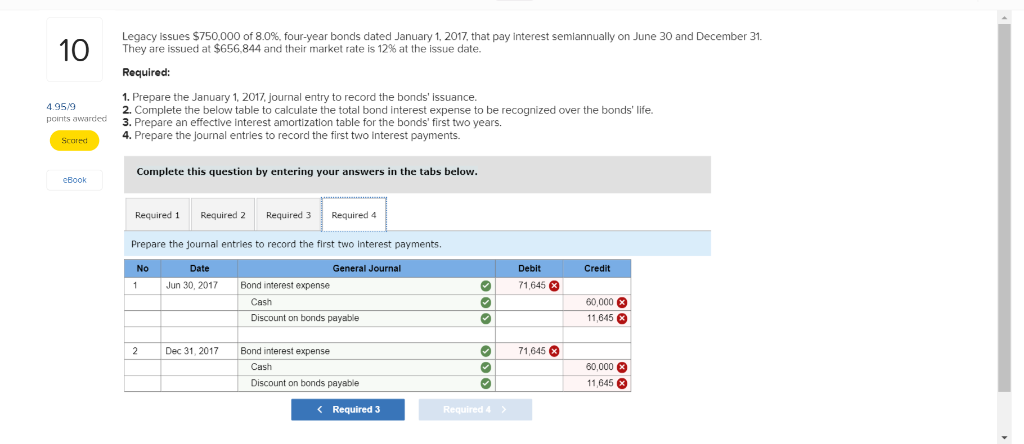

Legacy issues $750,000 of 8.0%, four-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. They are issued at $656,844 and their market rate is 12% at the issue date Required: 1. Prepare the January 1, 2017, journal entry to record the bonds' issuance 2. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first two interest payments. .95/9 points awarded Scored Complete this question by entering your answers in the tabs below eBook Required 1 Required 2Required 3Required 4 Prepare an effective interest amortization table for the bonds' first two years. Unamortized Carrying Interest Interest Paid Interest Discount Value S 93,156$ 656,844 01/01/2017 06/30/2017S30,000 39,411S 9,41181,512 668,489 12/31/2017 06/30/2018 12/31/2018 0,00040,109 0,000 30,000 10,109 6987680,133 358,223680,133 680,133 Required 2 Required 4> "Red text indicates no response was expected in cell or formula-based calculation is noorrect; no ponts deducted. Legacy issues $750,000 of 8.0%, four-year bonds dated January 1, 2017, that pay interest semiannually on June 30 and December 31. They are issued at $656.844 and their market rate is 12% at the issue date. Required: 1. Prepare the January 1, 2017, journal entry to record the bonds' issuance. 2. Complete the below table to calculate the total bond interest expense to be recognized over the bonds' life 3. Prepare an effective interest amortization table for the bonds' first two years. 4. Prepare the journal entries to record the first two interest payments. 4.95/9 points awarded Scored Complete this question by entering your answers in the tabs below eBook Required 1 Required 2Required 3 Required 4 Prepare the joumal entries to record the first two interest payments. No Date General Journal Debit Credit Jun 30, 2017 Bond interest expense 71,645 60,000 11,645 Cash Discount on bonds payable Dec 31, 2017 Bond interest expense 71,645 60,000 11,645 Cash Discount on bonds payable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts