Question: I need help with step by step solutions. Thank you 4. Calculate expected annual revenues (4 points) a. for low-price option: b. for high-price option:

I need help with step by step solutions. Thank you

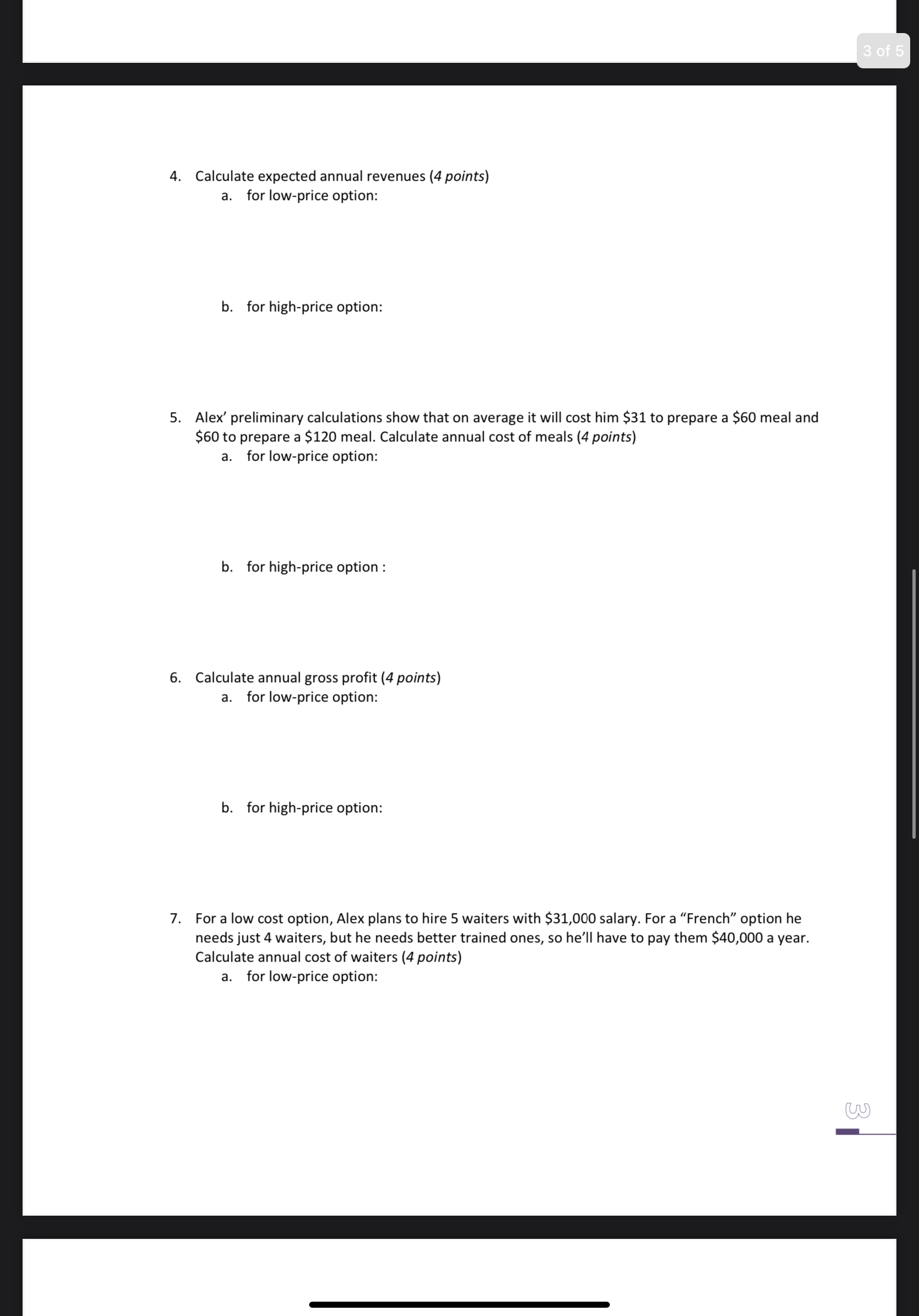

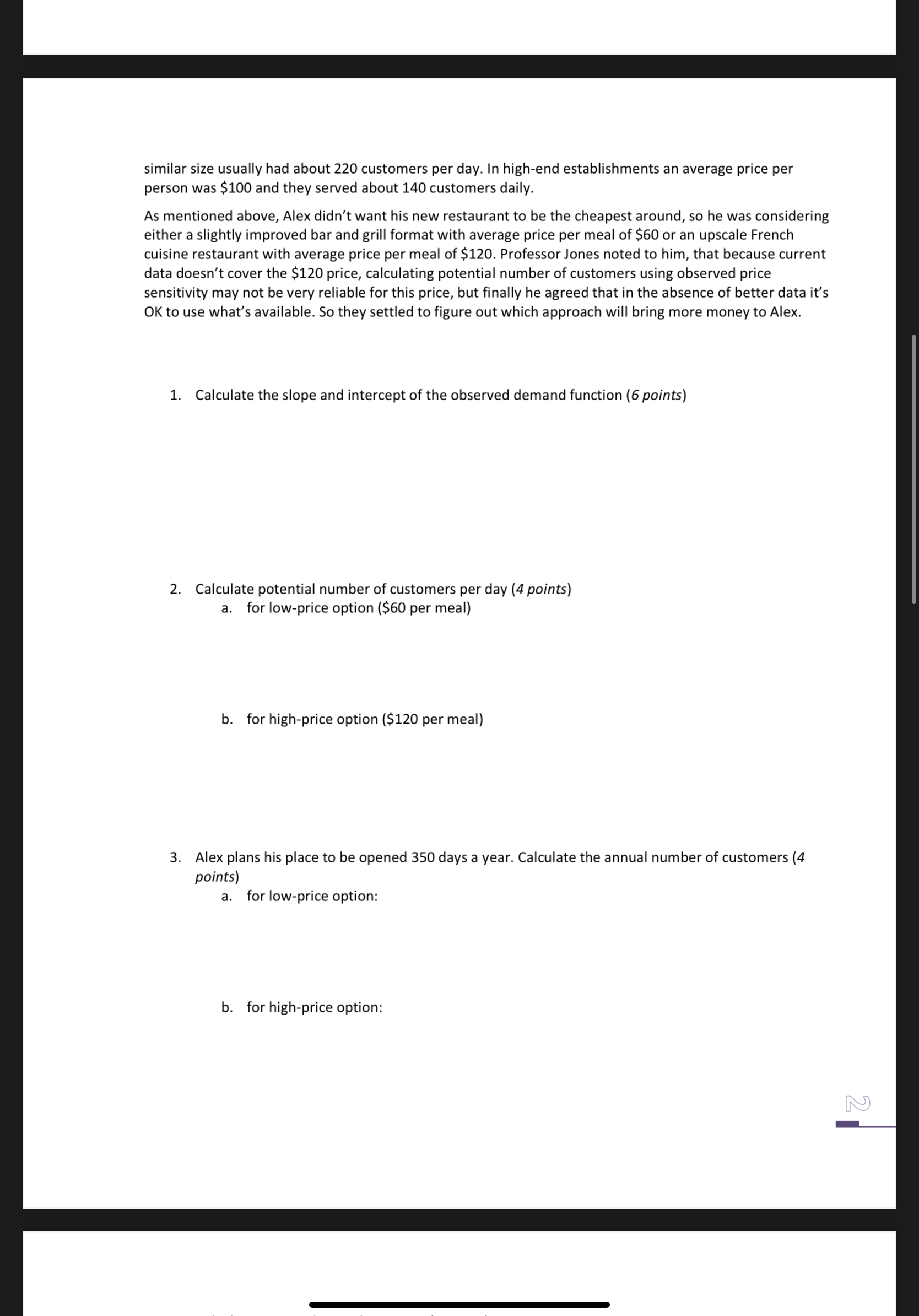

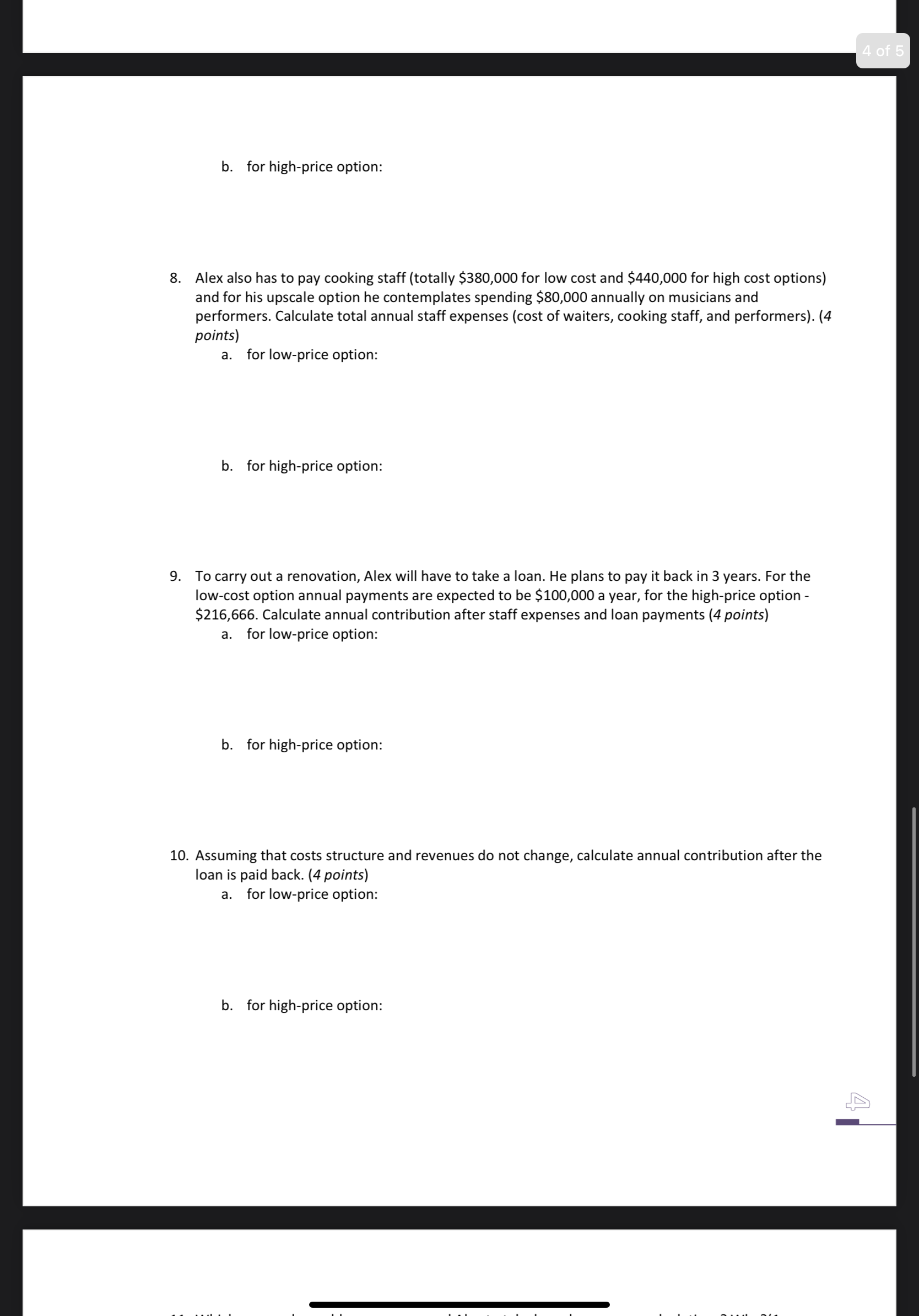

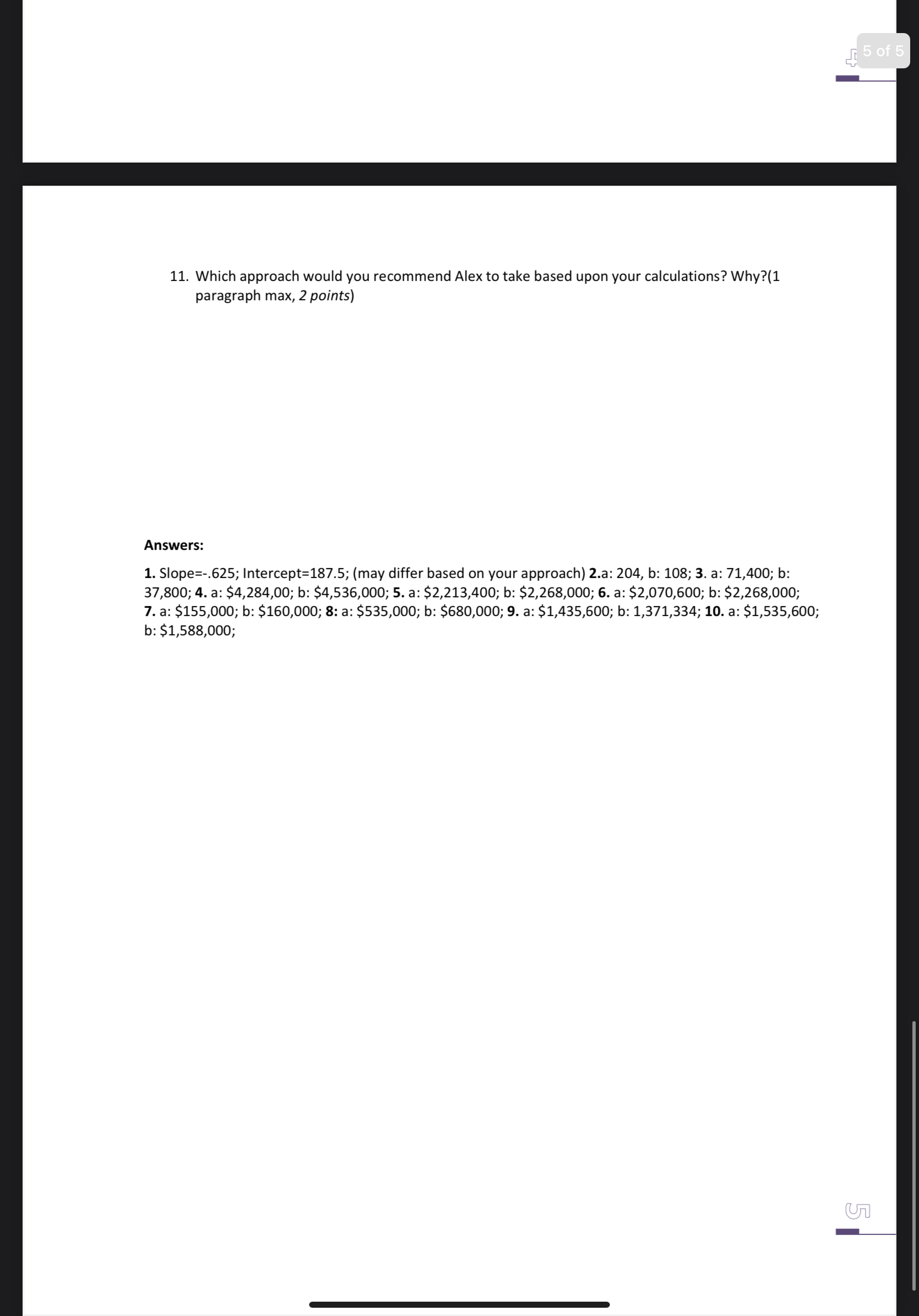

4. Calculate expected annual revenues (4 points) a. for low-price option: b. for high-price option: 5. Alex' preliminary calculations show that on average it will cost him $31 to prepare a $60 meal and $60 to prepare a $120 meal. Calculate annual cost of meals (4 points) a. for low-price option: b. for highprice option : 6. Calculate annual gross profit (4 points) a. for low-price option: b. for highprice option: 7. For a low cost option, Alex plans to hire 5 waiters with $31,000 salary. For a "French" option he needs just 4 waiters, but he needs better trained ones, so he'll have to pay them $40,000 a year. Calculate annual cost of waiters (4 points) a. for low-price option: similar size usually had about 220 customers per day. In high-end establishments an average price per person was $100 and they served about 140 customers daily. As mentioned above, Alex didn't want his new restaurant to be the cheapest around, so he was considering either a slightly improved bar and grill format with average price per meal of $60 or an upscale French cuisine restaurant with average price per meal of 5120. Professor Jones noted to him, that because current data doesn't cover the $120 price, calculating potential number of customers using observed price sensitivity may not be very reliable for this price, but finally he agreed that in the absence of better data it's OK to use what's available. So they settled to figure out which approach will bring more money to Alex. 1. Calculate the slope and intercept of the observed demand function (6 points) 2. Calculate potential number of customers per day (4 points) a. for low-price option ($60 per meal) b. for high-price option ($120 per meal) 3. Alex plans his place to be opened 350 days a year. Calculate the annual number of customers (4 points) a. for low-price option: b. for high-price option: b. for highprice option: 8. Alex also has to pay cooking staff (totally $380,000 for low cost and $440,000 for high cost options) and for his upscale option he contemplates spending $80,000 annually on musicians and performers. Calculate total annual staff expenses (cost of waiters, cooking staff, and performers). (4 points) a. for lowprice option: b. for high-price option: 9. To carry out a renovation, Alex will have to take a loan. He plans to pay it back in 3 years. For the low-cost option annual payments are expected to be $100,000 a year, for the high-price option - $216,666. Calculate annual contribution after staff expenses and loan payments (4 points) a. for lowprice option: b. for high-price option: 10. Assuming that costs structure and revenues do not change, calculate annual contribution after the loan is paid back. (4 points) a. for lowprice option: b. for high-price option: 11. which approach would you recommend Alex to take based upon your calculations? Why?(1 paragraph max, 2 points) Answers: 1. Slope=.625; |ntercept=187.5,' (may differ based on your approach) 2.a: 204, b: 108; 3. a: 71,400; b: 37,800; 4. a: $4,284,00; b: $4,536,000; 5. a: $2,213,400; b: $2,268,000,- 6. a: $2,070,500; b: $2,268,000; 7. a: $155,000; b: $160,000; 8: a: $535,000; b: $680,000; 9. a: $1,435,600; b: 1,371,334; 10. a: $1,535,600; b: $1,533,000; Alex's Bar and Grill Alex Long was excited: his lifelong dream of owning a restaurant in a lively Toronto neighborhood was coming to fruition. A retiring owner of a successful sports bar at West Bloor has put it on sale, and Alex decided to get it. The bar needed a renovation, though, so Alex started to contemplate the idea of changing the positioning of his new establishment. There were several medium-priced bars and restaurants around, but very few upscale ones. From observing the public it was clear that there was enough demand for any format. So the question for Alex became whether to invest a modest amount into the renovation and position his new restaurant as just another medium-priced place or to invest more and to occupy a niche of exclusive dining spot with few competitors around. Alex' wife saw quite clearly that Alex was inclining more and more towards the upscale option. "Look," - Alex was saying at the breakfast, - \"If we will make the place really nice, hire a musician, good chef, highly trained waiters, we can set prices in a way that average meal will cost $120 per customer instead of current 550. Yes, we're going to have fewer customers, but higher margins will make up the loss! It is going to be all about the image, and image doesn't cost much! We're going to be rich and with few competitors to threaten us!\" That sounded about right, but being more realistic, Alex' wife suggested that he do some more robust calculations of expected profits before making a final decision. Luckily, Alex had a friend, a university marketing professor Jones, who agreed to help him. So couple of week later, Dr. Jones came to Alex' home to go through the numbers together. He collected some interesting data. In the vicinity and in similar locations across the GTA majority of the restaurants fell into two large categories. Low priced restaurants charged on average 550 per meal, and establishments of a @