Question: i need help with the cash flow statement. thank you!! HINANCIAL FORECAST The attached financial statements (income statements, balance sheets and statements of eash flow)

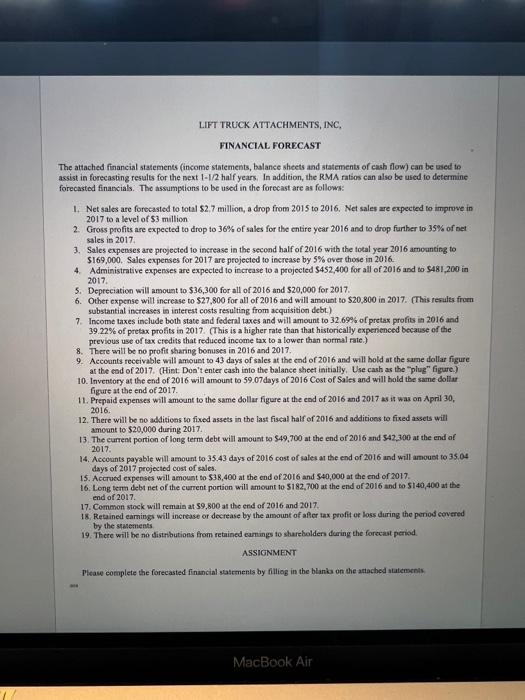

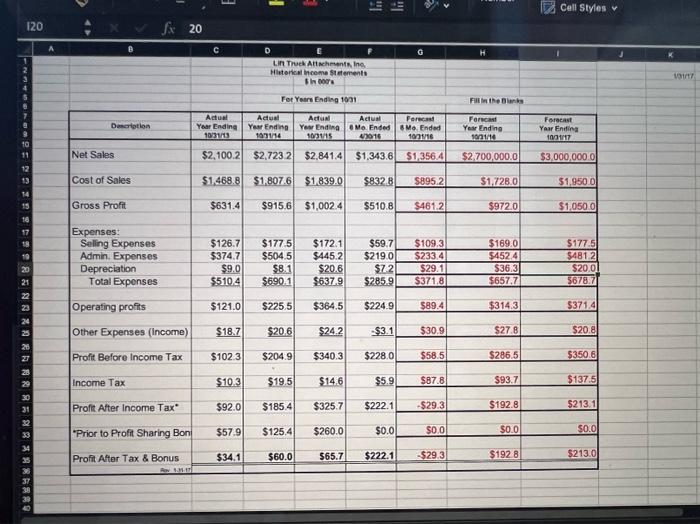

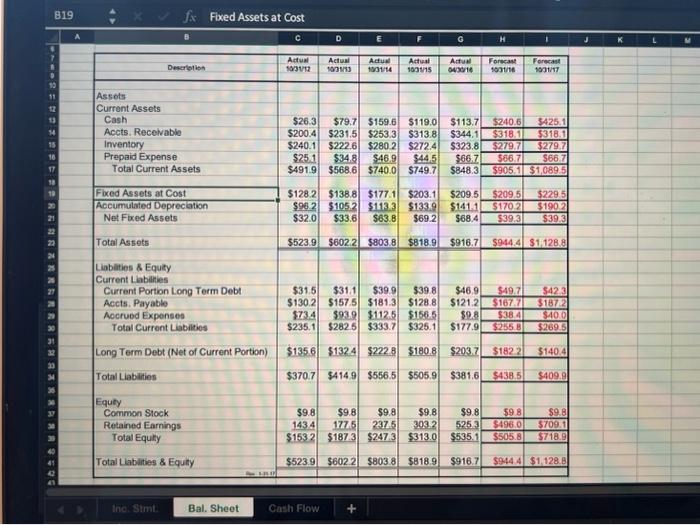

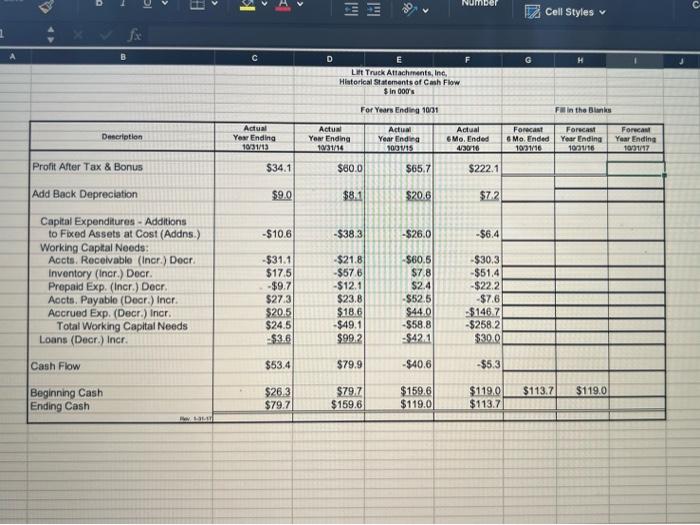

HINANCIAL FORECAST The attached financial statements (income statements, balance sheets and statements of eash flow) ean be used to assist in forecasting results for the next 1-1/2 half years, In addition, the RMA ratios can also be used to determine forecastod financials. The assumptions to be used in the forecast are as follows: 1. Net sales are forecasted to total $2,7 million, a drop from 2015 to 2016 . Net sales are expected to improve in 2017 to a level of $3 mullion 2. Gross profits are expected to drop to 36% of sales for the entire year 2016 and to drop further to 35% of net sales it 2017. 3. Sales expenses are projected to increase in the second half of 2016 with the fotal year 2016 amounting to $169,000. Sales expenses for 2017 are projected to iecrease by 5% over those in 2016. 4. Administrative expenses are expected to increase to a projected $452,400 for all of 2016 and to 5481,200 in 2017. 5. Depreciation will amount to $36,300 for all of 2016 and $20,000 for 2017. 6. Other expense will ineresse to $27,800 for all of 2016 and will amount to $20,800 in 2017. (This teruits from substantial increases in interest costs resulting from acquisition debt.) 7. Income taxes include both state and federal taxes and will amount to 32.69% of pretax profits in 2016 and 39.22% of pretax profits in 2017 . (This is a higher rate than that historically experienced because of the previous use of tax eredits that reduced income tax to a lower than normal rate.) 8. There will be no profit sharing bonuses in 2016 and 2017 . 9. Accounts receivable will amoust to 43 days of sales at the cad of 2016 and will hold at the same dollat figure ar the ead of 2017. (Hint: Doa't enter cash into the balance sheet initially, Use cash as the "plus" figure) 10. Inventory at the end of 2016 will amount to 59.07 days of 2016 Cost of Sales and will bald the same dollar Gigure at the end of 2017. 11. Prepaid expenses will amount to the same dollar figure at the eod of 2016 and 2017 as it was on April 30 , 2016. 12. There will be no additiens to fixed assets in the last fiscal half of 2016 and additions to fixed assets will amount to $20,000 during 2017. 13. The current porticn of long term debt witi amount to 549,700 at the end of 2016 and 542,300 at the end af 2017. 14. Accounts payable will amount to 35.43 days of 2016 cost of ales at the end of 2016 and will amouot to 35.04 days of 2017 projected cost of sales. 15. Accutd expenses will amount to 538,400 at the end of 2016 and $40,000 at the end of 2017 . 16. Long tean debt net of the current portion will ameunt 105182,700 at the end of 2016 and to 5140,400 at the end of 2017. 17. Common stock will remain at 39,800 at the end of 2016 and 2017 . 18. Retained earningt will inerease or decrease by the amount of after tax profit of loss during the period cevered by the srasements 19. There will be no distrbutions from retained camings to shareholden dearing the forecast period. ASSIGNMENT Please complete the forecasted financial statcments by filliog in the blanks on the attached atatements: HINANCIAL FORECAST The attached financial statements (income statements, balance sheets and statements of eash flow) ean be used to assist in forecasting results for the next 1-1/2 half years, In addition, the RMA ratios can also be used to determine forecastod financials. The assumptions to be used in the forecast are as follows: 1. Net sales are forecasted to total $2,7 million, a drop from 2015 to 2016 . Net sales are expected to improve in 2017 to a level of $3 mullion 2. Gross profits are expected to drop to 36% of sales for the entire year 2016 and to drop further to 35% of net sales it 2017. 3. Sales expenses are projected to increase in the second half of 2016 with the fotal year 2016 amounting to $169,000. Sales expenses for 2017 are projected to iecrease by 5% over those in 2016. 4. Administrative expenses are expected to increase to a projected $452,400 for all of 2016 and to 5481,200 in 2017. 5. Depreciation will amount to $36,300 for all of 2016 and $20,000 for 2017. 6. Other expense will ineresse to $27,800 for all of 2016 and will amount to $20,800 in 2017. (This teruits from substantial increases in interest costs resulting from acquisition debt.) 7. Income taxes include both state and federal taxes and will amount to 32.69% of pretax profits in 2016 and 39.22% of pretax profits in 2017 . (This is a higher rate than that historically experienced because of the previous use of tax eredits that reduced income tax to a lower than normal rate.) 8. There will be no profit sharing bonuses in 2016 and 2017 . 9. Accounts receivable will amoust to 43 days of sales at the cad of 2016 and will hold at the same dollat figure ar the ead of 2017. (Hint: Doa't enter cash into the balance sheet initially, Use cash as the "plus" figure) 10. Inventory at the end of 2016 will amount to 59.07 days of 2016 Cost of Sales and will bald the same dollar Gigure at the end of 2017. 11. Prepaid expenses will amount to the same dollar figure at the eod of 2016 and 2017 as it was on April 30 , 2016. 12. There will be no additiens to fixed assets in the last fiscal half of 2016 and additions to fixed assets will amount to $20,000 during 2017. 13. The current porticn of long term debt witi amount to 549,700 at the end of 2016 and 542,300 at the end af 2017. 14. Accounts payable will amount to 35.43 days of 2016 cost of ales at the end of 2016 and will amouot to 35.04 days of 2017 projected cost of sales. 15. Accutd expenses will amount to 538,400 at the end of 2016 and $40,000 at the end of 2017 . 16. Long tean debt net of the current portion will ameunt 105182,700 at the end of 2016 and to 5140,400 at the end of 2017. 17. Common stock will remain at 39,800 at the end of 2016 and 2017 . 18. Retained earningt will inerease or decrease by the amount of after tax profit of loss during the period cevered by the srasements 19. There will be no distrbutions from retained camings to shareholden dearing the forecast period. ASSIGNMENT Please complete the forecasted financial statcments by filliog in the blanks on the attached atatements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts