Question: I need help with the General Ledger Liability and Equity March 2021 Transactions Date Description of the Transaction March 1 Owners of OPJ invested an

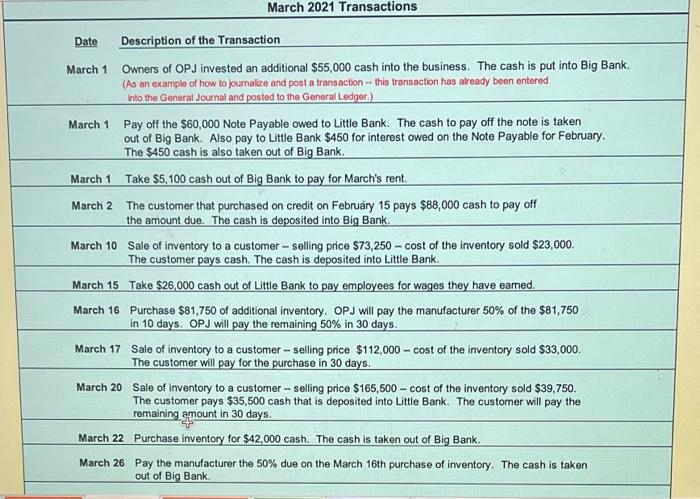

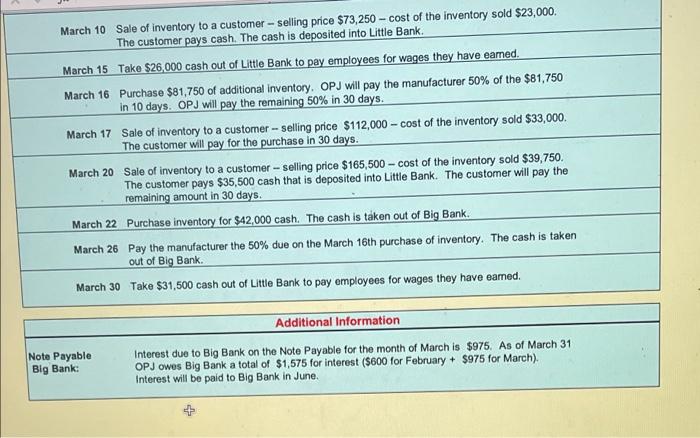

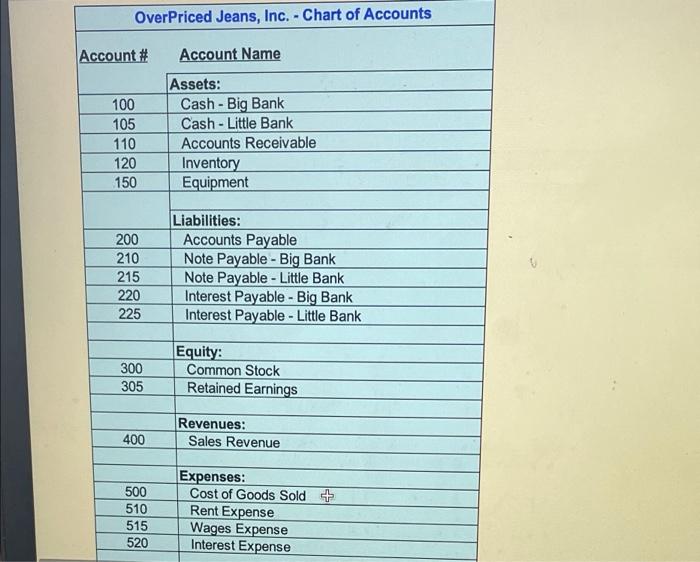

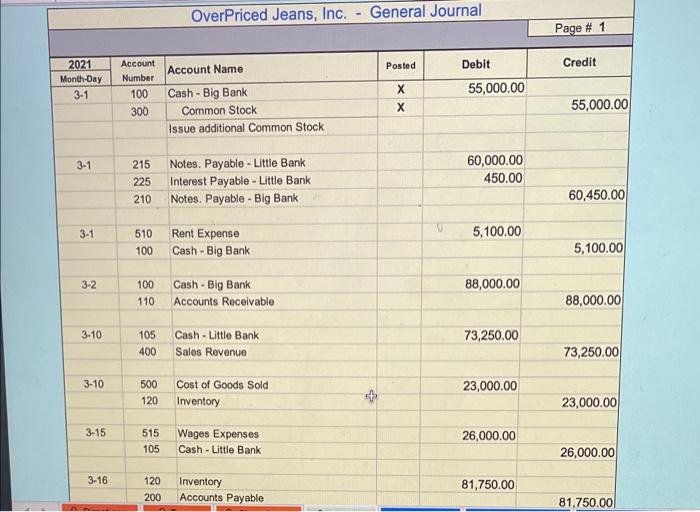

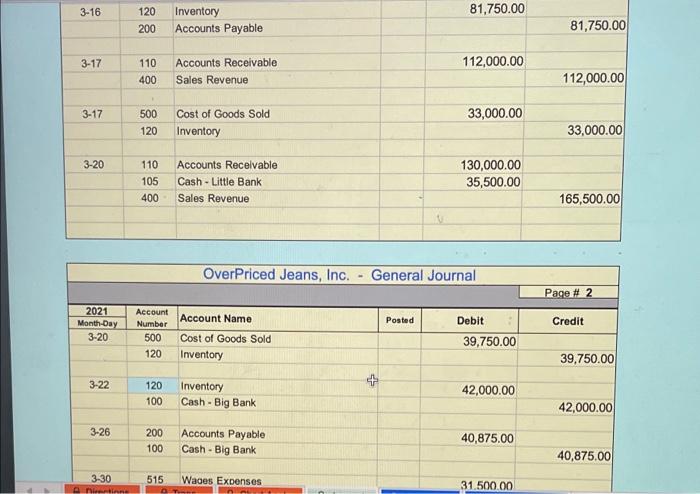

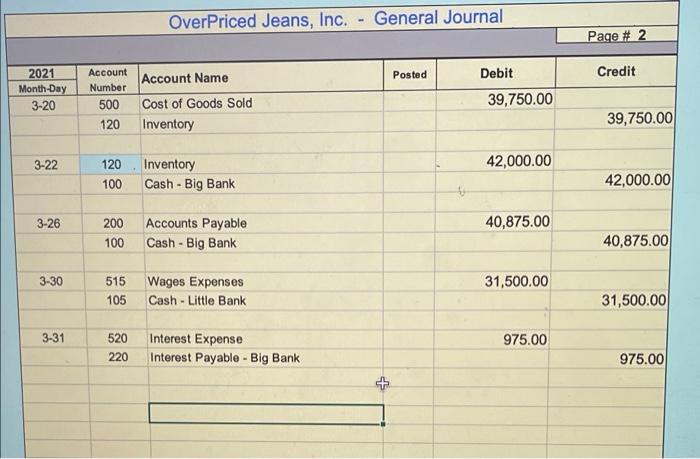

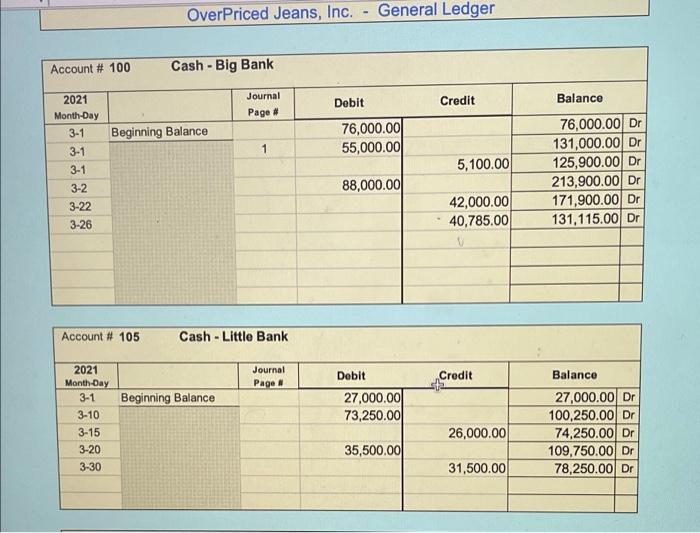

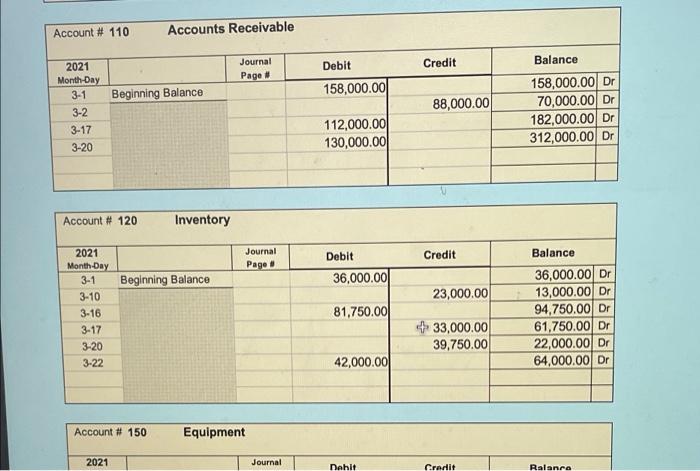

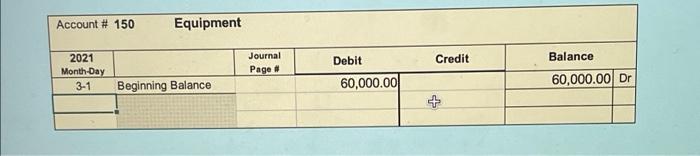

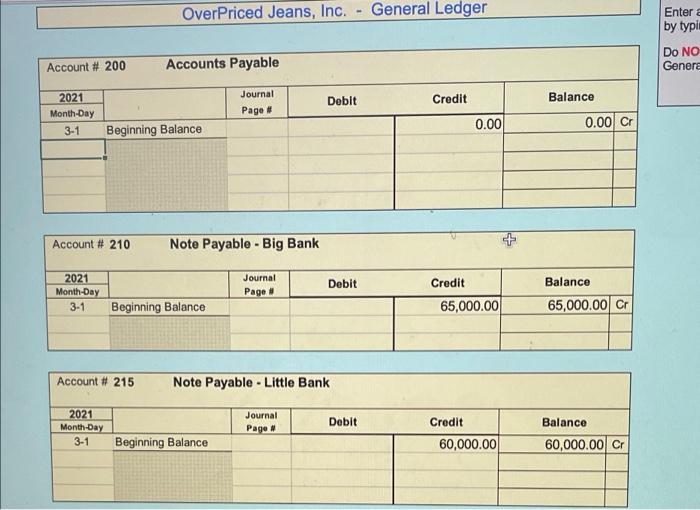

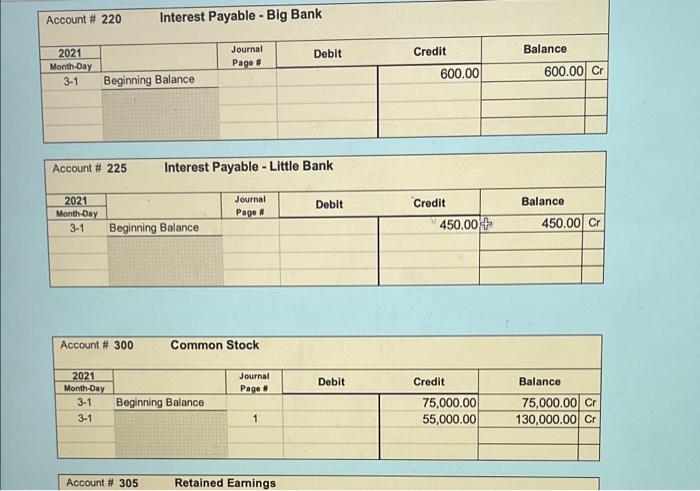

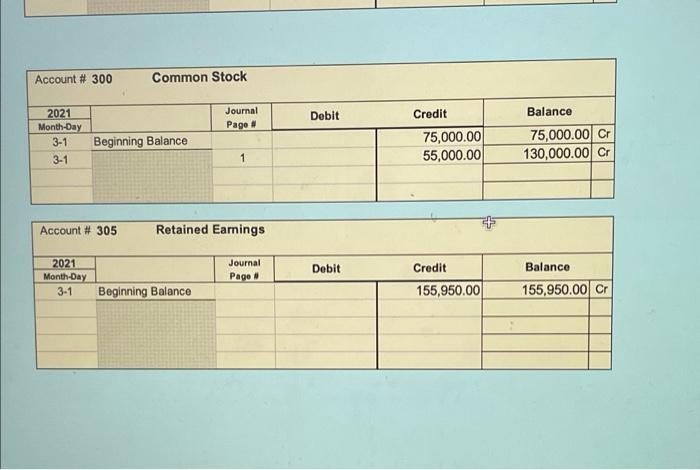

March 2021 Transactions Date Description of the Transaction March 1 Owners of OPJ invested an additional $55,000 cash into the business. The cash is put into Big Bank. (As an example of how to journalze and post a transaction -- this transaction has already been entered Into the General Journal and posted to the General Ledger.) March 1 Pay off the $60,000 Note Payable owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February. The $450 cash is also taken out of Big Bank. March 1 Take $5,100 cash out of Big Bank to pay for March's rent. March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank March 10 Sale of inventory to a customer-selling price $73,250 - cost of the inventory sold $23,000. The customer pays cash. The cash is deposited into Little Bank. March 15 Take $26,000 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $81,750 of additional inventory. OPJ will pay the manufacturer 50% of the $81,750 in 10 days. OPJ will pay the remaining 50% in 30 days. March 17 Sale of inventory to a customer-selling price $112,000 - cost of the inventory sold $33,000. The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer - selling price $165,500 - cost of the inventory sold $39,750. The customer pays $35,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $42,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 10 Sale of inventory to a customer-selling price $73,250 - cost of the inventory sold $23,000 The customer pays cash. The cash is deposited into Little Bank. March 15 Take $26,000 cash out of Little Bank to pay employees for wages they have earned. March 16 Purchase $81,750 of additional inventory. OPJ will pay the manufacturer 50% of the $81,750 in 10 days. OPJ will pay the remaining 50% in 30 days. March 17 Sale of inventory to a customer --selling price $112,000 - cost of the inventory sold $33,000 The customer will pay for the purchase in 30 days. March 20 Sale of inventory to a customer-selling price $165,500 - cost of the inventory sold $39,750. The customer pays $35,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $42,000 cash. The cash is taken out of Big Bank. March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Take $31,500 cash out of Little Bank to pay employees for wages they have earned. Note Payable Big Bank: Additional Information Interest due to Big Bank on the Note Payable for the month of March is $975. As of March 31 OPJ owes Big Bank a total of $1,575 for interest ($600 for February + $975 for March). Interest will be paid to Big Bank in June. OverPriced Jeans, Inc. - Chart of Accounts Account # Account Name 100 105 110 120 150 Assets: Cash - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment 200 210 215 220 225 Liabilities: Accounts Payable Note Payable - Big Bank Note Payable - Little Bank Interest Payable - Big Bank Interest Payable - Little Bank 300 305 Equity: Common Stock Retained Earnings Revenues: Sales Revenue 400 500 510 515 520 Expenses: Cost of Goods Sold+ Rent Expense Wages Expense Interest Expense OverPriced Jeans, Inc. General Journal Page # 1 Posted Debit Credit 2021 Month-Day 3-1 Account Number 100 300 55,000.00 Account Name Cash - Big Bank Common Stock Issue additional Common Stock 55,000.00 3-1 215 225 210 Notes. Payable - Little Bank Interest Payable - Little Bank Notes. Payable - Big Bank 60,000.00 450.00 60,450.00 3-1 5,100.00 510 100 Rent Expense Cash - Big Bank 5,100.00 3-2 88,000.00 100 110 Cash - Big Bank Accounts Receivable 88,000.00 3-10 105 400 73,250.00 Cash - Little Bank Sales Revenue 73,250.00 3-10 500 120 Cost of Goods Sold Inventory 23,000.00 23,000.00 3-15 515 105 Wages Expenses Cash - Little Bank 26,000.00 26,000.00 3-16 120 200 Inventory Accounts Payable 81,750.00 81.750.00 3-16 81,750.00 120 200 Inventory Accounts Payable 81,750.00 3-17 112,000.00 110 400 Accounts Receivable Sales Revenue 112,000.00 3-17 33,000.00 500 120 Cost of Goods Sold Inventory 33,000.00 3-20 110 105 400 Accounts Recevable Cash - Little Bank Sales Revenue 130,000.00 35,500.00 165,500.00 OverPriced Jeans, Inc. - General Journal Page #2 Posted 2021 Month-Day 3-20 Credit Account Number 500 120 Account Name Cost of Goods Sold Inventory Debit 39,750.00 39,750.00 3-22 + 120 100 Inventory Cash - Big Bank 42,000.00 42,000.00 3-26 200 100 Accounts Payable Cash - Big Bank 40,875.00 40,875.00 3-30 Anne 515 Wages Expenses 31.500.00 OverPriced Jeans, Inc. - General Journal Page # 2 Posted Account Name Debit Credit 2021 Month-Day 3-20 Account Number 500 120 39,750.00 Cost of Goods Sold Inventory 39,750.00 3-22 42,000.00 120 100 Inventory Cash - Big Bank 42,000.00 3-26 40,875.00 200 100 Accounts Payable Cash - Big Bank 40,875.00 3-30 31,500.00 515 105 Wages Expenses Cash - Little Bank 31,500.00 3-31 520 975.00 Interest Expense Interest Payable - Big Bank 220 975.00 Overpriced Jeans, Inc. General Ledger Account # 100 Cash - Big Bank Debit Credit Journal Page # Balance Beginning Balance 76,000.00 55,000.00 1 2021 Month-Day 3-1 3-1 3-1 3-2 3-22 3-26 5,100.00 76,000.00 Dr 131,000.00 Dr 125,900.00 DI 213,900.00 Dr 171,900.00 Dr 131,115.00 Dr 88,000.00 42,000.00 40,785.00 Account # 105 Cash - Little Bank Journal Page 8 Debit Credit Beginning Balance 2021 Month-Day 3-1 3-10 3-15 3-20 3-30 27,000.00 73,250.00 Balance 27,000.00 Dr 100,250.00 Dr 74,250.00 Dr 109,750.00 Dr 78,250.00 DI 26,000.00 35,500.00 31,500.00 Account # 110 Accounts Receivable Balance Credit Journal Page # Debit Beginning Balance 158,000.00 2021 Month Day 3-1 3-2 3-17 3-20 88,000.00 158,000.00 Dr 70,000.00 Dr 182,000.00 Dr 312,000.00 Dr 112,000.00 130,000.00 Account # 120 Inventory Journal Page Debit Credit Beginning Balance 36,000.00 23,000.00 2021 Month-Day 3-1 3-10 3-16 3-17 3-20 3-22 81,750.00 Balance 36,000.00 Dr 13,000.00 Dr 94,750.00 Dr 61,750.00 Dr 22,000.00 Dr 64,000.00 Dr + 33,000.00 39,750.00 42,000.00 Account # 150 Equipment 2021 Journal Dahit Credit Ralanca Account # 150 Equipment Debit Journal Page # Credit Balance 2021 Month-Day 3-1 Beginning Balance 60,000.00 60,000.00 Dr OverPriced Jeans, Inc. - General Ledger Enter a by typin Do NO Genere Account # 200 Accounts Payable Debit Journal Page # Credit Balance 2021 Month-Day 3-1 0.00 Cr 0.00 Beginning Balance Account # 210 Note Payable - Big Bank Journal Page Debit Credit 2021 Month-Day 3-1 Balance Beginning Balance 65,000.00 65,000.00 Cr Account # 215 Note Payable - Little Bank 2021 Month-Day 3-1 Journal Page Debit Credit 60,000.00 Balance 60,000.00 Cr Beginning Balance Account # 220 Interest Payable - Big Bank Debit Journal Page 1 Credit Balance 2021 Month-Day 3-1 600.00 600.00 Cr Beginning Balance Account # 225 Interest Payable - Little Bank Journal Page Debit 2021 Month-Day 3-1 Balanco Credit 450.00 + Beginning Balance 450.00 Cr Account # 300 Common Stock Journal Page Debit 2021 Month-Day 3-1 Balance Beginning Balance Credit 75,000.00 55,000.00 75,000.00 Cr 130,000.00 Cr 3-1 1 Account # 305 Retained Earnings Account # 300 Common Stock Journal Page Debit Credit Balance 2021 Month-Day 3-1 3-1 Beginning Balance 75,000.00 55,000.00 75,000.00 Cr 130,000.00 C 1 Account # 305 Retained Earnings Journal Page 8 Debit Credit 2021 Month-Day 3-1 Balance Beginning Balance 155,950.00 155,950.00 Cr

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts