Question: I need help with the highlighted questions Fund Performance (On Morningstar.com click on the performance tab, scroll down to trailing returns. Look at the total

I need help with the highlighted questions

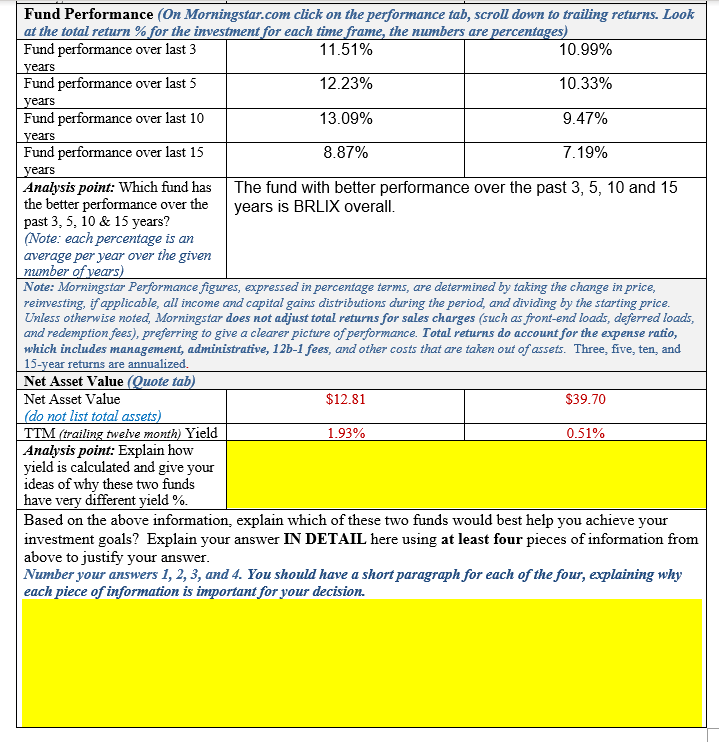

Fund Performance (On Morningstar.com click on the performance tab, scroll down to trailing returns. Look at the total return % for the investment for each time frame, the numbers are percentages) Fund performance over last 3 11.51% 10.99% years Fund performance over last 5 12.23% 10.33% years Fund performance over last 10 13.09% 9.47% years Fund performance over last 15 8.87% 7.19% years Analysis point: Which fund has The fund with better performance over the past 3, 5, 10 and 15 the better performance over the years is BRLIX overall. past 3, 5, 10 & 15 years? (Note: each percentage is an average per year over the given number of years) Note: Morningstar Performance figures, expressed in percentage terms, are determined by taking the change in price, reinvesting, if applicable, all income and capital gains distributions during the period, and dividing by the starting price. Unless otherwise noted, Morningstar does not adjust total returns for sales charges (such as front-end loads, deferred loads, and redemption fees), preferring to give a clearer picture of performance. Total returns do account for the expense ratio, which includes management, administrative, 126-1 fees, and other costs that are taken out of assets. Three, five, ten, and 15-year returns are annualized. Net Asset Value (Quote tab) Net Asset Value $12.81 $39.70 (do not list total assets) TTM (trailing twelve month) Yield 1.93% 0.51% Analysis point: Explain how yield is calculated and give your ideas of why these two funds have very different yield %. Based on the above information, explain which of these two funds would best help you achieve your investment goals? Explain your answer IN DETAIL here using at least four pieces of information from above to justify your answer. Number your answers 1, 2, 3, and 4. You should have a short paragraph for each of the four, explaining why each piece of information is important for your decision. Fund Performance (On Morningstar.com click on the performance tab, scroll down to trailing returns. Look at the total return % for the investment for each time frame, the numbers are percentages) Fund performance over last 3 11.51% 10.99% years Fund performance over last 5 12.23% 10.33% years Fund performance over last 10 13.09% 9.47% years Fund performance over last 15 8.87% 7.19% years Analysis point: Which fund has The fund with better performance over the past 3, 5, 10 and 15 the better performance over the years is BRLIX overall. past 3, 5, 10 & 15 years? (Note: each percentage is an average per year over the given number of years) Note: Morningstar Performance figures, expressed in percentage terms, are determined by taking the change in price, reinvesting, if applicable, all income and capital gains distributions during the period, and dividing by the starting price. Unless otherwise noted, Morningstar does not adjust total returns for sales charges (such as front-end loads, deferred loads, and redemption fees), preferring to give a clearer picture of performance. Total returns do account for the expense ratio, which includes management, administrative, 126-1 fees, and other costs that are taken out of assets. Three, five, ten, and 15-year returns are annualized. Net Asset Value (Quote tab) Net Asset Value $12.81 $39.70 (do not list total assets) TTM (trailing twelve month) Yield 1.93% 0.51% Analysis point: Explain how yield is calculated and give your ideas of why these two funds have very different yield %. Based on the above information, explain which of these two funds would best help you achieve your investment goals? Explain your answer IN DETAIL here using at least four pieces of information from above to justify your answer. Number your answers 1, 2, 3, and 4. You should have a short paragraph for each of the four, explaining why each piece of information is important for your decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts