Question: I need help with the values with the red x. Please show work Use of futures contracts to hedge cotton inventoryfair value hedge On December

I need help with the values with the red x. Please show work

Use of futures contracts to hedge cotton inventoryfair value hedge

On December 1, 2021, a cotton wholesaler purchases 8.4 million pounds of cotton inventory at an average cost of 95 cents per pound. To protect the inventory from a possible decline in cotton prices, the company sells cotton futures contracts for 8.4 million pounds at 86 cents a pound for delivery on June 1, 2022, to coincide with its expected physical sale of its cotton inventory. The company designates the hedge as a fair value hedge (i.e., the company is hedging changes in the inventorys fair value, not changes in cash flows from anticipated sales). The cotton spot price on December 1 is 94 cents per pound.

On December 31, 2021, the companys fiscal year-end, the June 1 cotton futures price has fallen to 76 cents a pound, and the spot price has fallen to 85 cents a pound. On June 1, 2022, the company closes out its futures contracts.

Following are futures and spot prices for the relevant dates:

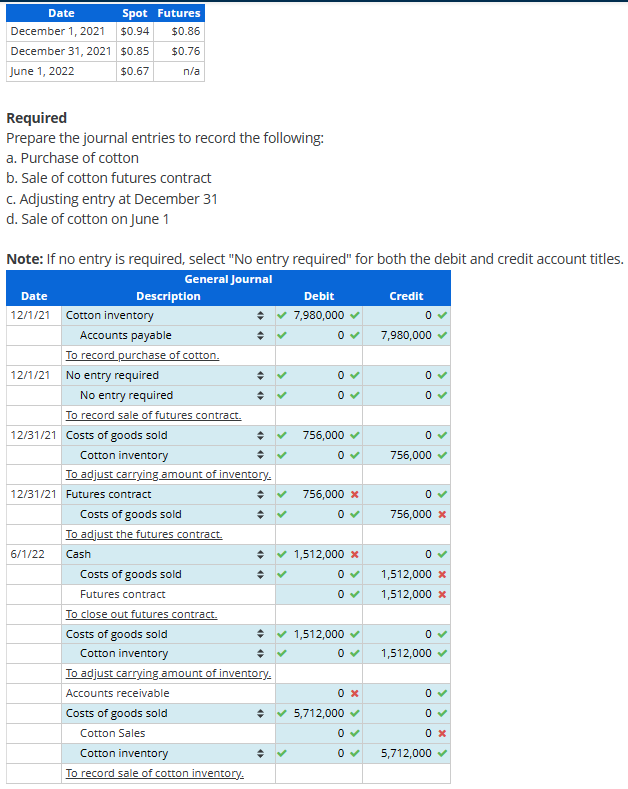

Required Prepare the journal entries to record the following: a. Purchase of cotton b. Sale of cotton futures contract c. Adjusting entry at December 31 d. Sale of cotton on June 1 Note: If no entry is required, select "No entry required" for both the debit and credit account titles Required Prepare the journal entries to record the following: a. Purchase of cotton b. Sale of cotton futures contract c. Adjusting entry at December 31 d. Sale of cotton on June 1 Note: If no entry is required, select "No entry required" for both the debit and credit account titles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts