Question: I need help with the whole thing. It needs a specific formula, even if you get the right amount, the answer will be marked wrong

I need help with the whole thing. It needs a specific formula, even if you get the right amount, the answer will be marked wrong because I am using the wrong formula.

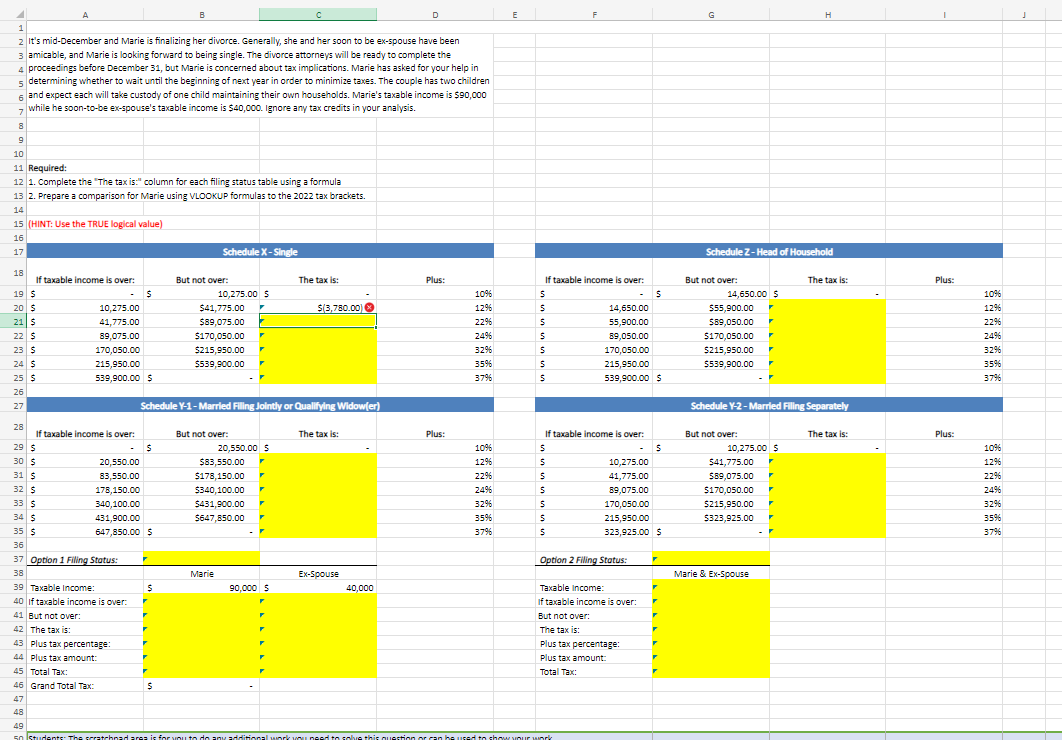

It's midDecember and Marie is finalizing her divorce. Generally, she and her soon to be exspouse have been amicable, and Marie is looking forward to being single. The divorce attorneys will be ready to complete the proceedings before December but Marie is concerned about tax implications. Marie has asked for your help in determining whether to wait until the beginning of next year in order to minimize taxes. The couple has two children and expect each will take custody of one child maintaining their own households. Marie's taxable income is $ while he soontobe exspouse's taxable income is $ Ignore any tax credits in your analysis.

Required

Complete the "The tax is: column for each filing status table using a formula

Prepare a comparison for Marie using VLOOKUP formulas to the tax brackets.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock