Question: I need help with the YTM part and graphing. If you give me the formula and at least two samples of each section i can

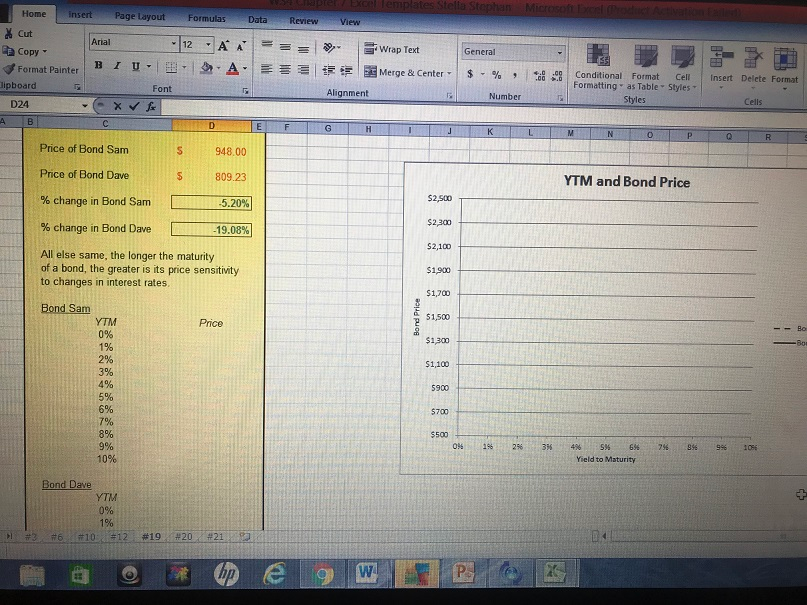

I need help with the YTM part and graphing. If you give me the formula and at least two samples of each section i can complete the rest.  I think i got the correct % change in bond for Sam and Dave.

I think i got the correct % change in bond for Sam and Dave.

Interest Rate Rise [L02] both bond sam and bond dave have 6.5 percent coupons, make semiannual payments, and are priced at par value. Bond sam has 3 years to maturity, whereas bond dave has 20 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of bod sam? Of bond dave? If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of bond sam be then? Of bond dave? Illustrate your answers by graphing bond prices versus ytm. What does this problem tell you about the interest rate risk of longer term bonds?

Home insert Page Layout Formulas Data Review View cut Copy aalid pu og Arial 4 5 6 7 8 9 10 insert D ,,Merge & Center- s % , ial, Conditional fo mat ce elete Format B 1 1-E,,A- t Formatting- as Table Styles Styles Format Painter Cells lipboard Font Alignment Number D24 s 948.00 809.23 Price of Bond Sam Price of Bond Dave % change in Bond Sam % change in Bond Dave YTM and Bond Price S2,s00 | 19.08%) S2,100 All else same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates $1,900 51,500 --Bo Price $1300 1% 500 9% 10%. 4% S% 6% Yield to Maturity 7% g% 3% 1% 2% 0% 3% 0% Home insert Page Layout Formulas Data Review View cut Copy aalid pu og Arial 4 5 6 7 8 9 10 insert D ,,Merge & Center- s % , ial, Conditional fo mat ce elete Format B 1 1-E,,A- t Formatting- as Table Styles Styles Format Painter Cells lipboard Font Alignment Number D24 s 948.00 809.23 Price of Bond Sam Price of Bond Dave % change in Bond Sam % change in Bond Dave YTM and Bond Price S2,s00 | 19.08%) S2,100 All else same, the longer the maturity of a bond, the greater is its price sensitivity to changes in interest rates $1,900 51,500 --Bo Price $1300 1% 500 9% 10%. 4% S% 6% Yield to Maturity 7% g% 3% 1% 2% 0% 3% 0%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts