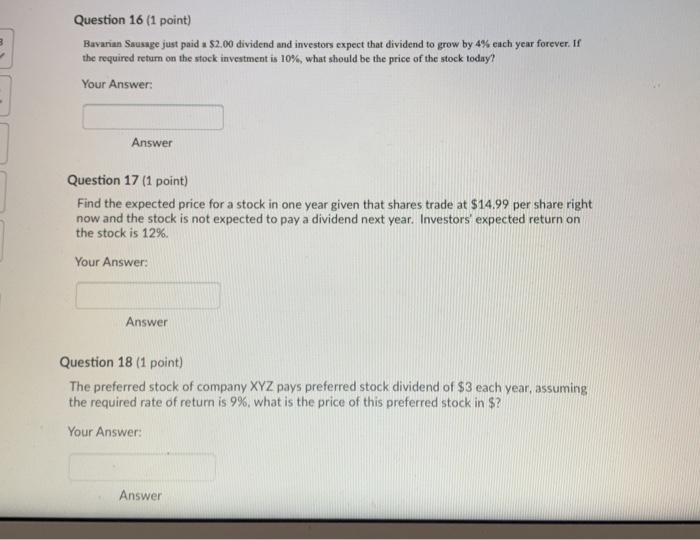

Question: I need help with these 3 questions. Question 16 (1 point) Bavanan Sausage just paid a $2.00 dividend and investors expect that dividend to grow

I need help with these 3 questions.

I need help with these 3 questions. Question 16 (1 point) Bavanan Sausage just paid a $2.00 dividend and investors expect that dividend to grow by 4% each year forever. If the required return on the stock investment is 10%, what should be the price of the stock today? Your Answer: Answer Question 17 (1 point) Find the expected price for a stock in one year given that shares trade at $14.99 per share right now and the stock is not expected to pay a dividend next year. Investors' expected return on the stock is 12%. Your Answer Answer Question 18 (1 point) The preferred stock of company XYZ pays preferred stock dividend of $3 each year, assuming the required rate of return is 9%, what is the price of this preferred stock in $? Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts