Question: I need help with these problems 34. Cassandra is a self-employed physical therapist who operates a qualifying office in her home. Cassandra has $180,000 gross

I need help with these problems

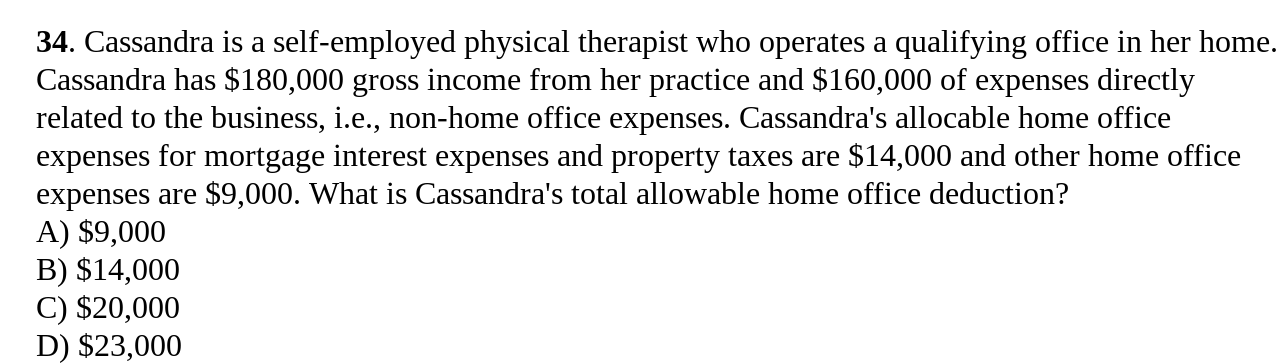

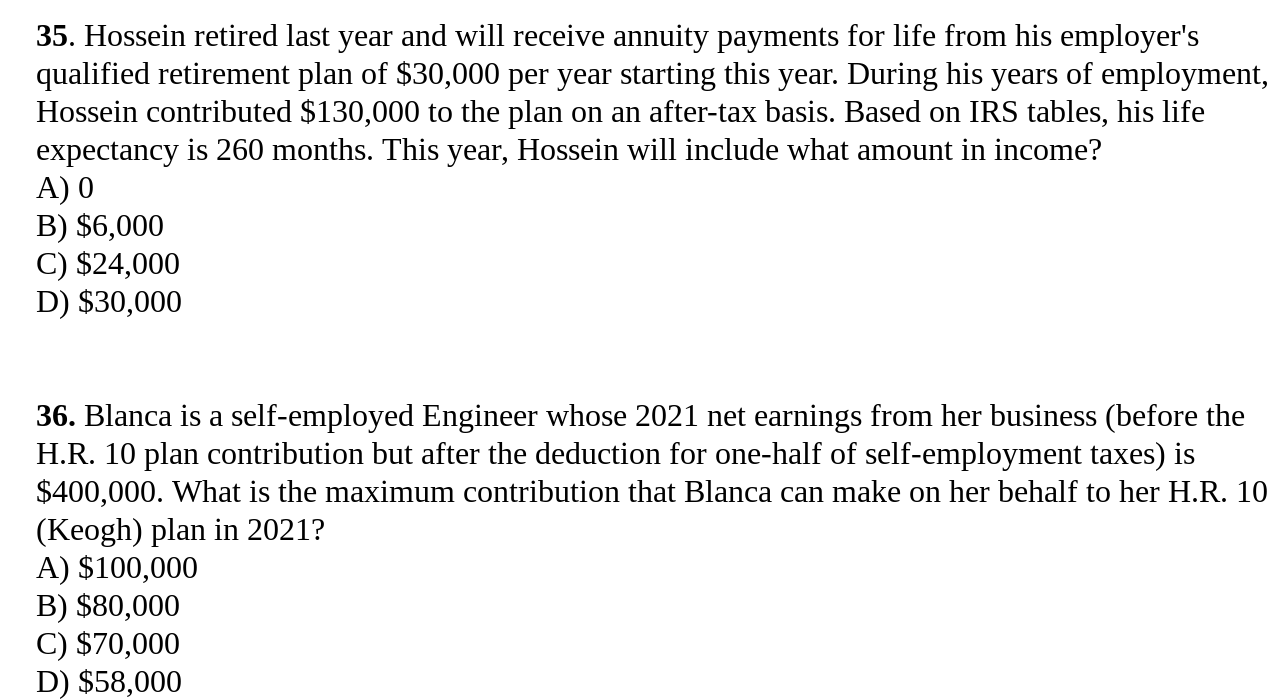

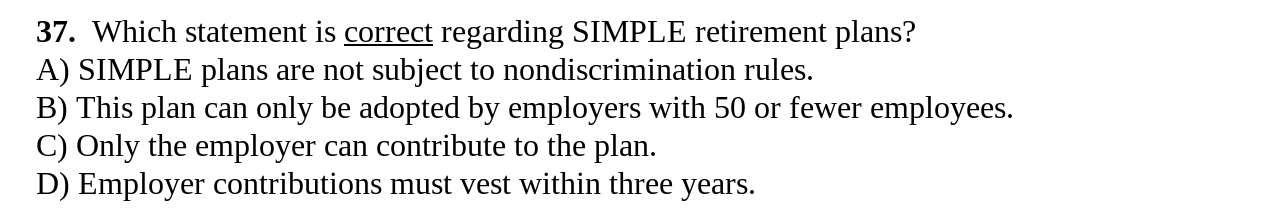

34. Cassandra is a self-employed physical therapist who operates a qualifying office in her home. Cassandra has $180,000 gross income from her practice and $160,000 of expenses directly related to the business, i.e., non-home office expenses. Cassandra's allocable home office expenses for mortgage interest expenses and property taxes are $14,000 and other home office expenses are $9,000. What is Cassandra's total allowable home office deduction? A) $9,000 B) $14,000 C) $20,000 D) $23,00035. Hossein retired last year and will receive annuity payments for life from his employer's qualified retirement plan of $30,000 per year starting this year. During his years of employment, Hossein contributed $130,000 to the plan on an after-tax basis. Based on IRS tables, his life expectancy is 260 months. This year, Hossein will include what amount in income? A) 0 B) $6,000 C) $24,000 D) $30,000 36. Blanca is a self-employed Engineer whose 2021 net earnings from her business (before the HR. 10 plan contribution but after the deduction for one-half of self-employment taxes) is $400,000. What is the maximum contribution that Blanca can make on her behalf to her HR. 10 (Keogh) plan in 2021? A) $100,000 B) $80,000 C) $70,000 D) $58,000 37. Which statement is correct regarding SIMPLE retirement plans? A) SIMPLE plans are not subject to nondiscrimination rules. B) This plan can only be adopted by employers with 50 or fewer employees. C.) Only the employer can contribute to the plan. D) Employer contributions must vest within three years. 38. Antoni (age 52) and Diana (age 48) are a married couple. Antoni is covered under a qualified retirement plan at his job and earned $90,000 in 2021. Diana is employed as a business consultant and earned $30,000 but is not covered under a qualified retirement plan. They file a joint return; have interest and dividend income of $25,000. What is the maximum amount of tax deductible contributions that may be made to a traditional IRA? A) $0 B) $12,000 C) $6,000 D) $13,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts