Question: Portal | UAGC | X A Week 3 - Quiz 1 X P Week 3 - Quiz 1 x IMA Reasearch.docx x | BookxIsx x

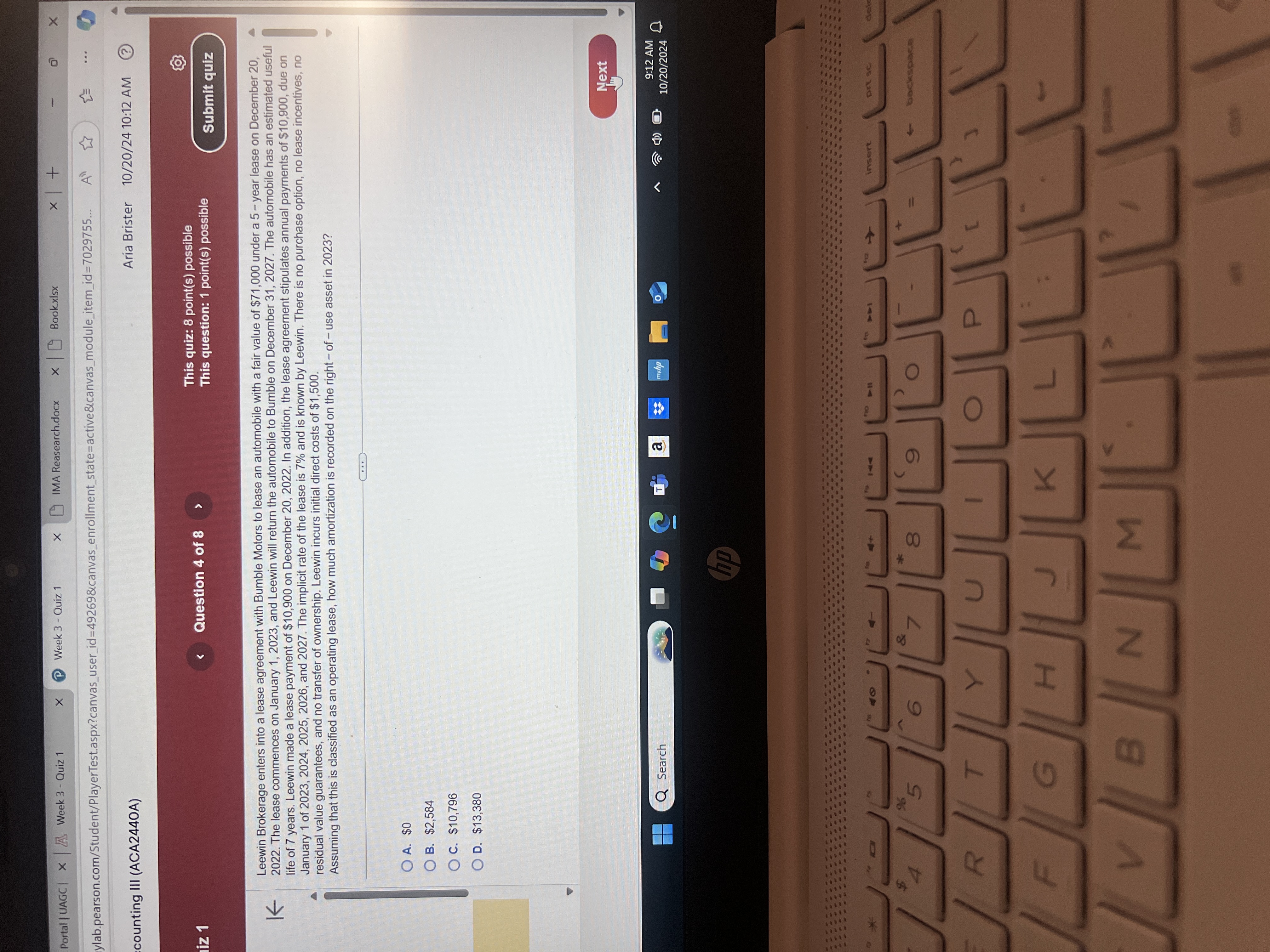

Portal | UAGC | X A Week 3 - Quiz 1 X P Week 3 - Quiz 1 x IMA Reasearch.docx x | BookxIsx x + X ylab.pearson.com/Student/PlayerTest.aspx?canvas_user_id=49269&canvas_enrollment_state=active&canvas_module_item_id=7029755.. ... counting III (ACA2440A) Aria Brister 10/20/24 10:12 AM iz 1 Question 4 of 8 This quiz: 8 point(s) possible This question: 1 point(s) possible Submit quiz Leewin Brokerage enters into a lease agreement with Bumble Motors to lease an automobile with a fair value of $71,000 under a 5 - year lease on December 20, K 2022. The lease commences on January 1, 2023, and Leewin will return the automobile to Bumble on December 31, 2027. The automobile has an estimated useful life of 7 years. Leewin made a lease payment of $10,900 on December 20, 2022. In addition, the lease agreement stipulates annual payments of $10,900, due on January 1 of 2023, 2024, 2025, 2026, and 2027. The implicit rate of the lease is 7% and is known by Leewin. There is no purchase option, no lease incentives, no residual value guarantees, and no transfer of ownership. Leewin incurs initial direct costs of $1,500. Assuming that this is classified as an operating lease, how much amortization is recorded on the right - of - use asset in 2023? O A. $0 O B. $2,584 O C. $10,796 O D. $13,380 Next Q Search 9:12 AM 10/20/2024 hp 4- 4+ 144 insert DYE SC 96 5 6 8 9 R T G H K B N M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts