Question: I need help with these questions. How would these be reported on their specific form. Questions:1,2,3,8,9 Thank you Individual Tax Return Required: Use the following

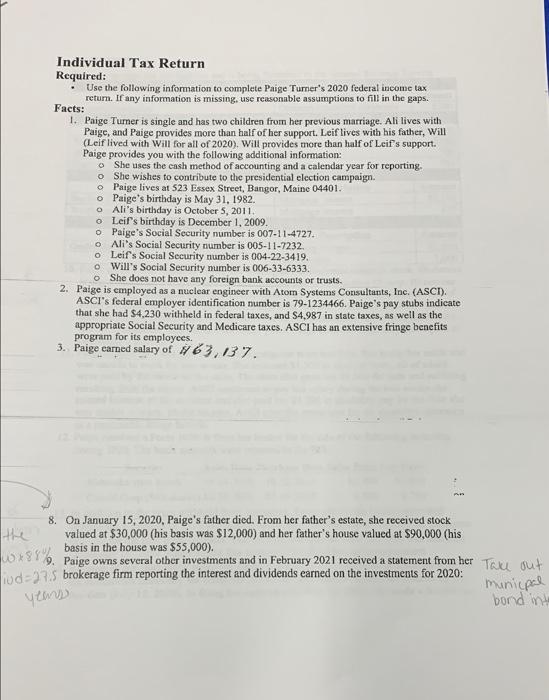

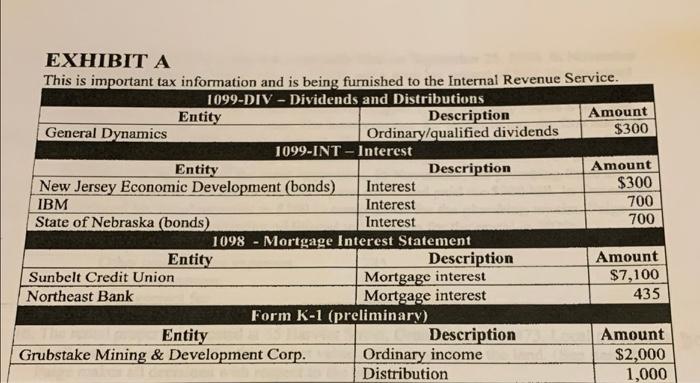

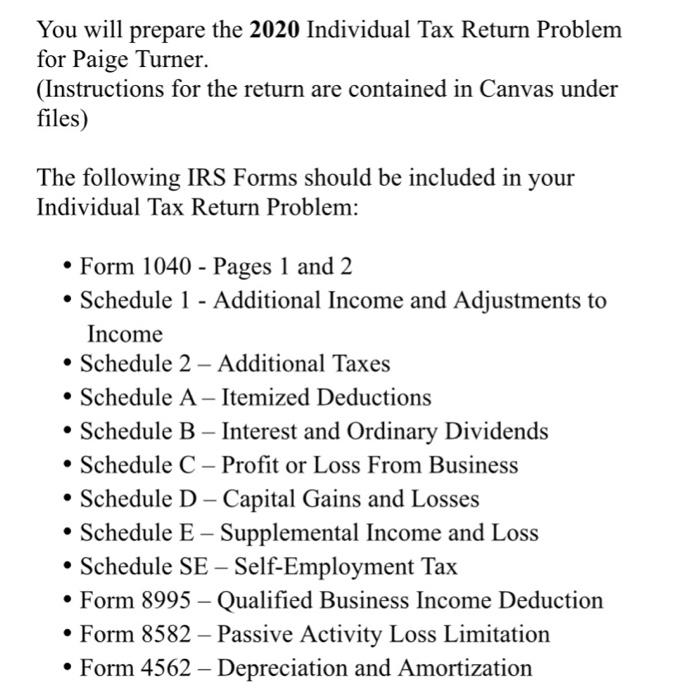

Individual Tax Return Required: Use the following information to complete Paige Turnier's 2020 federal income tax return. If any information is missing, use reasonable assumptions to fill in the gaps. Facts: 1. Paige Turner is single and has two children from her previous marriage. Ali lives with Paige, and Paige provides more than half of her support. Leif lives with his father, Will (Leif lived with Will for all of 2020). Will provides more than half of Leifs support. Paige provides you with the following additional information: She uses the cash method of accounting and a calendar year for reporting. She wishes to contribute to the presidential election campaign. o Paige lives at 523 Essex Street, Bangor, Mainc 04401. o Paige's birthday is May 31, 1982. O Ali's birthday is October 5, 2011 o Leif's birthday is December 1, 2009. Paige's Social Security number is 007-11-4727. Ali's Social Security number is 005-11-7232 Leif's Social Security number is 004-22-3419. o Will's Social Security number is 006-33-6333. She does not have any foreign bank accounts or trusts. 2. Paige is employed as a nuclear engineer with Atorn Systems Consultants, Inc. (ASCI). ASCI's federal employer identification number is 79-1234466. Paige's pay stubs indicate that she had $4,230 withheld in federal taxes, and $4.987 in state taxes, as well as the appropriate Social Security and Medicare taxes. ASCI has an extensive fringe benefits program for its employees. 3. Paige carned salary of 163,137. 8. On January 15, 2020, Paige's father died. From her father's estate, she received stock Hthe valued at $30,000 (his basis was $12,000) and her father's house valued at $90,000 (his basis in the house was $55,000). 9. Paige owns several other investments and in February 2021 received a statement from her take out hod. brokerage firm reporting the interest and dividends earned on the investments for 2020: municpal bond into w x 88% years EXHIBIT A This is important tax information and is being furnished to the Internal Revenue Service. 1099-DIV- Dividends and Distributions Entity Description Amount General Dynamics Ordinary qualified dividends $300 1099-INT-Interest Entity Description Amount New Jersey Economic Development (bonds) Interest $300 IBM Interest 700 State of Nebraska (bonds) Interest 700 1098 - Mortgage Interest Statement Entity Description Amount Sunbelt Credit Union Mortgage interest $7,100 Northeast Bank Mortgage interest 435 Form K-1 (preliminary) Entity Description Amount Grubstake Mining & Development Corp. Ordinary income $2,000 Distribution 1,000 You will prepare the 2020 Individual Tax Return Problem for Paige Turner. (Instructions for the return are contained in Canvas under files) The following IRS Forms should be included in your Individual Tax Return Problem: - Form 1040 - Pages 1 and 2 Schedule 1 - Additional Income and Adjustments to Income Schedule 2 - Additional Taxes Schedule A-Itemized Deductions Schedule B - Interest and Ordinary Dividends Schedule C - Profit or Loss From Business Schedule D - Capital Gains and Losses Schedule E - Supplemental Income and Loss Schedule SE - Self-Employment Tax Form 8995 - Qualified Business Income Deduction Form 8582 Passive Activity Loss Limitation Form 4562 - Depreciation and Amortization Individual Tax Return Required: Use the following information to complete Paige Turnier's 2020 federal income tax return. If any information is missing, use reasonable assumptions to fill in the gaps. Facts: 1. Paige Turner is single and has two children from her previous marriage. Ali lives with Paige, and Paige provides more than half of her support. Leif lives with his father, Will (Leif lived with Will for all of 2020). Will provides more than half of Leifs support. Paige provides you with the following additional information: She uses the cash method of accounting and a calendar year for reporting. She wishes to contribute to the presidential election campaign. o Paige lives at 523 Essex Street, Bangor, Mainc 04401. o Paige's birthday is May 31, 1982. O Ali's birthday is October 5, 2011 o Leif's birthday is December 1, 2009. Paige's Social Security number is 007-11-4727. Ali's Social Security number is 005-11-7232 Leif's Social Security number is 004-22-3419. o Will's Social Security number is 006-33-6333. She does not have any foreign bank accounts or trusts. 2. Paige is employed as a nuclear engineer with Atorn Systems Consultants, Inc. (ASCI). ASCI's federal employer identification number is 79-1234466. Paige's pay stubs indicate that she had $4,230 withheld in federal taxes, and $4.987 in state taxes, as well as the appropriate Social Security and Medicare taxes. ASCI has an extensive fringe benefits program for its employees. 3. Paige carned salary of 163,137. 8. On January 15, 2020, Paige's father died. From her father's estate, she received stock Hthe valued at $30,000 (his basis was $12,000) and her father's house valued at $90,000 (his basis in the house was $55,000). 9. Paige owns several other investments and in February 2021 received a statement from her take out hod. brokerage firm reporting the interest and dividends earned on the investments for 2020: municpal bond into w x 88% years EXHIBIT A This is important tax information and is being furnished to the Internal Revenue Service. 1099-DIV- Dividends and Distributions Entity Description Amount General Dynamics Ordinary qualified dividends $300 1099-INT-Interest Entity Description Amount New Jersey Economic Development (bonds) Interest $300 IBM Interest 700 State of Nebraska (bonds) Interest 700 1098 - Mortgage Interest Statement Entity Description Amount Sunbelt Credit Union Mortgage interest $7,100 Northeast Bank Mortgage interest 435 Form K-1 (preliminary) Entity Description Amount Grubstake Mining & Development Corp. Ordinary income $2,000 Distribution 1,000 You will prepare the 2020 Individual Tax Return Problem for Paige Turner. (Instructions for the return are contained in Canvas under files) The following IRS Forms should be included in your Individual Tax Return Problem: - Form 1040 - Pages 1 and 2 Schedule 1 - Additional Income and Adjustments to Income Schedule 2 - Additional Taxes Schedule A-Itemized Deductions Schedule B - Interest and Ordinary Dividends Schedule C - Profit or Loss From Business Schedule D - Capital Gains and Losses Schedule E - Supplemental Income and Loss Schedule SE - Self-Employment Tax Form 8995 - Qualified Business Income Deduction Form 8582 Passive Activity Loss Limitation Form 4562 - Depreciation and Amortization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts