Question: I need help with these three problems ASAP. Please and thanks! :) Analysis of Recelvabies Method At the end of the current year, Accounts Receivable

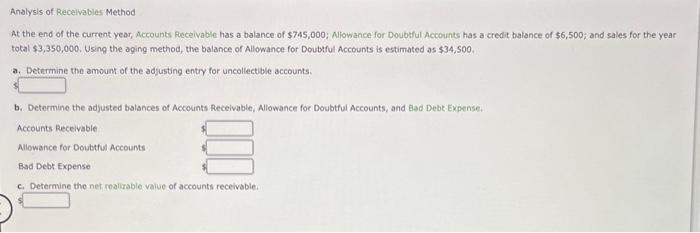

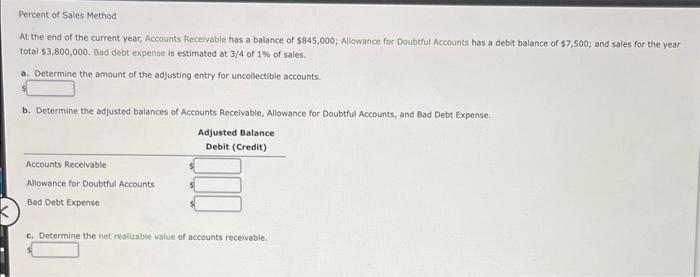

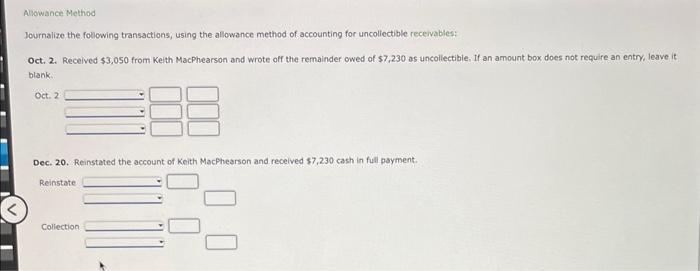

Analysis of Recelvabies Method At the end of the current year, Accounts Receivable has a balance of $745,000; Alowance for Doubtul Accoints has a credit balance of $6,500; and sales for the year total $3,350,000. Using the aging method, the balance of Allowance for Doubtul Accounts is estimated as $34,500. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Recelvable. Alowance for Doubtful Accounts, and Bad Debt Expense. c. Determine the net realizable vaiue of accounts receivable. Percent of Sales Method At the end of the current yeac, Accounts Recelvable has a balance of $845,000; Allawance for Doubtful Accounts has a debit balance of $7,500; and sales for the year total $3,800,000. Bad debt expense is estimated at 3/4 of 1% of sales. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Recelvable, Allowance for Doubtful Accounts, and Bad Debt Expense. c. Determine the net cealizable value of accounts receivable. Journalize the following transactions, using the allowance method of accounting for uncoliectible receivables: Oct. 2. Received $3,050 from Keith MacPhearson and wrote off the remainder owed of $7,230 as uncollectible, If an amount box does not require an entry, leave it blank. Dec. 20. Reinstated the account of Keith Machhearson and received $7,230 cash in full payment. Reinstate Coliection

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts