Question: This is all the information provided for this question. Cosmos Enterprises has the following information: Selling Price per Unit $120 Per Unit Variable Production Costs:

This is all the information provided for this question.

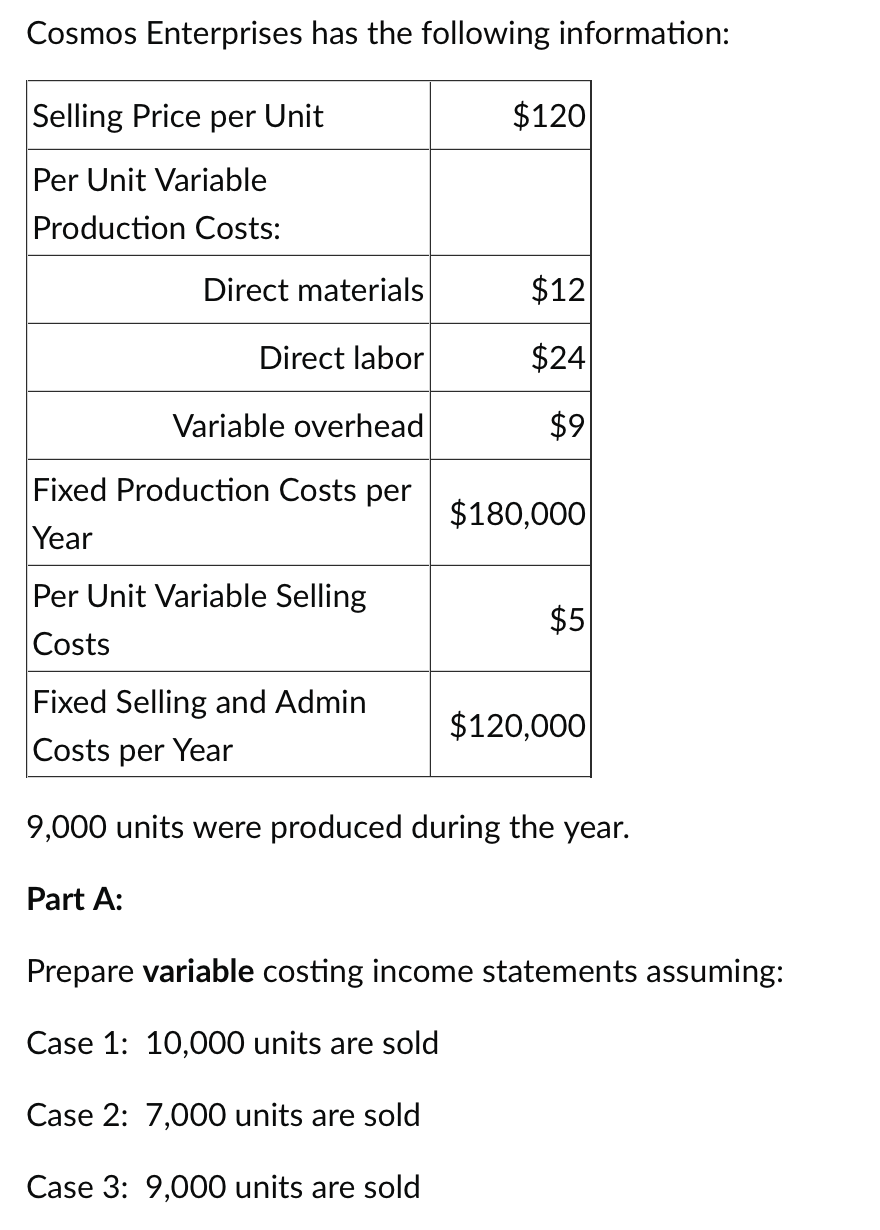

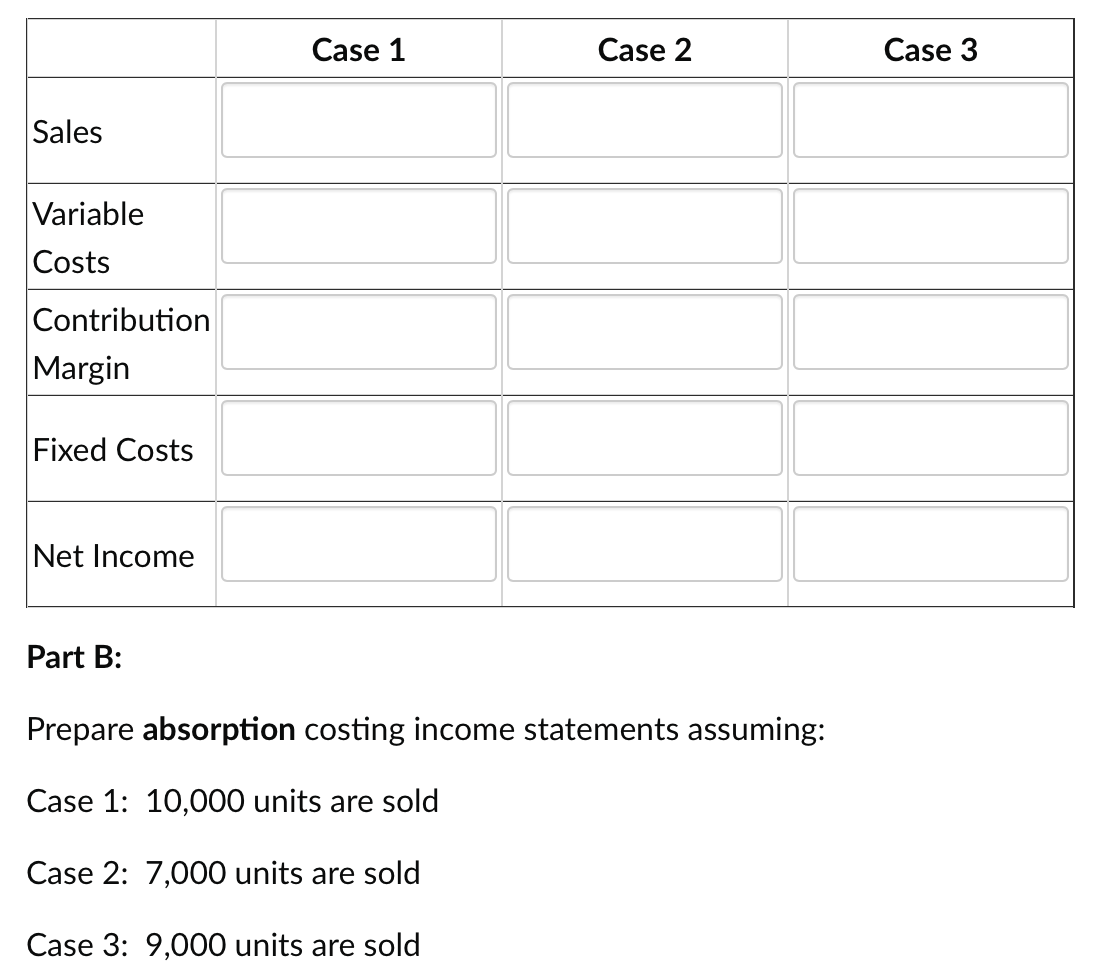

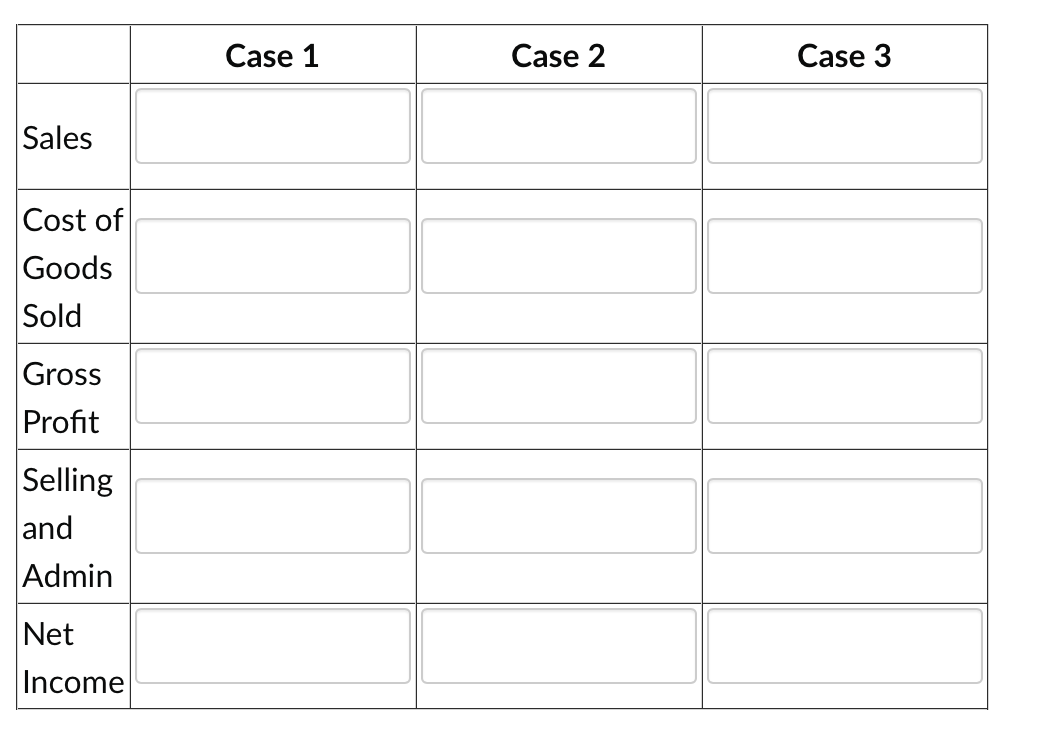

Cosmos Enterprises has the following information: Selling Price per Unit $120 Per Unit Variable Production Costs: Direct materials $12 Direct labor $24 Variable overhead $9 Fixed Production Costs per $180,000 Year Per Unit Variable Selling $5 Costs Fixed Selling and Admin $120,000 Costs per Year 9,000 units were produced during the year. Part A: Prepare variable costing income statements assuming: Case 1: 10,000 units are sold Case 2: 7,000 units are sold Case 3: 9,000 units are sold Case 2 Sales Variable Costs Contribution Margin Fixed Costs Net Income Part B: Prepare absorption costing income statements assuming: Case 1: 10,000 units are sold Case 2: 7,000 units are sold Case 3: 9,000 units are sold Case 1 Case 3 Sales Cost of Goods Sold Gross Profit Selling and Admin Net Income Case 1 Case 2 Case 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts