Question: I need help with this 3 part journal entry here is the tables Required information [The following information applies to the questions displayed below.] Treat

I need help with this 3 part journal entry

![tables Required information [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e83c6864c84_84766e83c67d5cbb.jpg)

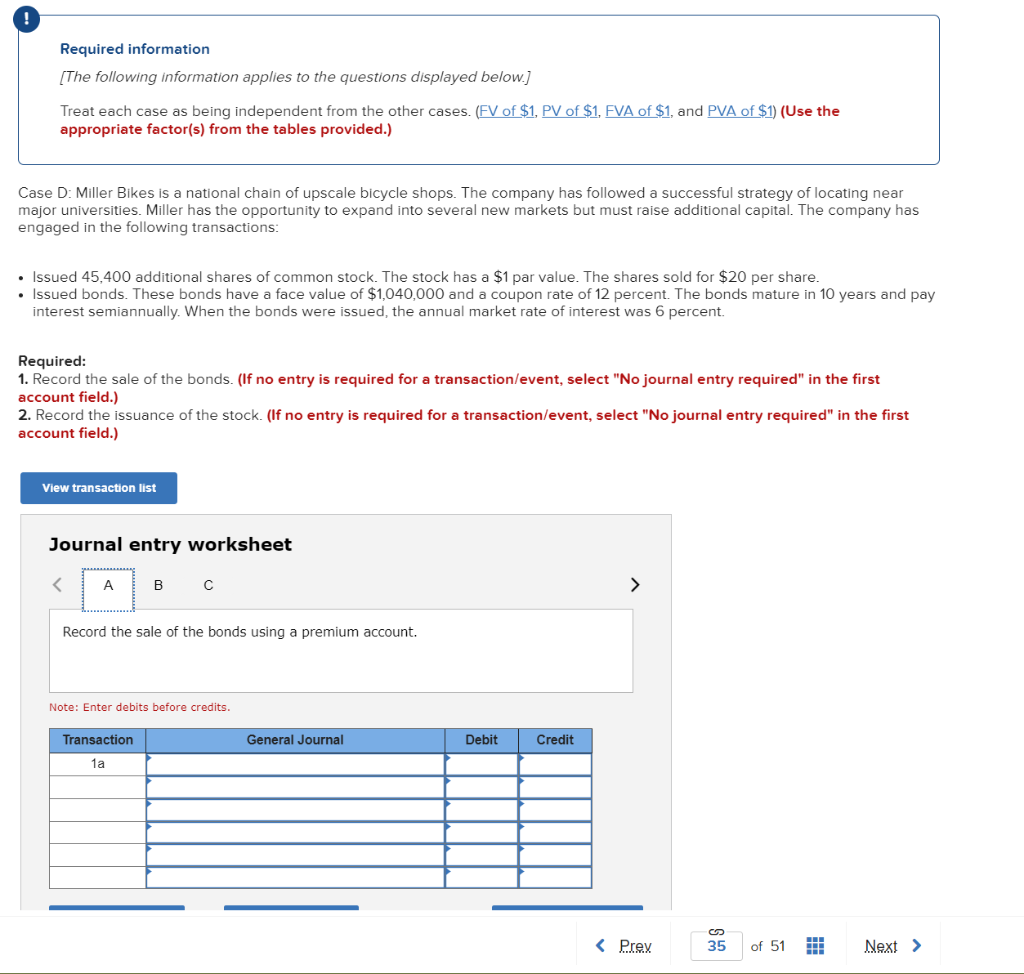

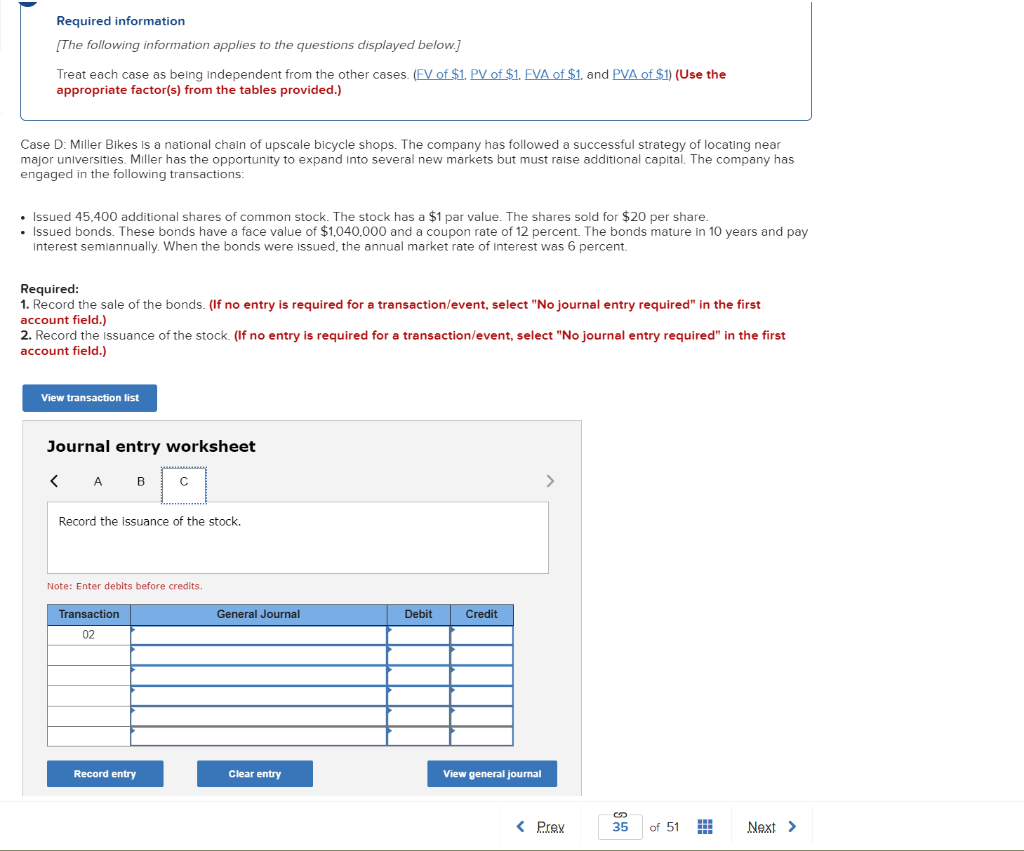

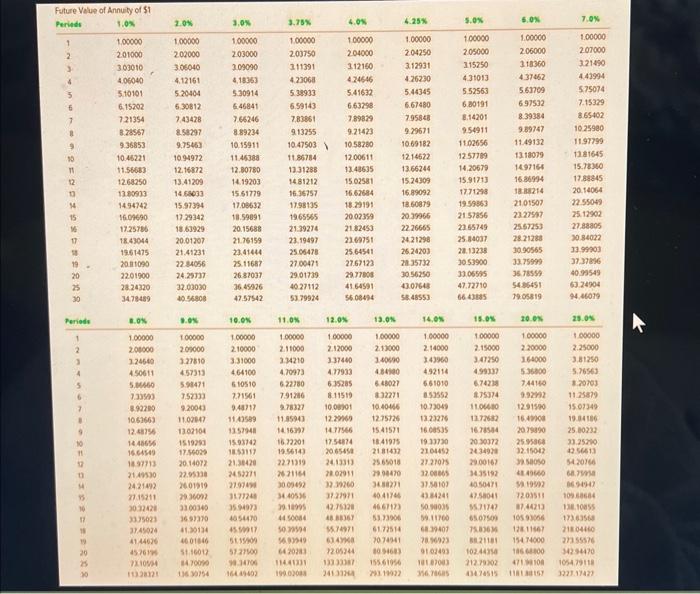

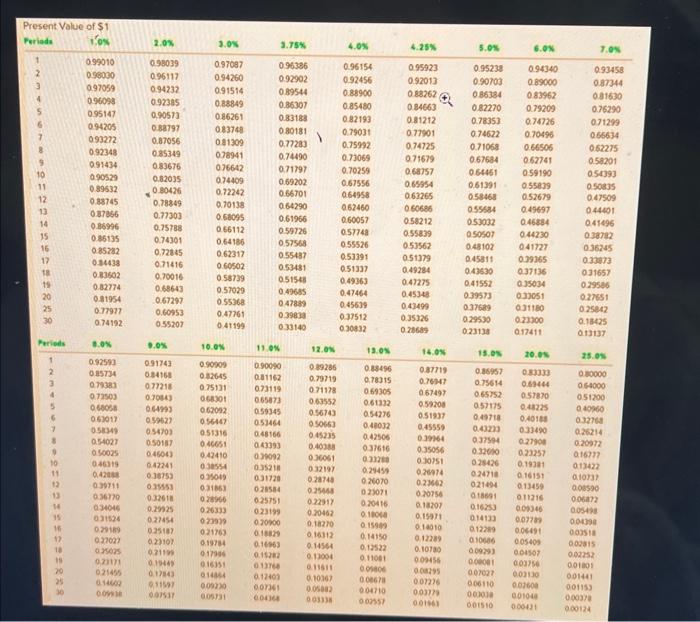

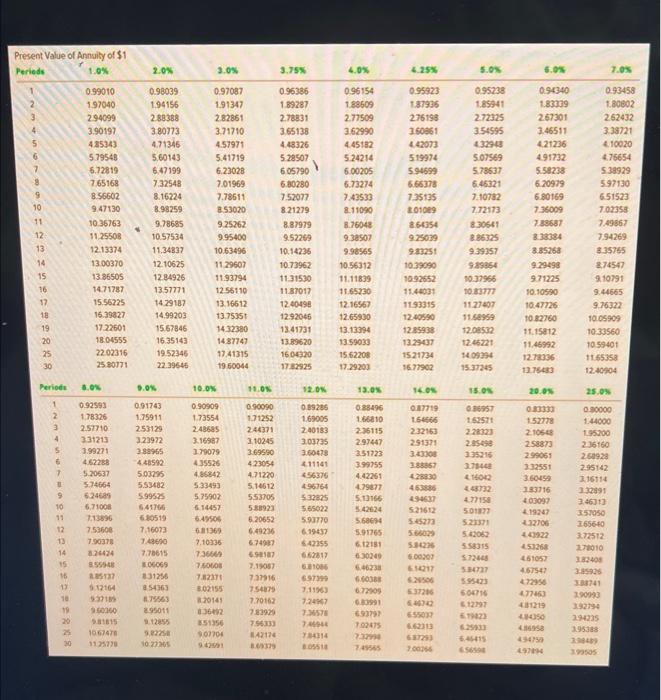

Required information [The following information applies to the questions displayed below.] Treat each case as being independent from the other cases. (FV of $1, PV of $1, FVA of $1, and (Use the appropriate factor(s) from the tables provided.) Case D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near major universities. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has engaged in the following transactions: - Issued 45,400 additional shares of common stock. The stock has a $1 par value. The shares sold for $20 per share. - Issued bonds. These bonds have a face value of $1,040,000 and a coupon rate of 12 percent. The bonds mature in 10 years and pay interest semiannually. When the bonds were issued, the annual market rate of interest was 6 percent. Required: 1. Record the sale of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Record the issuance of the stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the sale of the bonds using a premium account. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Treat each case as being independent from the other cases. (FV of $1,PV of $1, FVA of $1, and (Use the appropriate factor(s) from the tables provided.) Case D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near najor universities. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has engaged in the following transactions: Issued 45.400 additional shares of common stock. The stock has a $1 par value. The shares sold for $20 per share. Issued bonds. These bonds have a face value of $1,040,000 and a coupon rate of 12 percent. The bonds mature in 10 years and pay interest semiannually. When the bonds were issued, the annual market rate of interest was 6 percent. Required: . Record the sale of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first iccount field.) 2. Record the issuance of the stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first iccount field.) Journal entry worksheet Record the sale of the bonds without using a premium account. Note: Enter debits before credits. Required information [The following information applies to the questions displayed below.] Treat each case as being independent from the other cases. (EV of $1. PV of $1. FVA of $1, and PVA of $1 ) (Use the appropriate factor(s) from the tables provided.) Case D: Miller Bikes is a national chain of upscale bicycle shops. The company has followed a successful strategy of locating near major universitles. Miller has the opportunity to expand into several new markets but must raise additional capital. The company has engaged in the following transactions: - Issued 45,400 additional shares of common stock. The stock has a $1 par value. The shares sold for $20 per share. - Issued bonds. These bonds have a face value of $1,040.000 and a coupon rate of 12 percent. The bonds mature in 10 years and pay Interest semlannually. When the bonds were issued, the annual market rate of interest was 6 percent. Required: 1. Record the sale of the bonds. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 2. Record the Issuance of the stock. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note: Enter debits before credits. Present Value of $1 Pres

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts