Question: I need help with this assignment. I have submission due on afternoon of 30th April. Can you help me solve this? College Algebra Project Saving

I need help with this assignment. I have submission due on afternoon of 30th April. Can you help me solve this?

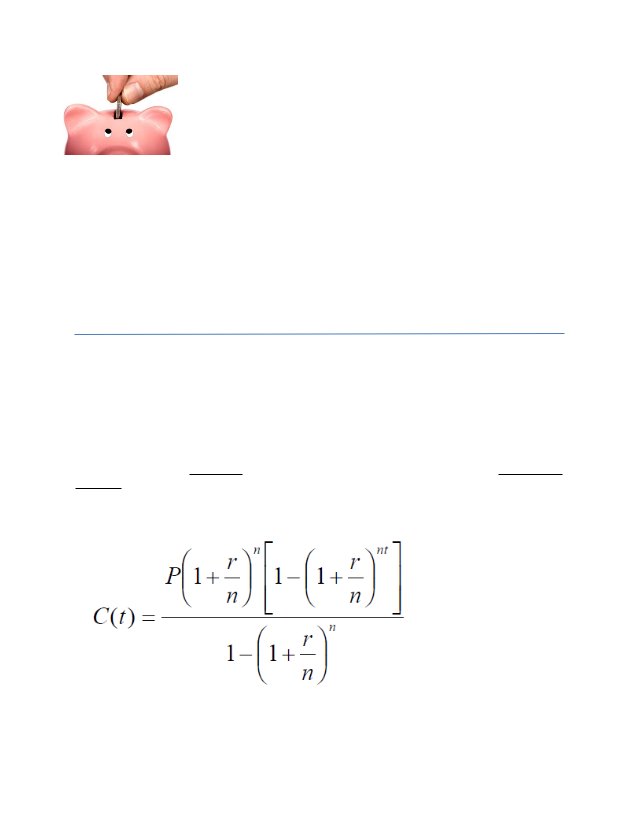

College Algebra Project Saving for the Future This project is to be completed individually! If the plaigerism software pings your assignment as being turned in by another student you will receive a 0 and possibly an XF for the course . It is very important that you work on the assignment by yourself. Mr. Dawdy is willing to check your work for 1a - c and 2a - c to ensure you are using the formula correctly. Use the Email tab in the course to send him your work and he will let you know if you are on the right track before you finish out #3. You will need to type up your answers and submit them to the Dropbox as part of your final grade. You can handwrite and scan your work or type it to turn it in for a chance to receive partial credit but make sure you turn in a typed version of your final answers as well. In this project you will investigate compound interest, specifically how it applies to the typical retirement plan. For instance, many retirement plans deduct a set amount out of an employee's paycheck. Thus, each year you would invest an additional amount on top of all previous investments including all previously earned interest. If you invest P dollars every year for t years in an account with an interest rate of r (expressed as a decimal) compounded n times per year, then you will have accumulated C dollars as a function of time, given by the following formula. Compound Interest Formula, with Annual Investments: I will derive this formula to give you a broader understanding of where it came from and how it is based upon the single deposit compound interest formula. If you invest P dollars every year for t years at an interest rate r, expressed as a decimal, compounded n times per year, then you will have accumulated the cumulative amount of C dollars given by the formula derived below: Each annual investment would grow according to the compound interest formula: Thus the first deposit of P dollars would draw interest for the full t years, the second deposit would only draw interest for t-1 years, the third deposit would only draw interest for t-2 years... and the last deposit would only draw interest for a single year. Thus we need to add up each deposit and their respectively gained interest values, resulting in the following: Do NOT let this alarm you or scare you - this is just the proof of how the formula that you will use for the entire project is obtained. -- EXAMPLE: If you invest $1200 every year (P = 1200) for 3 years (t=3) at an interest rate of 5% (r = 0.05) compounded weekly (n = 52), then the first year's investment of $1200 would earn interest for 3 years, but then the next year, the next investment of $1200 would only earn interest for 2 years, and then the final investment of $1200 would only earn interest for 1 year. This lends itself to the following: As you can see we got the same answer. Now although it was not difficult to do the problem the long way with only three years, when t gets large, the formula simplifies the work quite a bit. However, you have to be sure not to round until the very end where you round to the nearest cent. (So be sure to keep as many decimal places as possible until the end, as you will be taken off for rounding before then.) For more information about round-off errors click on the link: http://mathworld.wolfram.com/RoundoffError.html The entire project deals with annual deposits so you will be using this formula below to answer the following questions: 1) How much will you have accumulated over a period of 20 years if, in an IRA which has a 10% interest rate compounded quarterly, you annually invest: a. $1 b. $1200 c. $5,000 d. Part (a) is called the effective yield of an account. How could Part (a) be used to determine Parts (b) and (c)? (Your answer should be in complete sentences free of grammar, spelling, and punctuation mistakes.) 2) How much will you have accumulated, if you invest annually $10,000 into an IRA at 8% interest compounded monthly for: a. b. c. d. 5 year 10 years 25 years How long will it take to earn your first million dollars? Round your answer to two decimal places. You will need to be exact and use logarithms to solve for this value so you may need to wait until after Unit 5 to solve. 3) Now you will plan for your retirement. To do this we need to first determine a couple of values. a. How much will you invest each year? Even $50 a month is a start ($600 a year), you'll be surprised at how much it will earn. You can chose a number you think you can afford on your life circumstances or you can dream big. The typical example of a retirement investment is an I.R.A., an Individual Retirement Account, although other options are available. However, for this example, we will assume that you are investing in an I.R.A. (for more information see: http://en.wikipedia.org/wiki/Individual_Retirement_Account ) earning 8% interest compounded annually. (This is a good estimate, basically, hope for 10%, but expect 8%. But again this is just one example; I would see a financial advisor before investing, as there is some risk involved, which explains the higher interest rates.) b. Determine the formula for the accumulated amount that you will have saved for retirement as a function of time and be sure to simplify it as much as possible. You need to be able to show me what you used for r, n, and P so that I can calculate your answers. Plug in those values into the formula and simplify the equation. c. Graph this function from t = 0 to t = 50. including graphs into your document. See the document in DocSharing about d. When do you want to retire? Use this to determine how many years you will be investing. (65 years old is a good retirement-age estimate). You need to say how old you are if you are retiring when you are 65 or tell me how long until you retire. e. Determine how much you will have at retirement using the values you decided upon above. f. How much of that is interest? g. Now let's say you wait just 5 years before you start saving for retirement, how much will that cost you in interest? How about 10 years? How about just 1 year? Now you need to consider if that is enough. If you live to be 90 years old, well above average, then from the time you retire, to the time you are 90, you will have to live on what you have in retirement (not including social security). So if you retired at 65, you will have another 25 years where your retirement funds have to last. h. Determine how much you will have to live on each year. Note, we are neither taking into account taxes nor inflation (which is about 2% a year). Let's look at this from the other direction then, supposing that you wanted to have $40,000 a year after retirement. i. How much would you need to have accumulated before retirement? j. How much would you need to start investing each year, beginning right now, to accumulate this amount? A \"short-cut\" to doing this is to first compute the effective yield at your retirement age, then divide this amount into Part (i). This is the amount you will need to invest each year. k. That was just using $40,000, how much would you want to have each year to live on? Now using that value, repeat parts (i) and (j) again. Your answer to (k) would work, if you withdrew all of your retirement funds at once and divided it up. However, if you left the money in the account and let it draw interest, it is possible that the interest itself would be enough to live on, or at the very least if you had to withdraw some of the principle, the remaining portion would still continue to earn interest. Essentially, what you have found is the upper bound for the amount of money that you will need to invest each year to attain your financial goals. l. Finish by summarizing what you have learned in the entire project and consider setting a goal towards saving for retirement. (Your answer should be in complete sentences free of grammar, spelling, and punctuation mistakes.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts