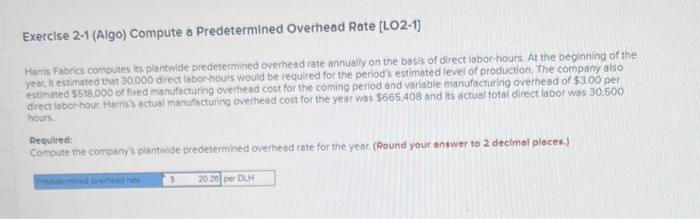

Question: i need help with this Exercise 2-1 (Algo) Compute o Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the

![Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9c42a9d2c9_13866e9c42a49fd9.jpg)

![2 decimal places.) Exercise 2-2 (Algo) Apply Overhead Cost to Jobs [LO2-2]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e9c4304579e_14366e9c42fdaa19.jpg)

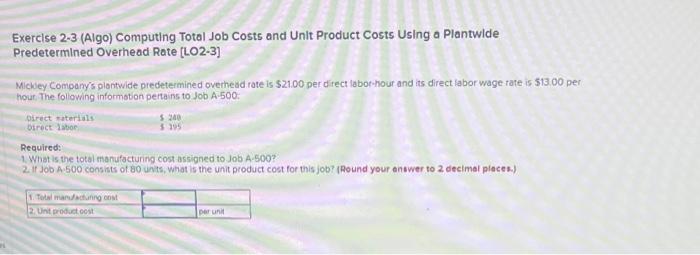

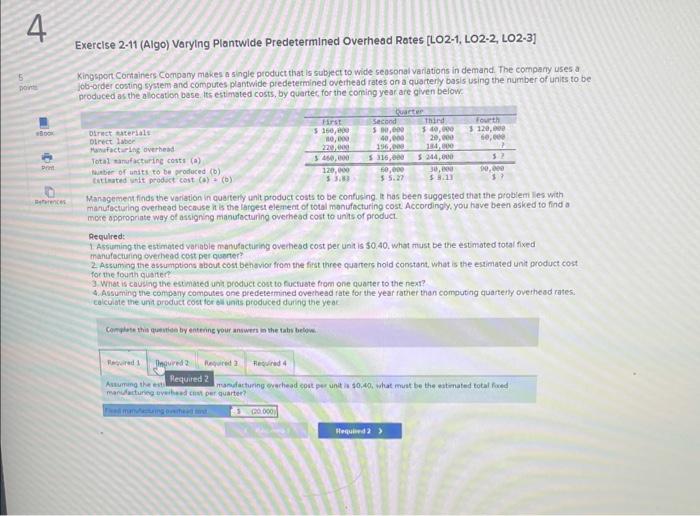

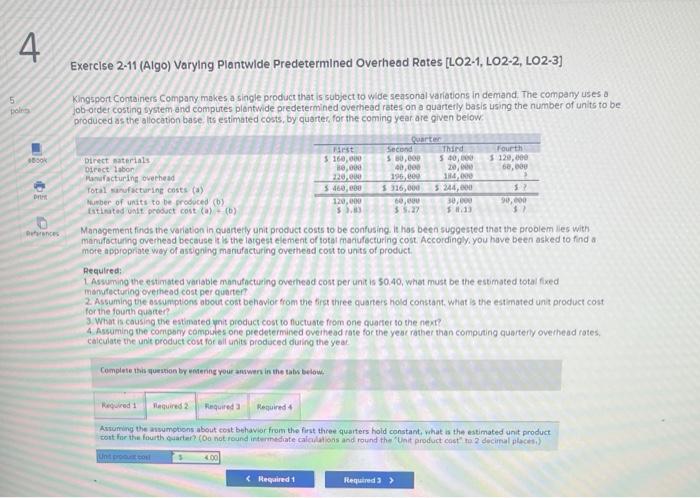

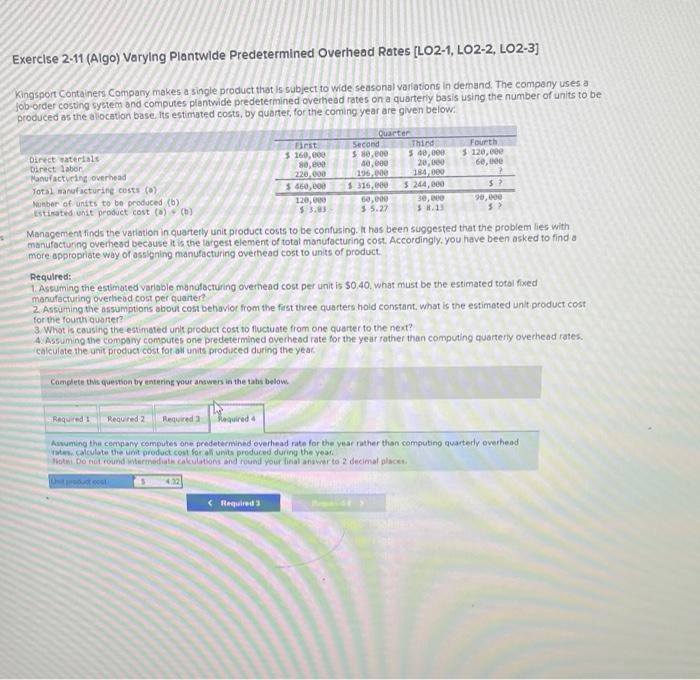

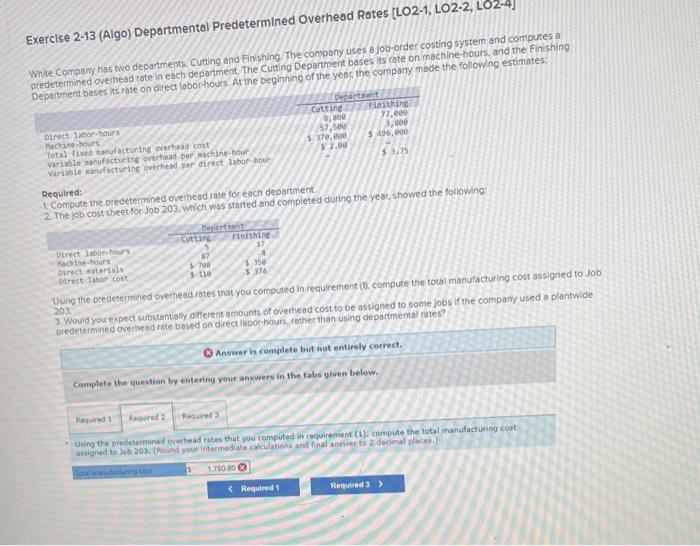

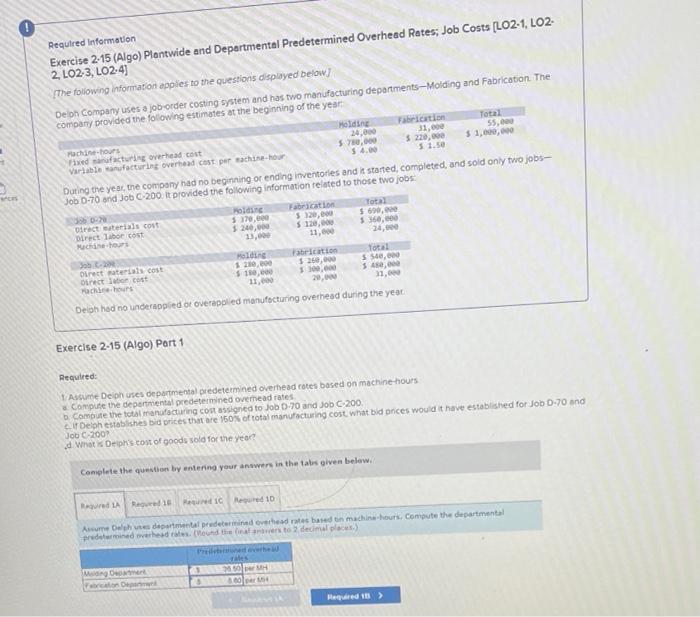

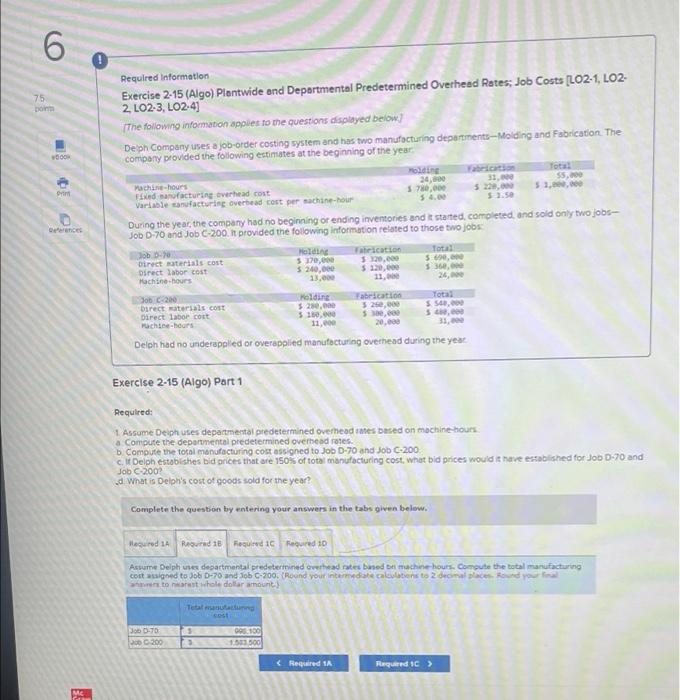

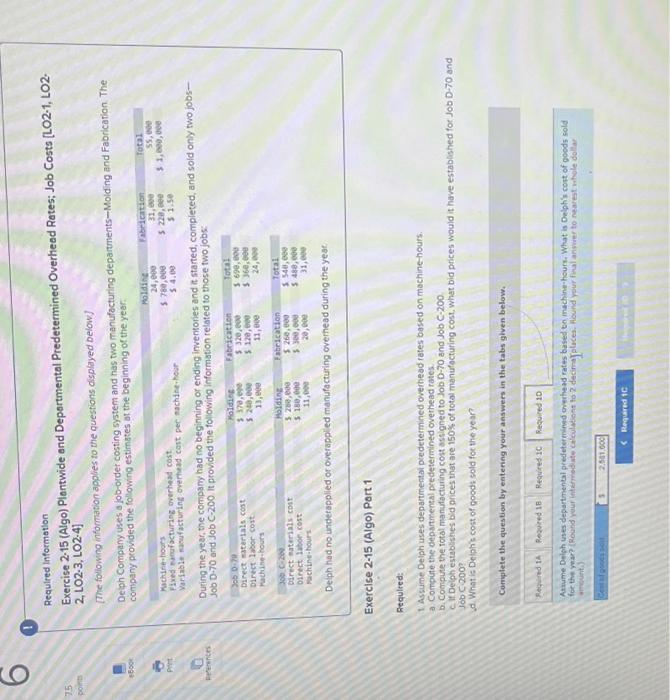

Exercise 2-1 (Algo) Compute o Predetermined Overhead Rate [LO2-1] Harris Fabrics computes its plantwide predetermined overhead rate annually on the basis of direct labor-hours. At the beginning of the yeoc, in estimated that 30.000 direct labor-hours would be required for the period's estimated level of production. The company aiso estimated $5t8,000 of fored manufacturing overhead cost for the coming period and varlable manufacturing overhead of $3.00 per: direct iabor-hour. Haris's actual manufacturing overhead cest for the year. was $665.408 and its actual total direct labor was 30.500 hours. Pequlred: Compute the compsny's piantwide predetermined overhead rate for the yeat. (Round your answer to 2 decimal places.) Exercise 2-2 (Algo) Apply Overhead Cost to Jobs [LO2-2] Luthon Company uses a plantwide predetermined overhead rate of $23.50 per direct labor-hour. This predetermined rate was based on a cost formula that estimated $282000 of totai manufacturing overhead cost for an estimated activity level of 12000 direct laborhourk. The compary incurred actual total manufacturing overhead cost of $269,000 and 11,200 total direct labor-hours during the period. Aequired: Determine the amount of manufacturing overhead cost that would have been applied to all jobs during the period. Exerclse 2-3 (Algo) Computing Total Job Costs and Unit Product Costs Using a Plantwide Predetermined Overhead Rate [LO2-3] Mickey Company's plantwide predetermined overhead rate is $21.00 per direct labor-hour and its direct labor wage rate hour. The following informoton pertains to Job A.500: Required: 1. What is the total manufacturing cost assigned to Job A. 500 ? 2. If Job A.500 consists of 80 unis, what is the unit product cost for this job? (Round your anawer to 2 decimat pleces.) Exercise 2-11 (Algo) Varying Plantwide Predetermined Overhead Rates [LO2-1, LO2-2, LO2-3] Kingsport Conainers Company mekes a single product that is subyect to wide seosonal variations in demand. The comparty uses a job-order costing system and computes plantwide predetermined overtead rates an a quarterly basis using the number of units to be produced as the allocation base. Itr estimated costs, by quarter, for the coming year are given below. Management finds the variation in quartery unit product costs to be confusing. it has been suggested that the problemt les with manufactaring overhesd because it is the largest element of total manufactufing cost Accordingly. you have been asked to find a more oppropriate way of assigning manufecturing overhead cost to units of product. Required: 1. Assuming the estimated vatiable manufacturing overhesd cost per unt is 50.40. what must be the estimsted total fixed manufacturing entrined cost per ouster? 2. Assuming the assumptions about cost behovior from the first three quarters hoid constant, what is the estimated unit product cost for the founth guster? 3. What is causing the estimated unit product cost to fuctuste from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year father than computing quarteny overhead rates: calculate the unt aroduct cost for sil units produced duting the ye ac. Colmylete thi quevides by entenne vour answers in the tabs betowe Astuming the eni mandacturing ovarhead sost per unit is 10,40, what mast be the eatmated total fued manidarturieg uveibesd chst per quarter? Exercise 2-11 (Algo) Varying Plantwide Predetermined Overheod Rates [LO2-1, LO2-2, LO2-3] Kingsport Containers Company makes a single product that is subject to wide seasonal variations in demand. The company uses a job-order costing system and computes plantwide predetermined overhead rates on a quarterly basis using the number of units to be. produced as the allocation base, its estimated costs, by quarter, for the coming year are given below. Manegement finds the variation in quartefly unit product costs to be confusing. it has been suggested that the proolem les with manufocturing overnead because it is the latgest element of total peanufecturing cost. Accordingly. you have been asked to find a more approprate woy of assigning manufacturing oyethead cost to units of product. Required: 1. Assuming the estimated yanable manufacturing overhead cost per unit is 50.40, what must be the estimated total fixed inanufacturing oveinead cost per quartent 2. Assuming vie oswhiptions about cost behowior from the firg three quanters hold constant, what is the estinated unit product cost for the founth quarter? 3. What is causing the estimated ynit product cost to fluctuste from one quarter to the nent? 4. Assuming the compony compues one predetermined oveinead rate for the yeac rather than computing quarterly overhead rates. calculate the unit product cost for ail units produced during the year. Complete this queation by ensenig your answer in the tabs below. Assuming the assumptions about cost behavior from the first thee quaiters hold constant, what is the estimated unit product wont for the fourth euarter? (Oo not round intermediate calcidal ons and round the "Unit product cost" ma? 2 decirnal plactis) Exerclse 2-11 (Algo) Varying Plantwide Predetermined Overhead Rates [LO2-1, LO2-2, LO2-3] Kingsport Containers Company makes a single product that is subject to wide seasonal varlations in demand. The company uses a job-order costing sybtem and computes plantwide predetermined overhead rates on a quarteriy basis using the number of units to be produced as the allocation base. Its estimated costs, by quarter, for the coming year are given below: Management finds the variation in quarterly unit product costs to be confusing. it has been suggested that the problem lies with manufactuning ovemead because it is the largest element of total manufacturing cost. Accordingly, you have been asked to find a more sppropriate way of assligning manufacturing overhead cost to units of product. Required: 1. Aseuming the estimated variable manufactuing overhead cost per unit is $0.40, what must be the estimated total fixed manufactuting overheod cost per quarter? 2. Assuming the assumptions about cost behavior from the fest thee quarters hoid constant, what is the estimeted unit product cost for the fourth quarter? 3. Whot is cousing the estimsted unlt product cost to fluctuate from one quarter to the next? 4. Assuming the company computes one predetermined overhead rate for the year rather than computing quarterly overhead rates. calculate the unit produci cost for all units produced during the yeaf. Camplete this equestion by entering your answers in the tahs below. Aswuming the cervpany computes one predetermined overhead rate for the vear rather than computing quarterly overhead iates. Calculate the kint product cost for all units produced during the year. Ibotwi Do not round whterinediate cakulations and round your lifal anawer to 2 decimal places. Exercise 2-13 (Algo) Departmental Predetermined Overhead Rates [LO2-1, LO2-2, LO2-4] White Company has two departments. Cutting and Finishing. The company uses a job-order costing system and computes a predetemined overhead tate in each department. The Cutting Department bases its fate on machine-hours. and the Finishing 1. Compute the piedeteinned ovemeded rate for each department. 1. Compute the predetermined ove weed she wo for for 203, which was started and completed during the year, showed the following: Using the predetermined overhesd rates that you compuned in requirement (D. compute the total manufacturing cost assigned to Jo 203. 3. Wouid you expect substantially different amounts of overhead cost to be assigned to some jobs if the company used a plantwide predetermined oveihead rate based on direct labothours, rother than using deportmental rates? Q Answer is complete but not entirely correct. Camplete the question by entering your answers in the tabs quen below. - Using the predetermined overhend mtes that you computed in requiremant (1), compute the total manufacturing cost. assigned to 3 b 203 . (Round wour intermediate colculations and final antwer to 2 decimal places.) Required lnformation Exercise 215( Algo) Plantwide and Depertmental Predetermined Overhead Rates; Job Costs [LO2-1, LO2. 2, LO2,3, LO2,4) The foliowing information applies to the questions displayed belowv] Deiph Compary uses a joborder costing system and has two manufacturing departments-Molding and Fabricaton. The company provided the following estimates at the beginning of the year: Pochinethours Fixed ranufacturing orerhead coit Varlable vantwacturling overhead cost per wachine - hoor: Duting the year, me compary had no beginning orending ifventorles and it started, completed, and sold only two jobs- Exercise 2-15 (Algo) Part 1 Required: T Assume Deiph uses deportmental predetermined overbead rotes bosed on machine hours a. Corpuse the depertmental predeteimined ovemiead rates b. Compute the total tranafactuing cosk assigned to Job D. 70 and Job C.200. Job C-200? d Whit is Deiphis cont of goods sold for rre yeor? Conplete the question by emtenng your anowers in the talis given below. Required Information Exercise 2-15 (Algo) Plantwide and Depertmental Predeternined Overhead Rates; Job Costs [LO2-1, LO22, LO2.3, LO2.4] [The following information appies to the questions alsplayed below.] Deph Company uses a job-order costing system and has two manufacturing deperinents-Molding and fabication. The combany Dovided the following ectinuates at the beginning of the year During the year, the company had no beginning or ending inventories and it started, completed and sold only two jobsJob D-70 and Job C-200. it provided the following informbtion related to those swo jobs: Delph had no underapplied or overapplied manufecturing overheod dueing the year: Exerclse 2-15 (Algo) Part 1 Required: 1. Assume Deiph uses departmental predetermined ovemead sates based on mochine hours a Compute the departmental predetermined ovethead roses. b. Compute the tokal msnutacturing cost assigned to Job D-70 and Job C-200. c. It Delph estobisthes bid onices that are 150% of total manufocturing cost, what bid prices would it nave essabished for Job D-70 and Job 200 ? ab What is Delpois cost of poods sold for the year? Complete the question by entering your anwwers in the tabs given below. Acrume Delph wher desartmental predeternined crethead notes bined on mashine hourh comoule the total manufacturing Gocruents to nearest whole doEsar a mountil Required informetion Exercise 2.15 (Algo) Plantwide and Departmental Predetermined Overhead Rates; Job Costs [LO2-1, LO2. 2,LO2,3,LO24] The following information apples to the questions displayed beiow.) Delph Company uses 8 job-order costing system and has fwo manufecturing departments-Molding and Fabiication. The company provided the following estimates at the beginning of the year: During the year, the company had no beginning or ending irwentories and it started, completed, and sold only two jobsJob D-70 and Job C.200. It provided the following information reiared to those two jobs: Delph had no underapplied or overapplied menufacturing ovemead during the yeat. Exerclee 2-15 (Algo) Port 1 Requlred; 1 Assume Deiph oses depaitmemal predeterained overhead rates besed on machine hours. a. Compute the departnentai predetermined oveme ad tates b. Compule the totsi manutscauring cost aspigned to Job D-70 and 306C200. 6. If Delph esabishes bid onces that are 150 f of totat menisfacturing cost. What bid prices would it have estabiahed for Job D-TO and Job C.200? a. What is Delohis cost of ooods sold for the year? Complete the question by entering your answers in the tabs given below. Ausirne pelch ines separtmental predotarmined orarhead rater bated bn machine hourz. If owloh estalishes bit prices that: Required Information Exercise 2-15 (Algo) Plantwide and Departmental Predetermined Overhead Rates; Job Costs [LO2-1, LO2. 2, LO23,LO241 [The following information applies to the questions oisplayed below] Deiph Company uses a job-order costing systems and nas two manufacturing departments-Moiding and Fabricarian The copinanu ivnuirled the following estimates at the beginning of the year: During the year, the company had no beginning or ending inventories and it started, completed, and sold only two jobsjob 0-70 and job C-200 it provided the following information related to those two jobs: Deiph had no underapplied or overappled manufacturing overhead during the yeat. Exercise 2-15 (Algo) Port 1 Required: 1 Assume Delph uses departinentai predetermined overhead rates based on machine hours. a. Compute the oepartmental predetermined overhead rates. b. Compute the fotal manudacturing cost assigned to Job D-70 and Job C-200 C. If Delph establshes bid prices that are 150 Ss of total manufacturing cost, what bid prices would it have estabished for Job D-70 and Job 5200% W. What is Delphis cost of goodi sold fot the year? Complete the question by entering your answers in the tabs given below. Arwume Deloh uses departmental predeternined overhe ad rates based tn mechine-hours. What is Delphis cort of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts