Question: i need help with this general journal entry A-O. please make it clear so i can refer to yours as i fill in my chart.

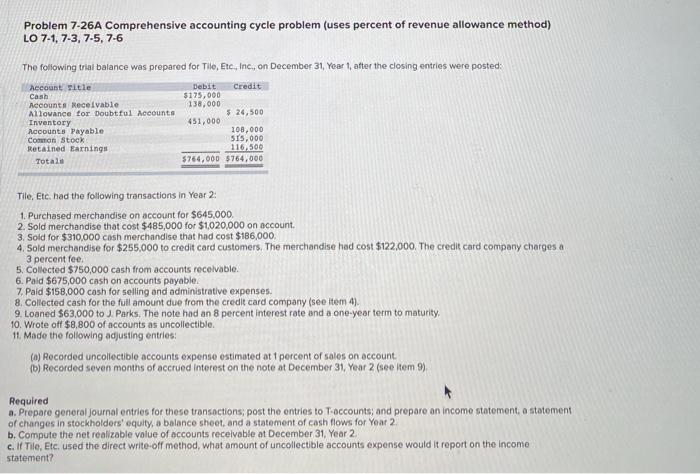

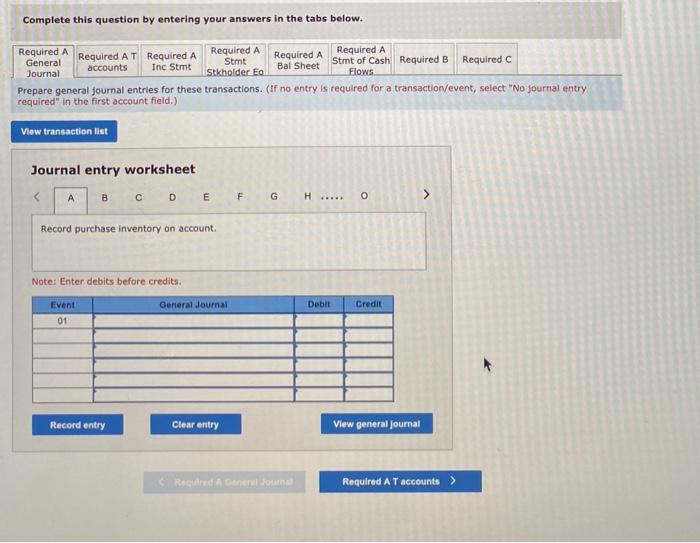

Problem 7-26A Comprehensive accounting cycle problem (uses percent of revenue allowance method) LO 7-1,7-3, 7-5, 7-6 The following trial balance was prepared for Tile, Etc., Inc., on December 31, Year 1, after the closing entries were posted: Debit 138,000 Credit $175,000 Account witle Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Accounts Payable Common Stock Retained Earnings Total 5 24,500 451,000 100,000 515,000 116.500 $764,000 $764,000 Tile, Etc. had the following transactions in Year 2: 1. Purchased merchandise on account for $645,000 2. Sold merchandise that cost $485,000 for $1,020,000 on account. 3. Sold for $310,000 cash merchandise that had cost $186,000. 4. Sold merchandise for $255,000 to credit card customers. The merchandise had cost $122,000. The credit card company charges a 3 percent fee. 5. Collected $750,000 cash from accounts receivable 6. Paid $675,000 cash on accounts payable 7. Pald $158,000 cash for selling and administrative expenses. 8. Collected cash for the full amount due from the credit card company (see item 4). 9 Loaned $63,000 to J. Parks. The note had an 8 percent interest rate and a one-year term to maturity 10. Wrote off $8,800 of accounts as uncollectible 11. Made the following adjusting entries: (a) Recorded uncollectible accounts expense estimated at 1 percent of sales on account (b) Recorded seven months of accrued Interest on the note at December 31. Year 2 (see item 9) Required a. Prepare general Journal entries for these transactions, post the entries to accounts, and prepare an income statement, a statement of changes in stockholders' equity, a balance sheet, and a statement of cash flows for Year 2 b. Compute the net realizable value of accounts recelvable at December 31, Year 2 c. If Tile, Etc. used the direct write-off method, what amount of uncollectible accounts expense would it report on the income statement? Complete this question by entering your answers in the tabs below. Required A Required AT Required A Required A Required A Required A General Stmt Stmt of Cash Required B Required C accounts Bal Sheet Inc Stmt Journal Stkholder Ea Flows Prepare general Journal entries for these transactions. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet B C D E F H.... o Record purchase inventory on account Note: Enter debits before credits General Journal Debit Credit Event 01 Record entry Clear entry View general Journal Rod A Del 2 Required AT accounts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts