Question: I need help with this. I post this before and yhe person give me an example and the working out of the example keep giving

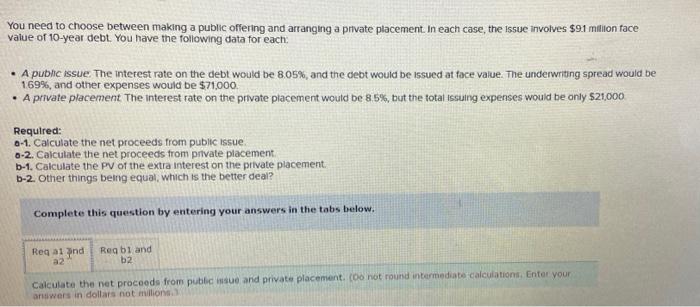

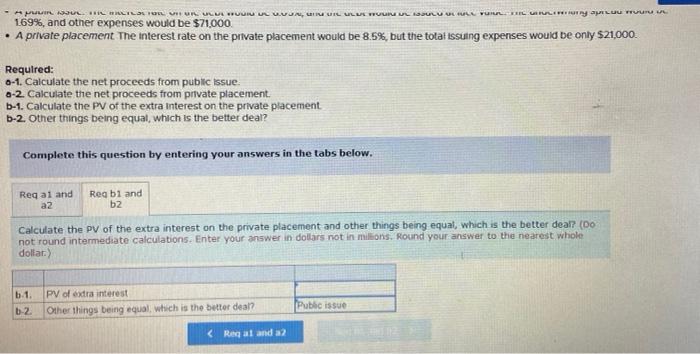

You need to choose between making a public offering and arranging a private placement. In each case, the issue involves $9.1 milion face value of 10-year debt. You have the following data for each A public issue The interest rate on the debt would be 8.05%, and the debt would be issued at face value. The underwriting spread would be 169%, and other expenses would be $71,000. A private placement The interest rate on the private placement would be 8.5%, but the total issuing expenses would be only $21,000 Required: 0-1. Calculate the net proceeds from public issue 3-2. Calculate the net proceeds from private placement b-1. Calculate the PV of the extra interest on the private placement b-2. Other things being equal, which is the better deal? Complete this question by entering your answers in the tabs below. Regaland Regbi and b2 a2 Calculate the net proceeds from public and private placement. Oo not round intermediate calculations, Enter your answers in dollars not millions - - 169%, and other expenses would be $71,000 A private placement The interest rate on the private placement would be 8.5%, but the tolat issuing expenses would be only $21,000. Required: 0-1. Calculate the net proceeds from public issue. 6-2. Calculate the net proceeds from private placement. b-1. Calculate the PV of the extra interest on the private placement b-2. Other things being equal, which is the better deal? Complete this question by entering your answers in the tabs below. Regal and Reg bl and a2 b2 Calculate the PV of the extra interest on the private placement and other things being equat, which is the better deal? (Do not round intermediate calculations. Enter your answer in dollars not in millions. Round your answer to the nearest whole dollar) PV of extra interest Other things being equal, which is the better deal? Pubic issue b-2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts