Question: I NEED HELP WITH THIS PLEASE Now assume that YourTech began operations on January 1, 2019. YourTech manufactures electronic components for the aerospace industry. YourTech

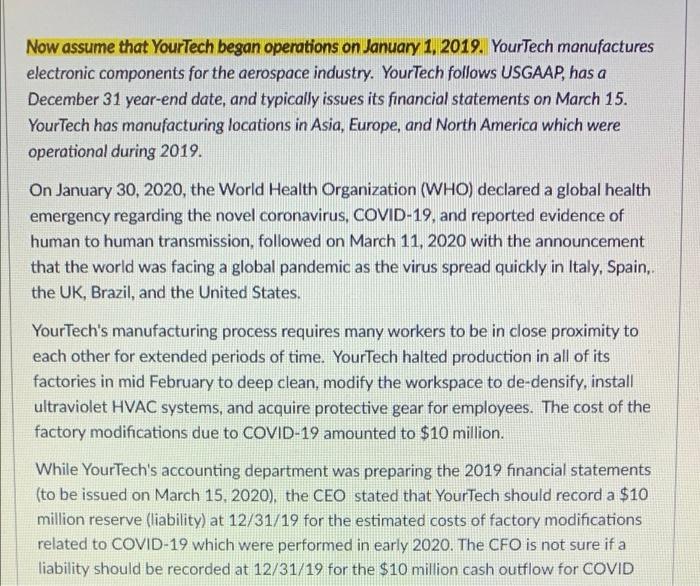

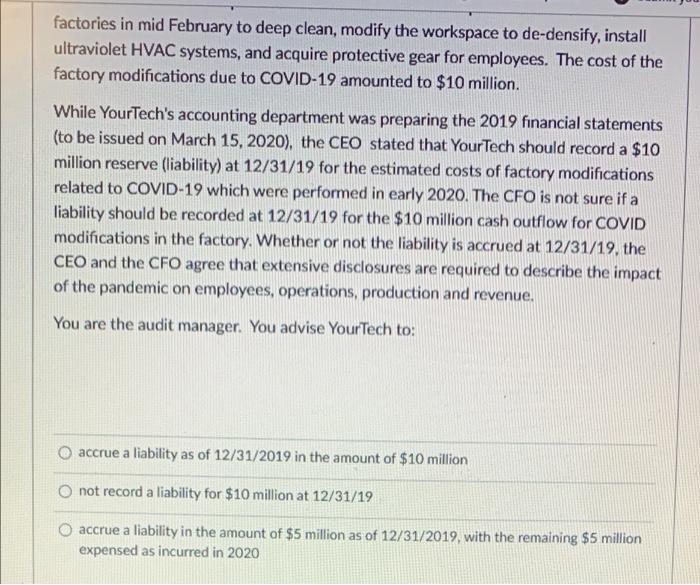

Now assume that YourTech began operations on January 1, 2019. YourTech manufactures electronic components for the aerospace industry. YourTech follows USGAAP, has a December 31 year-end date, and typically issues its financial statements on March 15. YourTech has manufacturing locations in Asia, Europe, and North America which were operational during 2019. On January 30, 2020, the World Health Organization (WHO) declared a global health emergency regarding the novel coronavirus, COVID-19, and reported evidence of human to human transmission, followed on March 11, 2020 with the announcement that the world was facing a global pandemic as the virus spread quickly in Italy, Spain, the UK, Brazil, and the United States. YourTech's manufacturing process requires many workers to be in close proximity to each other for extended periods of time. YourTech halted production in all of its factories in mid February to deep clean, modify the workspace to de-densify, install ultraviolet HVAC systems, and acquire protective gear for employees. The cost of the factory modifications due to COVID-19 amounted to $10 million. While YourTech's accounting department was preparing the 2019 financial statements (to be issued on March 15, 2020), the CEO stated that YourTech should record a $10 million reserve (liability) at 12/31/19 for the estimated costs of factory modifications related to COVID-19 which were performed in early 2020. The CFO is not sure if a liability should be recorded at 12/31/19 for the $10 million cash outflow for COVID factories in mid February to deep clean, modify the workspace to de-densify, install ultraviolet HVAC systems, and acquire protective gear for employees. The cost of the factory modifications due to COVID-19 amounted to $10 million. While YourTech's accounting department was preparing the 2019 financial statements (to be issued on March 15, 2020), the CEO stated that YourTech should record a $10 million reserve (liability) at 12/31/19 for the estimated costs of factory modifications related to COVID-19 which were performed in early 2020. The CFO is not sure if a liability should be recorded at 12/31/19 for the $10 million cash outflow for COVID modifications in the factory. Whether or not the liability is accrued at 12/31/19, the CEO and the CFO agree that extensive disclosures are required to describe the impact of the pandemic on employees, operations, production and revenue. You are the audit manager. You advise YourTech to: O accrue a liability as of 12/31/2019 in the amount of $10 million O not record a liability for $10 million at 12/31/19 O accrue a liability in the amount of $5 million as of 12/31/2019, with the remaining $5 million expensed as incurred in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts