Question: I NEED HELP WITH THIS PLEASE YourTech began operations on January 1, 2022, and manufactures electronic components for the aerospace industry. YourTech follows USGAAP, has

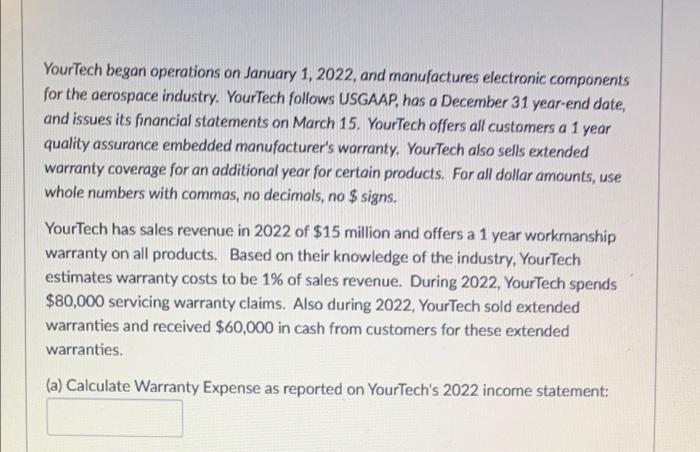

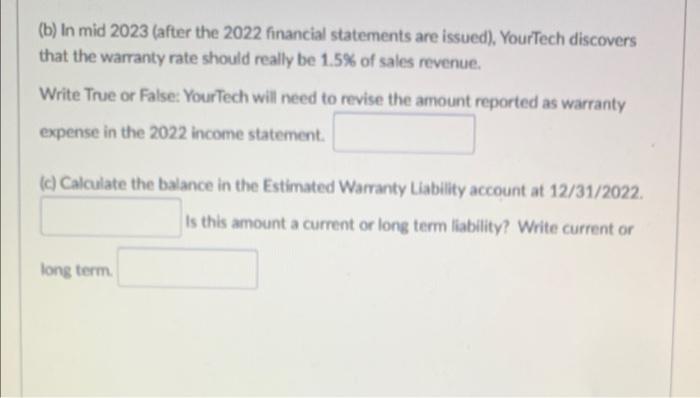

YourTech began operations on January 1, 2022, and manufactures electronic components for the aerospace industry. YourTech follows USGAAP, has a December 31 year-end date, and issues its financial statements on March 15. YourTech offers all customers a 1 year quality assurance embedded manufacturer's warranty. YourTech also sells extended warranty coverage for an additional year for certain products. For all dollar amounts, use whole numbers with commas, no decimals, no $ signs. YourTech has sales revenue in 2022 of $15 million and offers a 1 year workmanship warranty on all products. Based on their knowledge of the industry, YourTech estimates warranty costs to be 1% of sales revenue. During 2022, Your Tech spends $80,000 servicing warranty claims. Also during 2022, YourTech sold extended warranties and received $60,000 in cash from customers for these extended warranties. (a) Calculate Warranty Expense as reported on YourTech's 2022 income statement: (b) In mid 2023 (after the 2022 financial statements are issued), YourTech discovers that the warranty rate should really be 1.5% of sales revenue. Write True or False: YourTech will need to revise the amount reported as warranty expense in the 2022 income statement. (dCalculate the balance in the Estimated Warranty Liability account at 12/31/2022 Is this amount a current or long term liability? Write current or long term

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts