Question: i need help with this practice question Oct. 1 Kelly started his law practice by contributing $30,500 cash to the business on October 1, receiving

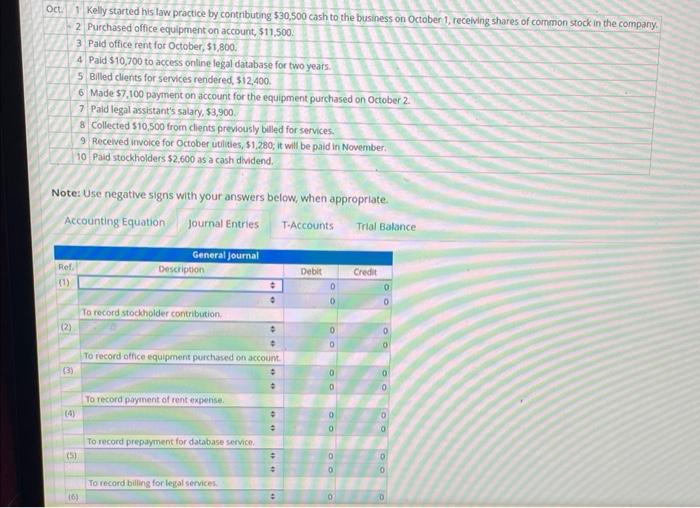

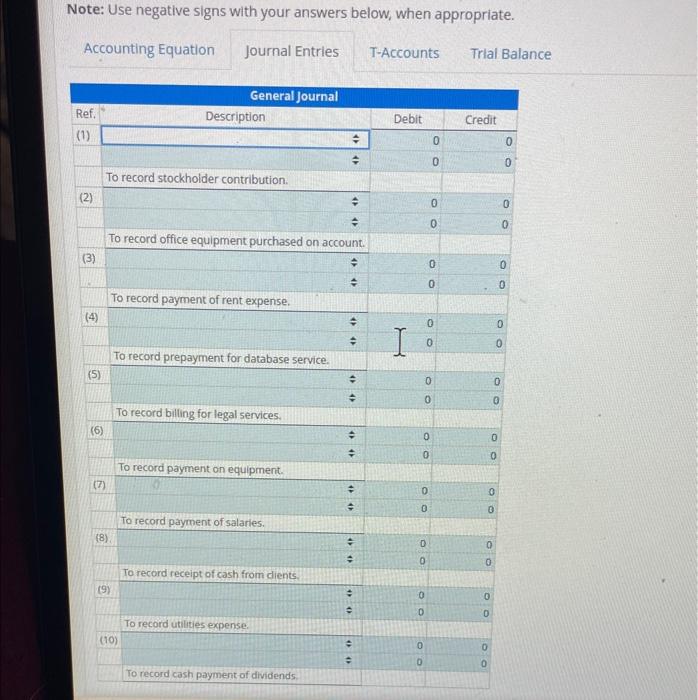

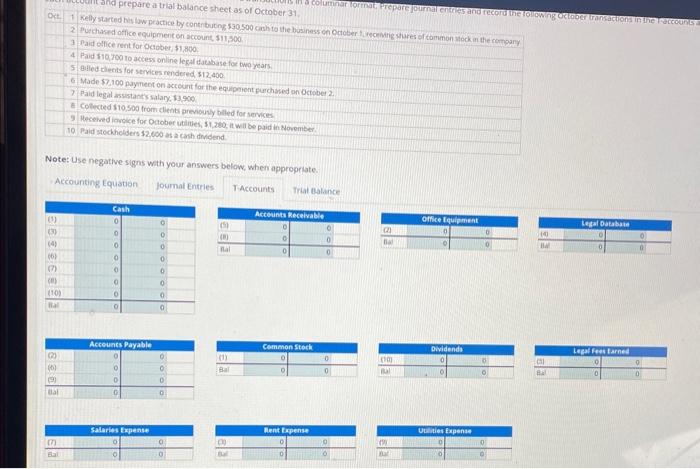

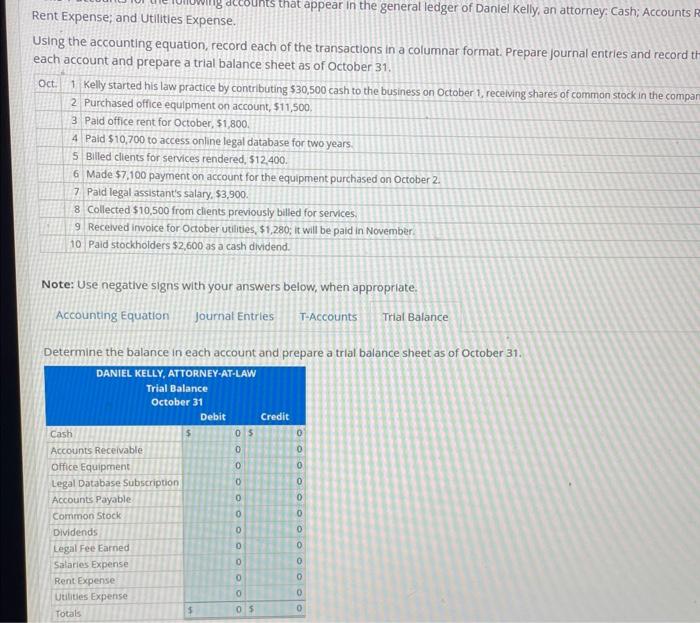

Oct. 1 Kelly started his law practice by contributing $30,500 cash to the business on October 1, receiving shares of common stock in the company. 2 Purchased office equipment on account, $11,500. 3 Paid office rent for October, $1,800. 4 Paid $10,700 to access online legal database for two years. 5 Billed clients for services rendered, $12,400. 6 Made $7,100 payment on account for the equipment purchased on October 2. 7 Paid legal assistant's salary, $3,900. Note: Use negative signs with your answers below, when appropriate. Accounting Equation Journal Entries Ref. (1) (2) (3) (4) 8 Collected $10,500 from clients previously billed for services. 9 Received invoice for October utilities, $1,280; it will be paid in November. 10 Paid stockholders $2,600 as a cash dividend. (5) (6) General Journal Description To record stockholder contribution. To record payment of rent expense. To record prepayment for database service. # 0 To record office equipment purchased on account. D # To record billing for legal services. D # # # T-Accounts # Debit 0 0 0 0 0 0 0 0 0 0 0 Trial Balance Credit 0 0 ...O 0 0 0 0 0 0 0 D Note: Use negative signs with your answers below, when appropriate. Accounting Equation Journal Entries Trial Balance Ref. (1) (2) (3) (4) (5) (6) (7) (8) To record stockholder contribution. General Journal (9) Description To record payment of rent expense. To record office equipment purchased on account. To record prepayment for database service. (10) To record billing for legal services. To record payment on equipment. To record payment of salaries. To record receipt of cash from clients. To record utilities expense. + To record cash payment of dividends. 47 46 # 04 + 46 47 OO 00 T-Accounts Debit L 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Credit 0 0 0 0 0 0 0 0 0 0 00 00 0 0 0 0 0 0 prepare a trial balance sheet as of October 31, Oct. 1 Kelly started his law practice by contributing $30,500 cash to the business on October 1, receiving shares of common stock in the company 2 Purchased office equipment on account, $11,500 3 Paid office rent for October, $1,800 4 Paid $10,700 to access online legal database for two years. 5 Billed clients for services rendered $12,400 6 Made $7,100 payment on account for the equipment purchased on October 2 7 Paid legal assistant's salary: $3,900 (1) (3) (4) (6) (7) (0) (10) Bal Note: Use negative signs with your answers below, when appropriate. Accounting Equation Journal Entries T-Accounts Trial Balance 3 (6) (9) Bal S Bal Collected $10,500 from clients previously billed for services 9 Received invoice for October utilities, $1,280, it will be paid in November. 10 Paid stockholders $2,600 as a cash dividend Cash 0 0 0 0 0 0 0 0 Accounts Payable 0 0 0 Salaries Expense 0 0 0 0 0 0 0 0 0 0 0 0 0 0 ch (8) Bal (1) Bal columinar format. Prepare journal entries and record the following October transactions in the accounts a Accounts Receivable 0 0 0 Common Stock Rent Expense 0 0 0 (2) Bal m Bal Office Equipment 0 Dividends 0 0 Utilities Expense (4) IM C31 Bal LegalDatabate Legal Fees Earned 0 0 Rent Expense; and Utilities Expense. g accounts that appear in the general ledger of Daniel Kelly, an attorney: Cash; Accounts Pa Using the accounting equation, record each of the transactions in a columnar format. Prepare journal entries and record ti- each account and prepare a trial balance sheet as of October 31. Oct. 1 Kelly started his law practice by contributing $30,500 cash to the business on October 1, receiving shares of common stock in the compar 2 Purchased office equipment on account, $11,500. 3 Paid office rent for October, $1,800. 4 Paid $10,700 to access online legal database for two years. 5 Billed clients for services rendered, $12,400. 6 Made $7,100 payment on account for the equipment purchased on October 2. 7 Paid legal assistant's salary, $3,900. 8 Collected $10,500 from clients previously billed for services. 9 Received invoice for October utilities, $1,280; it will be paid in November 10 Paid stockholders $2,600 as a cash dividend. Note: Use negative signs with your answers below, when appropriate. Accounting Equation Journal Entries T-Accounts Trial Balance Determine the balance in each account and prepare a trial balance sheet as of October 31. DANIEL KELLY, ATTORNEY-AT-LAW Trial Balance October 31 Cash Accounts Receivable Office Equipment Legal Database Subscription: Accounts Payable Common Stock Dividends Legal Fee Earned Salaries Expense Rent Expense Utilities Expense Totals Debit 05 OOOOOO 0 0 0 0 oooooo 05 Credit 000 0 0 0 0 0 0 0 0 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts