Question: I need help with this problem 18. Complete the check register for Ulrich Zwingli. It has a previous balance of $175.40. He wrote check number

I need help with this problem

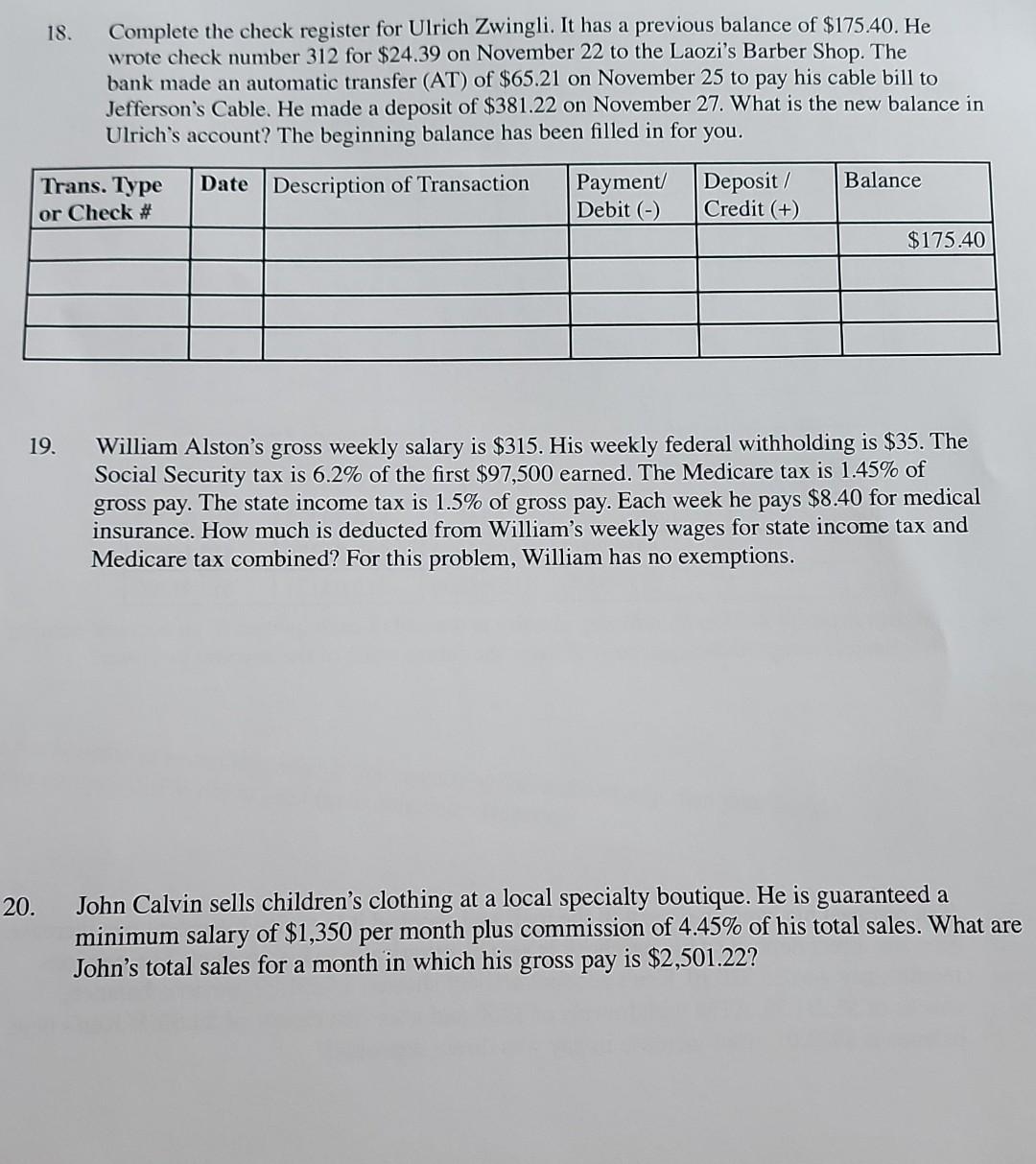

18. Complete the check register for Ulrich Zwingli. It has a previous balance of $175.40. He wrote check number 312 for $24.39 on November 22 to the Laozi's Barber Shop. The bank made an automatic transfer (AT) of $65.21 on November 25 to pay his cable bill to Jefferson's Cable. He made a deposit of $381.22 on November 27 . What is the new balance in Ulrich's account? The beginning balance has been filled in for you. 19. William Alston's gross weekly salary is $315. His weekly federal withholding is $35. The Social Security tax is 6.2% of the first $97,500 earned. The Medicare tax is 1.45% of gross pay. The state income tax is 1.5% of gross pay. Each week he pays $8.40 for medical insurance. How much is deducted from William's weekly wages for state income tax and Medicare tax combined? For this problem, William has no exemptions. John Calvin sells children's clothing at a local specialty boutique. He is guaranteed a minimum salary of $1,350 per month plus commission of 4.45% of his total sales. What are John's total sales for a month in which his gross pay is $2,501.22

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts