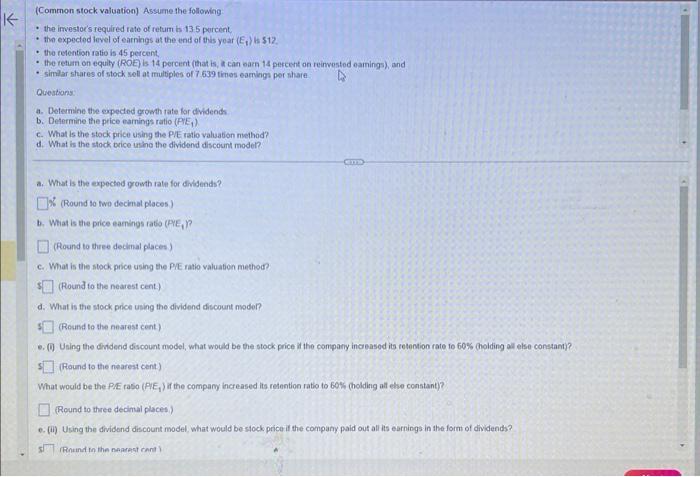

Question: I need help with this problem (Common stock valuation) Assume the following - the irvestoe's required rate of refurr ts 135 porcent. - the expectod

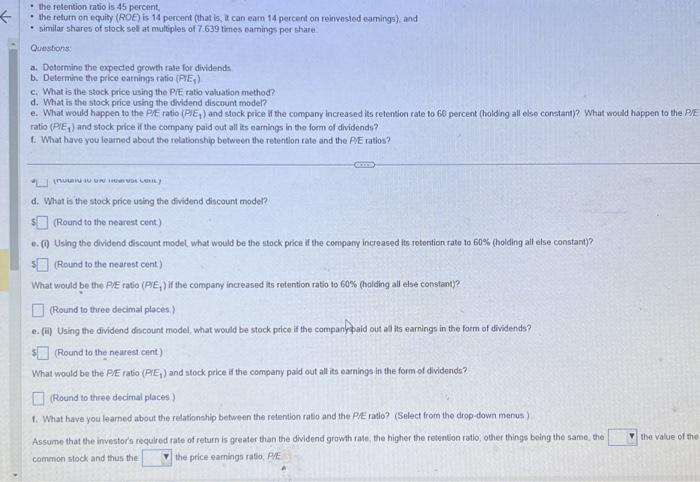

(Common stock valuation) Assume the following - the irvestoe's required rate of refurr ts 135 porcent. - the expectod level of earnhogs at the end of this year (E1) is 512 . - the folention ratio is 45 percent. - The reiuar on equity (ROE) is 14 percent (that is, \& can earn 14 pefcent on reinvestod eamings), and - similar shares of stock sell at ruultiples of 7.639 times eamings per whare Qieutaray a. Determine the expected growih rate for divdends b. Defermine the price eamings ratio (P1k1) c. What is the stock price using the PiE ratio valisabon nethod? d. What is the stock brice unthe the dividond discount modet? a. What is the expectod growth rate for didends? F Round fo fovo decienal places) b. Wiat is the price earnings fato (PYE ) ? (Found to three decinal places) C. What is the stock price using the PrE ratio valuation method? (Round to the nearest cent.) d. What is the stock price using the dividend discount noder? (Round to the nharest cent) e. (D) Using the dividend discount model, what would be the stock price il the conipariy increasod its ietemion rate to 69% (holding ail else constant?? (Round to the niearest cent.) What would be the PAE raso (PFE) it the company increased its redention ratio to 66% (holding ail ehe constant)? (Round to three decimal places.) e. (ii) Using the dividend discount model, what would besiock price if the company paid ouf all its earnings in ihe form of dinidends? Finuind in the noarest rant ) - the retention ratio is 45 percent, - the refum on equity (ROE) is 14 percent (that is, if can eam 14 percent on reinvested eamings), and - similar shares of tocksell at muttiples of 7.639 times eamings per share Questions: a. Determine the expected growth rate for dividends b. Determine the price eatnings ratio (PPEF) c. What is the stock price uring the PiE ratio valuation method? d. What is the stock price uring the dividend discount model? e. What would happen to the PEE ratio (PE1) and stock price if the company increased its retension rate to 60 percent (hoid ng all else constant)? What would happen to the Pht ratio (PiE1) and stock price if the cocrpary paid out all is eamings in the form of dividenids? f. What have you leamed about the relationship between the retention rate and the PVE ratios? d. What is the stock price using the dividend discount moder? (Round to the nearest cent) e. (i) Using the dividend discount model, what would be the stock price if the conpany increased its rotention rate to 60% (holding all else constant)? (Round to the nearest cent) What would be the PhE ratio (PIE, ) if the company increased its retention ratio to to\% (holding all else constant)? (Round to three decimal places ) e. (ii) Using the dividend discount model, what would be stock peice if the companf haid out allits earnings in the form of dividends? (Round to the nearest cent) What would be the PEE ratio (PE E1) and stock price tr the company paid out all its earnings in the form of dividends? (Found to three decimal places) 1. What have you learned about the relationehip between the retention ratio and the P.E ratio? (Select frorn the drop-down menus ) Assume that the investor's required rate of return is greater than the dividend grawth rate, the higher the retention ratio, other things being the same, the the value of the common tock and thus the the price earnings rafo. Pht

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts