Question: I need help with this problem (Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $25. Dividends of $1.56

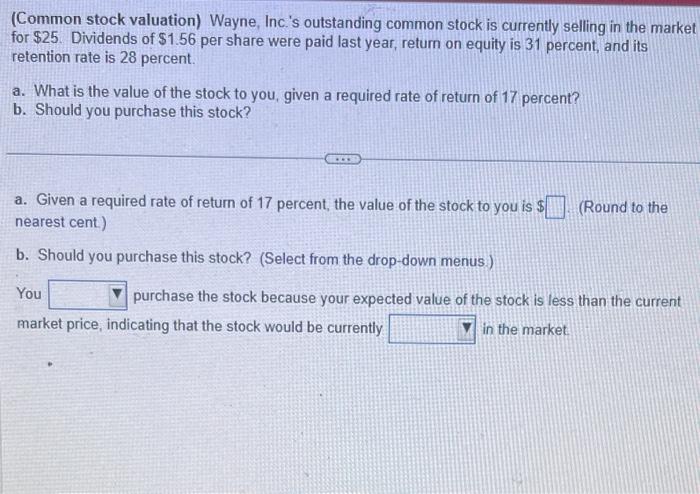

(Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $25. Dividends of $1.56 per share were paid last year, return on equity is 31 percent, and its retention rate is 28 percent. a. What is the value of the stock to you, given a required rate of return of 17 percent? b. Should you purchase this stock? a. Given a required rate of return of 17 percent, the value of the stock to you is $ (Round to the nearest cent) b. Should you purchase this stock? (Select from the drop-down menus) You purchase the stock because your expected value of the stock is less than the current market price, indicating that the stock would be currently in the market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts