Question: I need help with this programming question in python format please Task 4: Income Tax Bracket A new tax law was approved in 2019 with

I need help with this programming question

in python format please

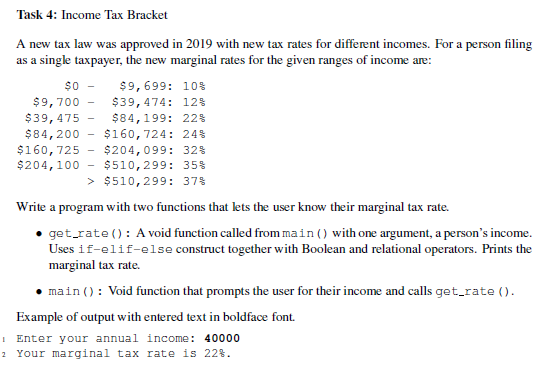

Task 4: Income Tax Bracket A new tax law was approved in 2019 with new tax rates for different incomes. For a person filing as a single taxpayer, the new marginal rates for the given ranges of income are: $0- $9,700- $39,475- $9,699: $39,474: $84,199: $160,124: $204,099: $510,299: $510,299: 10% 12% 22% 24 32% 35% 37% $84,200 $160,725 $204,100 _ _ > . get.rate ): A void function called frommain) with one argument, a person's income. Uses if-elif-else construct together with Boolean and relational operators. Prints the marginal tax rate. mainO: Void function that prompts the user for their income and calls get.rate ). Example of output with entered text in boldface font. Enter your annual income: 40000 2 Your marginal tax rate is 22%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts